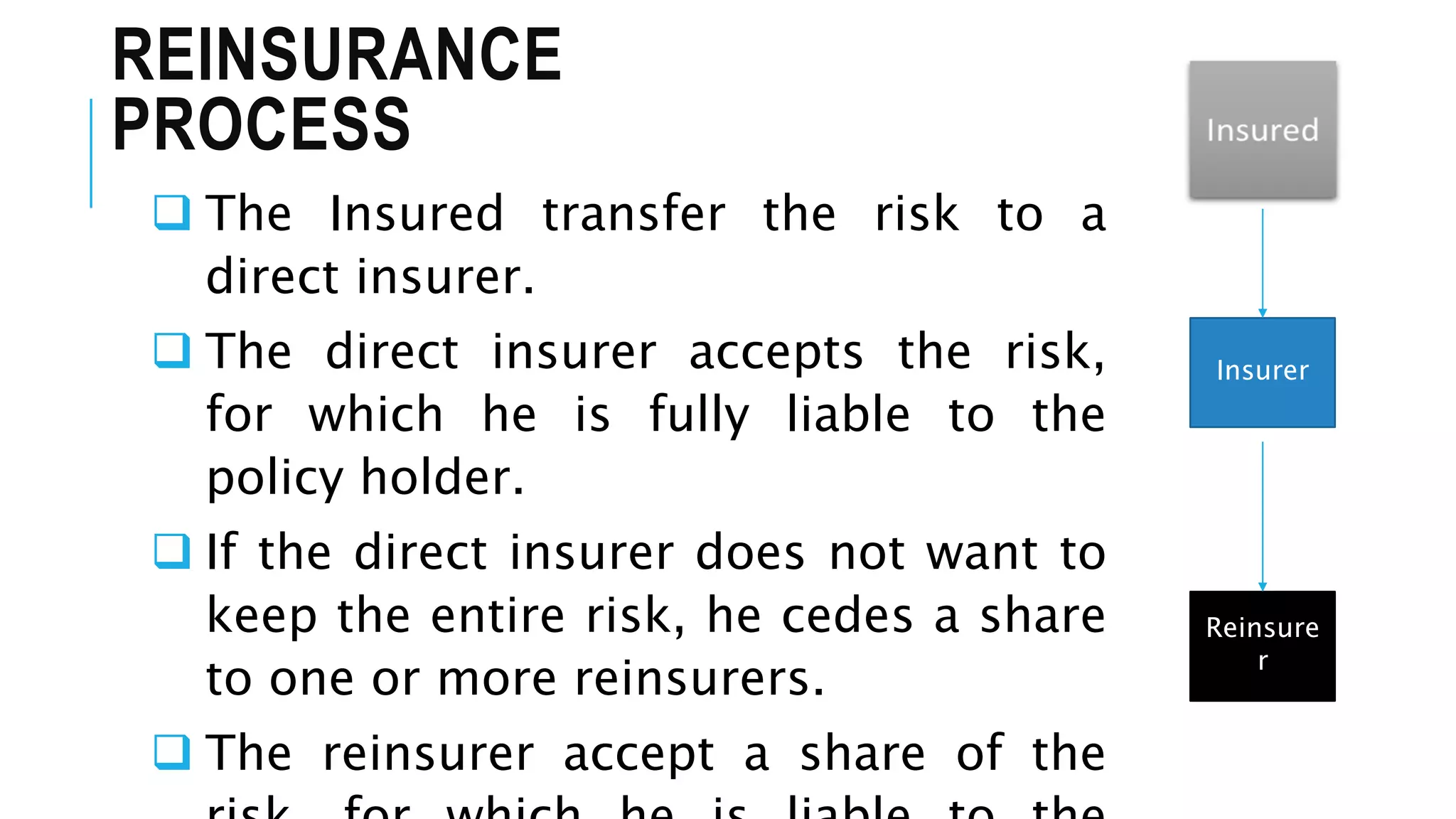

This document provides an introduction to reinsurance. It begins by explaining that reinsurance exists because insurance companies need ways to manage large risks that exceed their individual capacities. Reinsurance allows insurance companies to transfer portions of risks to reinsurers. The document then defines reinsurance as "insurance for insurance companies" whereby a reinsurer takes on part of the liability from an insurer for a given policy. The main purposes and functions of reinsurance are then outlined as increasing insurers' underwriting capacity, providing financial stability, and strengthening insurers' finances. The document concludes by briefly describing the main types and methods of reinsurance.