This document discusses key concepts related to life insurance premiums, including:

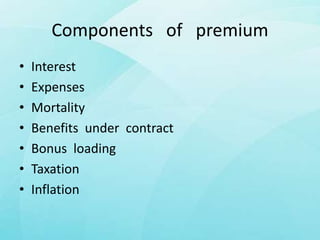

- Premium components include interest, expenses, mortality, benefits, bonus loading, taxation, and inflation.

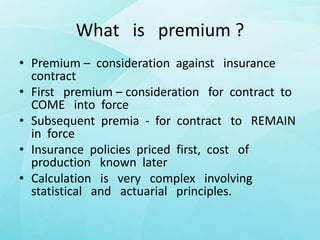

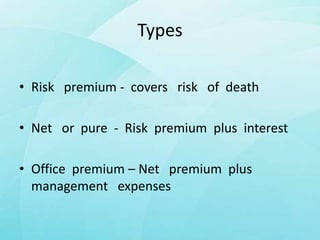

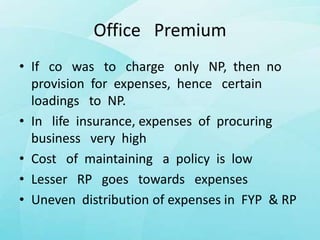

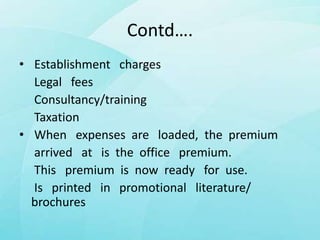

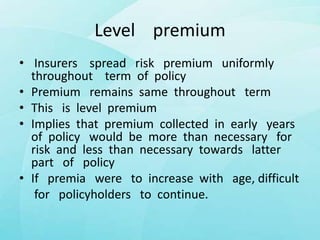

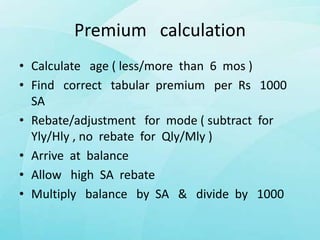

- There are different types of premiums such as risk premium, net premium, and office premium. Premium calculation is complex and involves actuarial and statistical principles.

- Insurers establish a life fund to hold all income from life insurance policies to exclusively meet liabilities and claims expenses.

- Insurers conduct annual actuarial valuations to ensure assumptions about mortality, interest, and expenses are valid and the business remains financially sound. Bonus may be distributed if valuations show surplus funds.