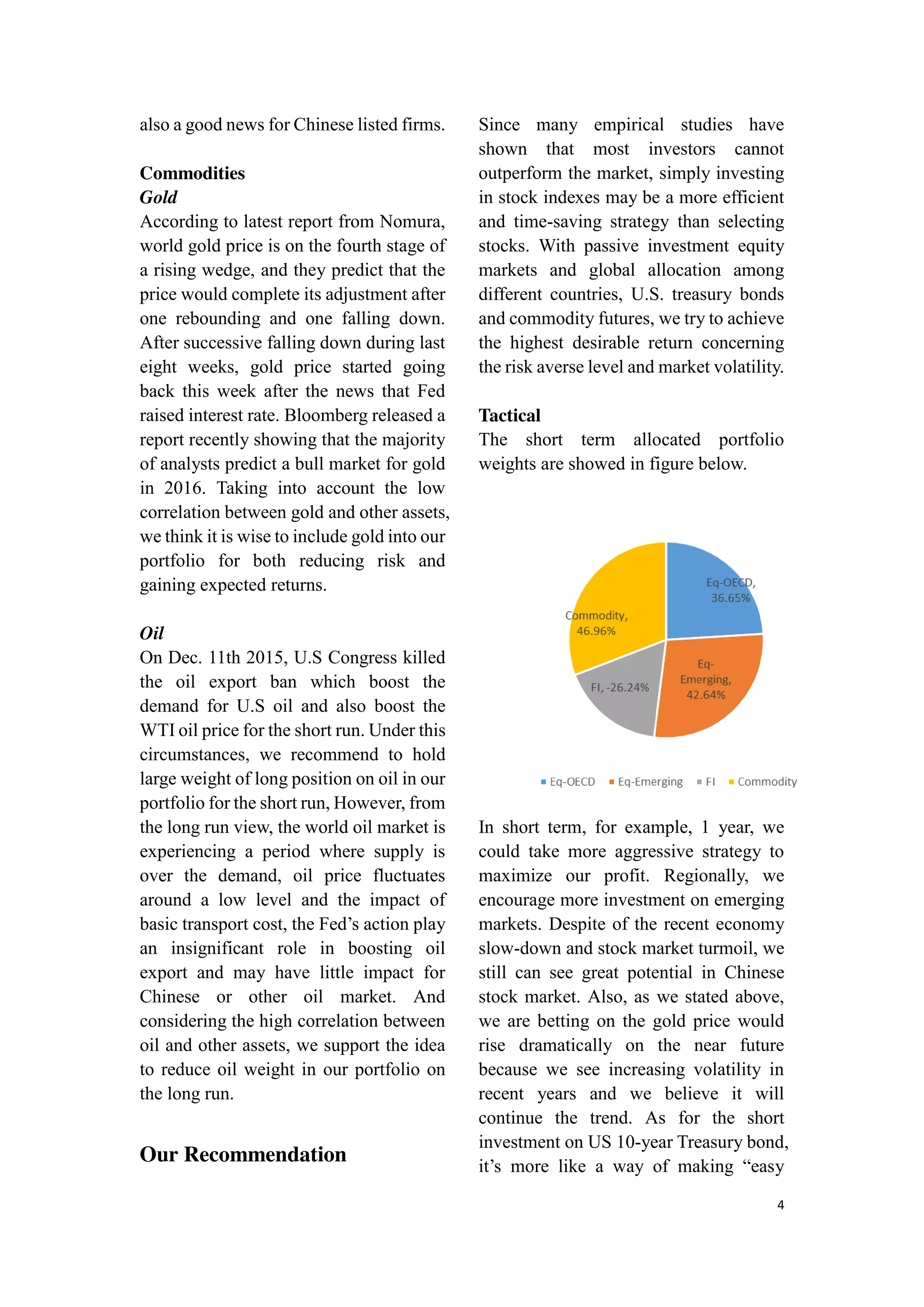

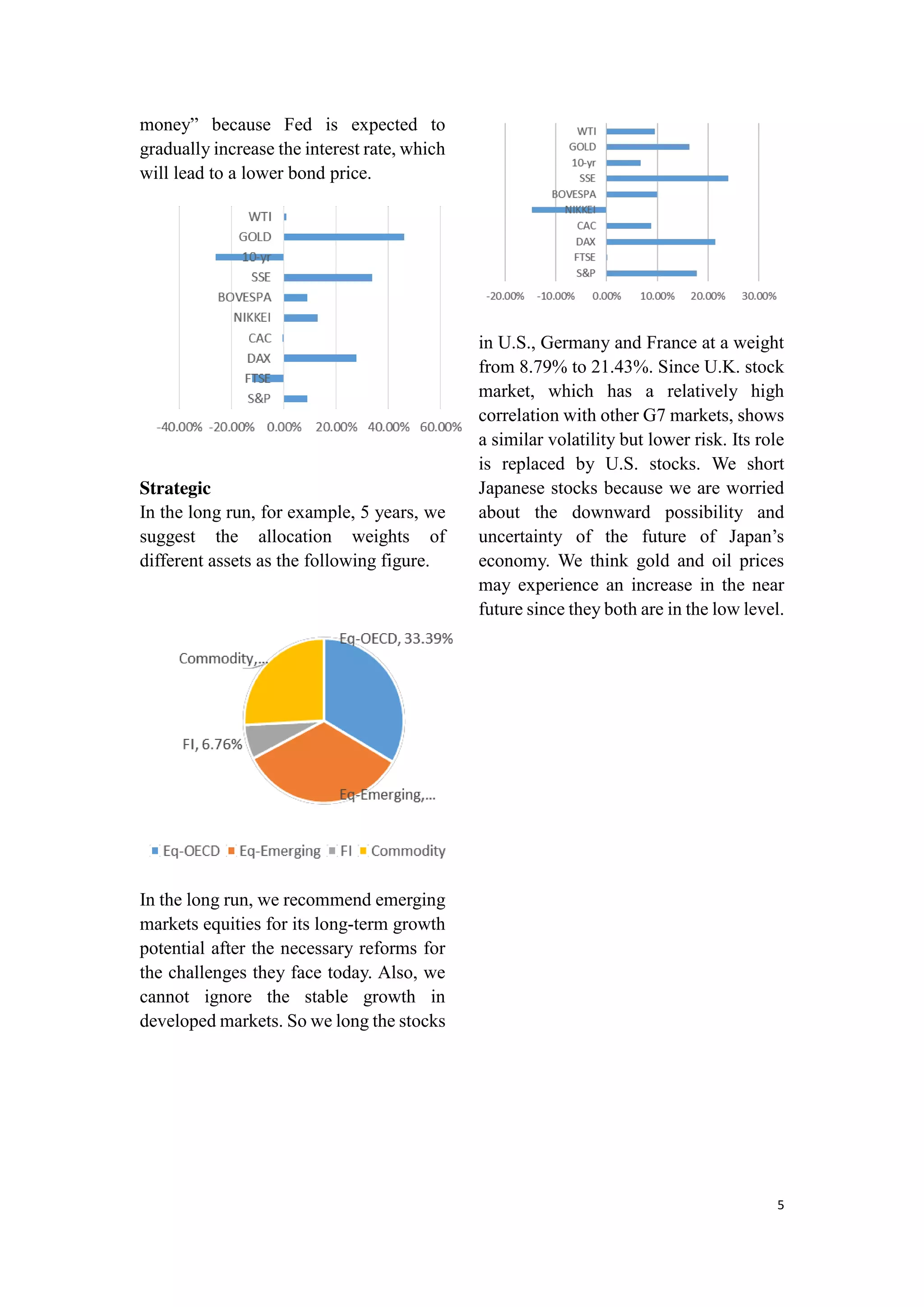

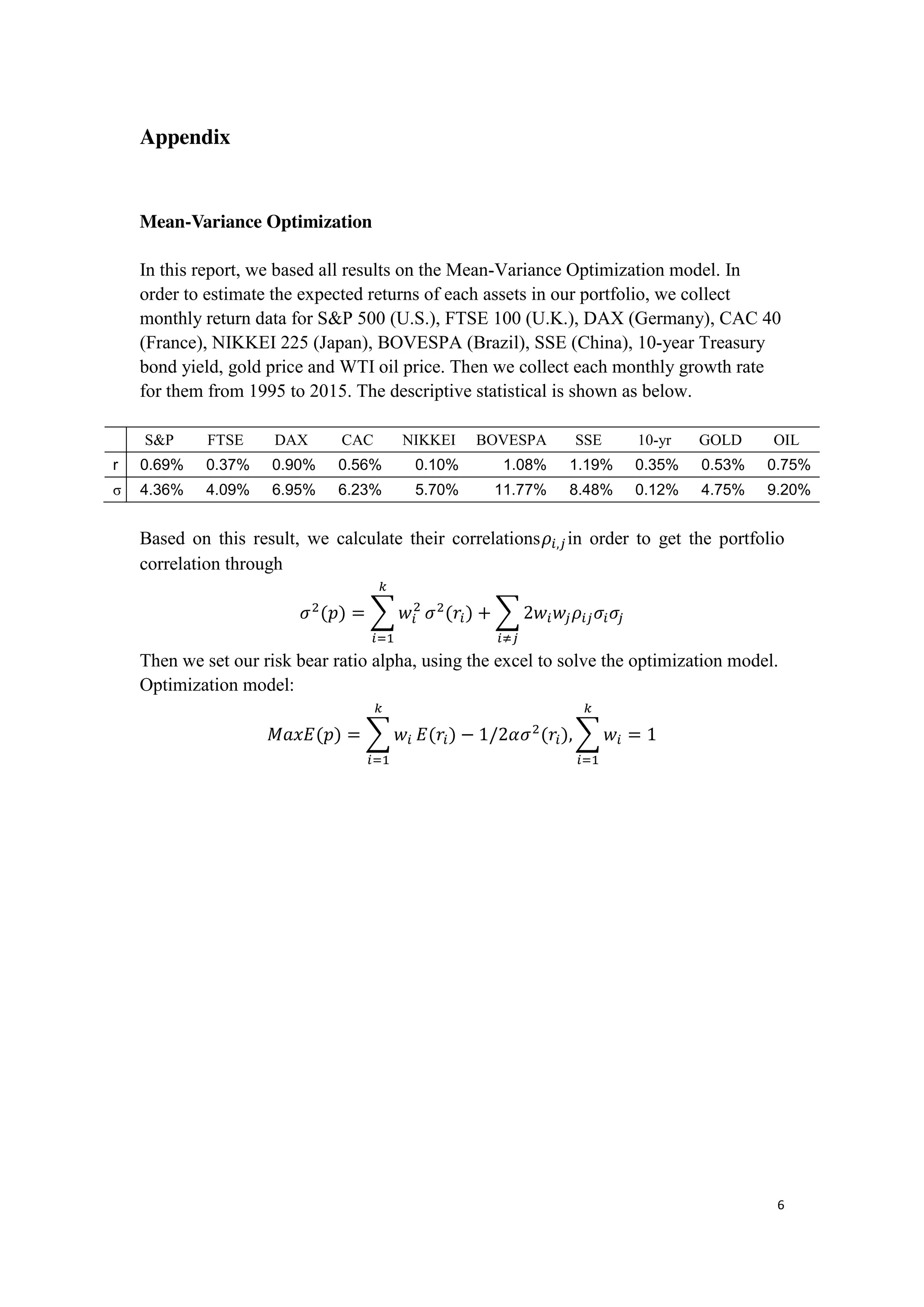

This document provides an asset allocation report for both tactical (short-term) and strategic (long-term) investment strategies. For tactical investments over the next year, the report recommends overweighting emerging markets like China and gold, while shorting US treasury bonds. For strategic investments over the next 5 years, the report recommends a balanced portfolio with exposure to developed and emerging equity markets, as well as gold and oil. Key assets include US, German, and French stocks, while Japanese stocks are shorted due to economic uncertainties.