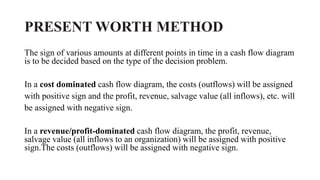

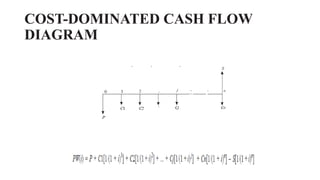

The document discusses the present worth method for comparing alternatives based on their cash flows. It explains that the present worth method discounts all cash flows to present value using a discount rate. It then describes how to determine the best alternative by comparing the present worth amounts, with the minimum cost alternative selected for cost-dominated decisions and the maximum profit alternative selected for revenue-dominated decisions. Examples of applying the method to choose between expansion technologies and elevator bids are also provided.