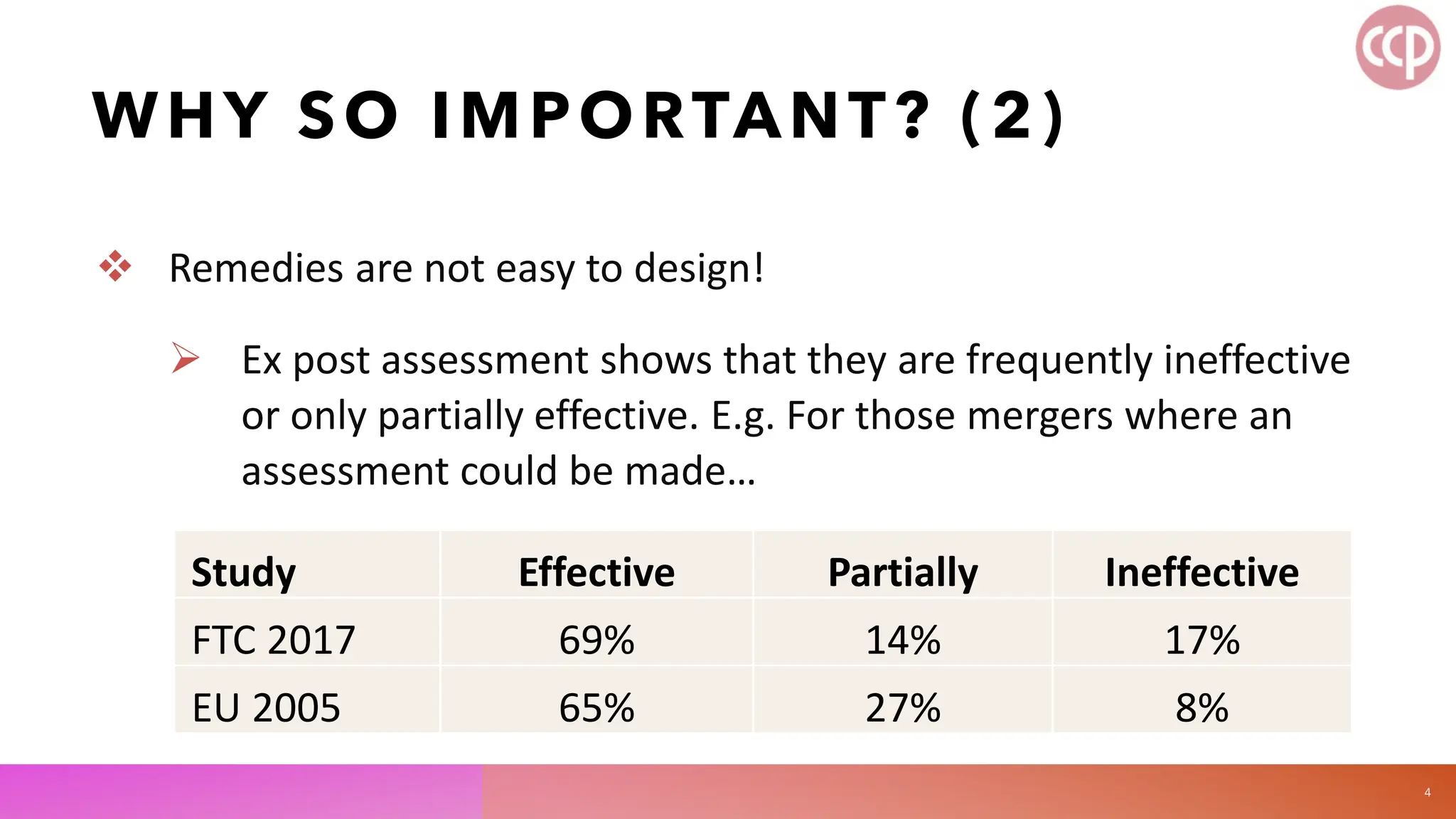

The document discusses the importance of ex post assessments of merger remedies, highlighting that poorly designed remedies can lead to anti-competitive mergers. Key lessons emphasize the need for careful design and monitoring of remedies, with structural remedies generally being more effective than behavioral ones. It also reflects on the complexities of access deals and the necessity for backup remedies in cases where initial remedies fail.