1. The global economy is expected to see tepid growth through 2017 as aging populations and structural slowdowns weigh on major economies. However, manufacturing and trade indicators point to a synchronized pickup in growth across countries.

2. Markets are likely to remain influenced by Donald Trump's policies, which could boost growth through fiscal stimulus but also raise inflation concerns. Risk assets may perform well while safe havens like Treasuries sell off. Commodity prices may rise further due to OPEC production cuts supporting oil.

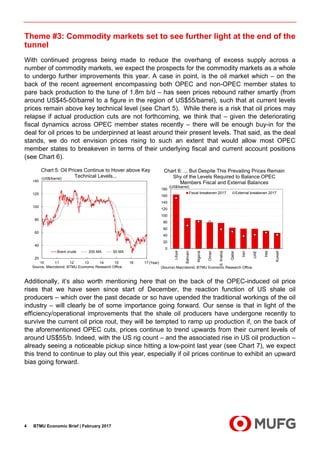

3. Commodity markets overall are set to continue improving in 2017 as efforts to reduce excess supply bear fruit, exemplified by an OPEC agreement boosting oil prices above key technical levels