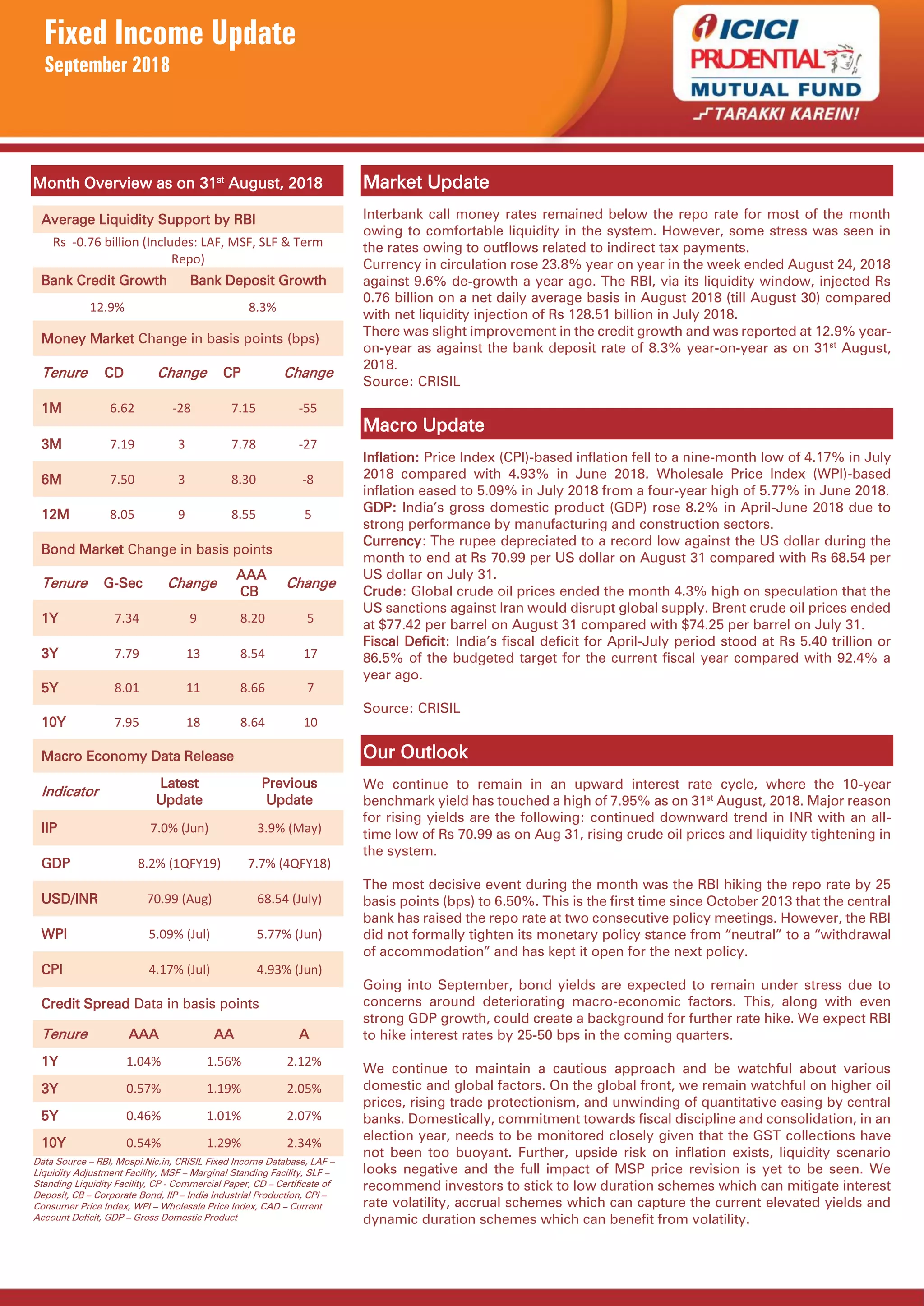

1) The document provides a fixed income market update for September 2018, including macroeconomic indicators, interest rates, and bond market performance.

2) Inflation rates declined while GDP growth increased in the latest periods. The rupee depreciated against the US dollar.

3) Interest rates increased during the month. The authors expect rates to remain high given inflation risks and global uncertainties. They recommend low duration and accrual schemes.