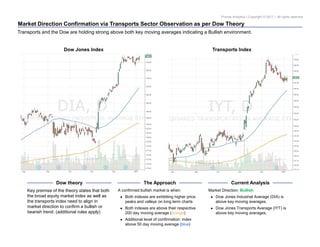

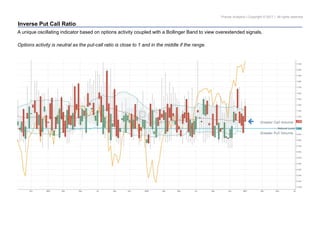

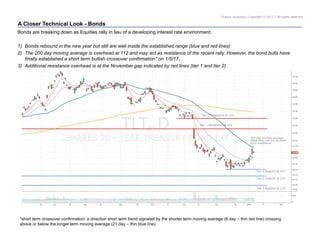

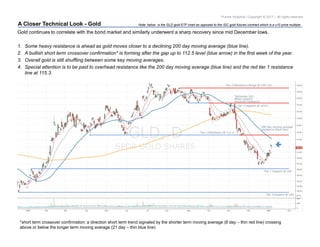

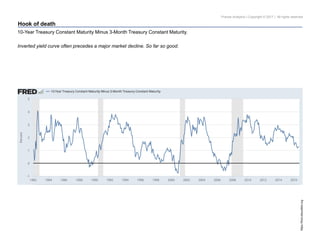

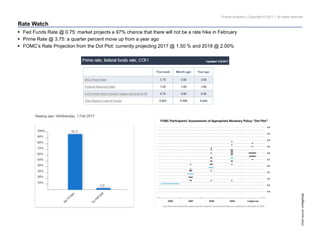

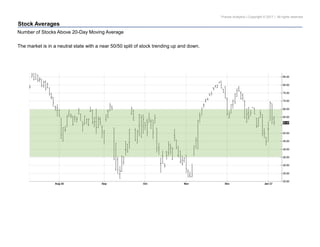

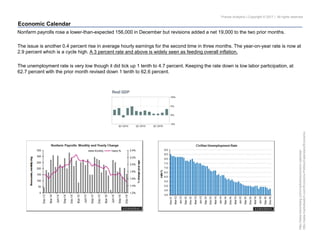

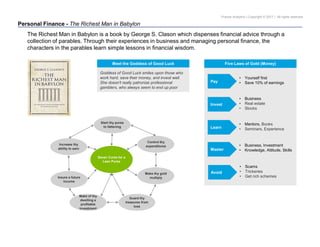

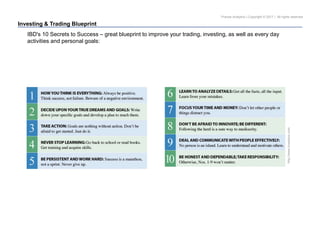

The document is a monthly market report from Pravda Analytics covering various financial markets and economic indicators. It provides technical analysis of the S&P 500, Dow Jones Industrial Average, bond and gold markets. It also discusses options activity, social media sentiment, currencies, oil, economic calendar events and personal finance tips. Charts and analysis point to an overall bullish view of the major US stock market indexes based on technical factors.