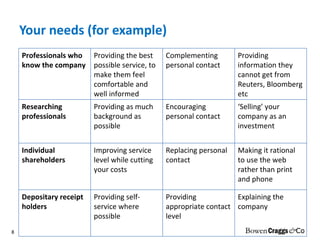

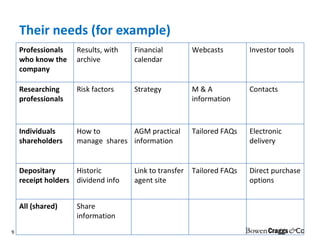

1) The presentation discusses developing a needs-driven approach to online investor relations by segmenting audiences and understanding what information and functionality each group needs.

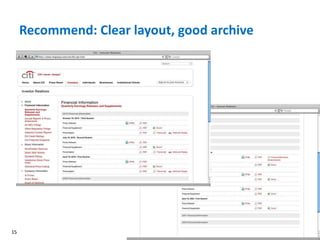

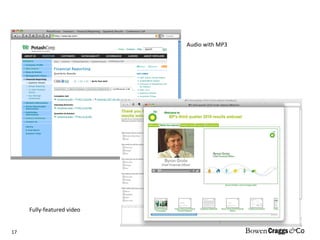

2) It recommends providing clear signposting, archives, webcasts, and contact details for analysts, as well as practical guidance and appropriate share data for individual investors.

3) It also suggests considering the use of social media and mobile sites but cautions that social media requires understanding to avoid potential risks from viral stories.

![For more information please contact: Dan Drury Director [email_address] +44 7786 707434 Sign up for David Bowen’s free bi-monthly column: www.bowencraggs.com/best-practice/commentaries Or contact David Bowen dbowen@bowencraggs.com](https://image.slidesharecdn.com/irmoscownov2010-eng-101202035957-phpapp02/85/IR-website-Investor-Relations-What-to-do-online-Nov-2010-eng-63-320.jpg)