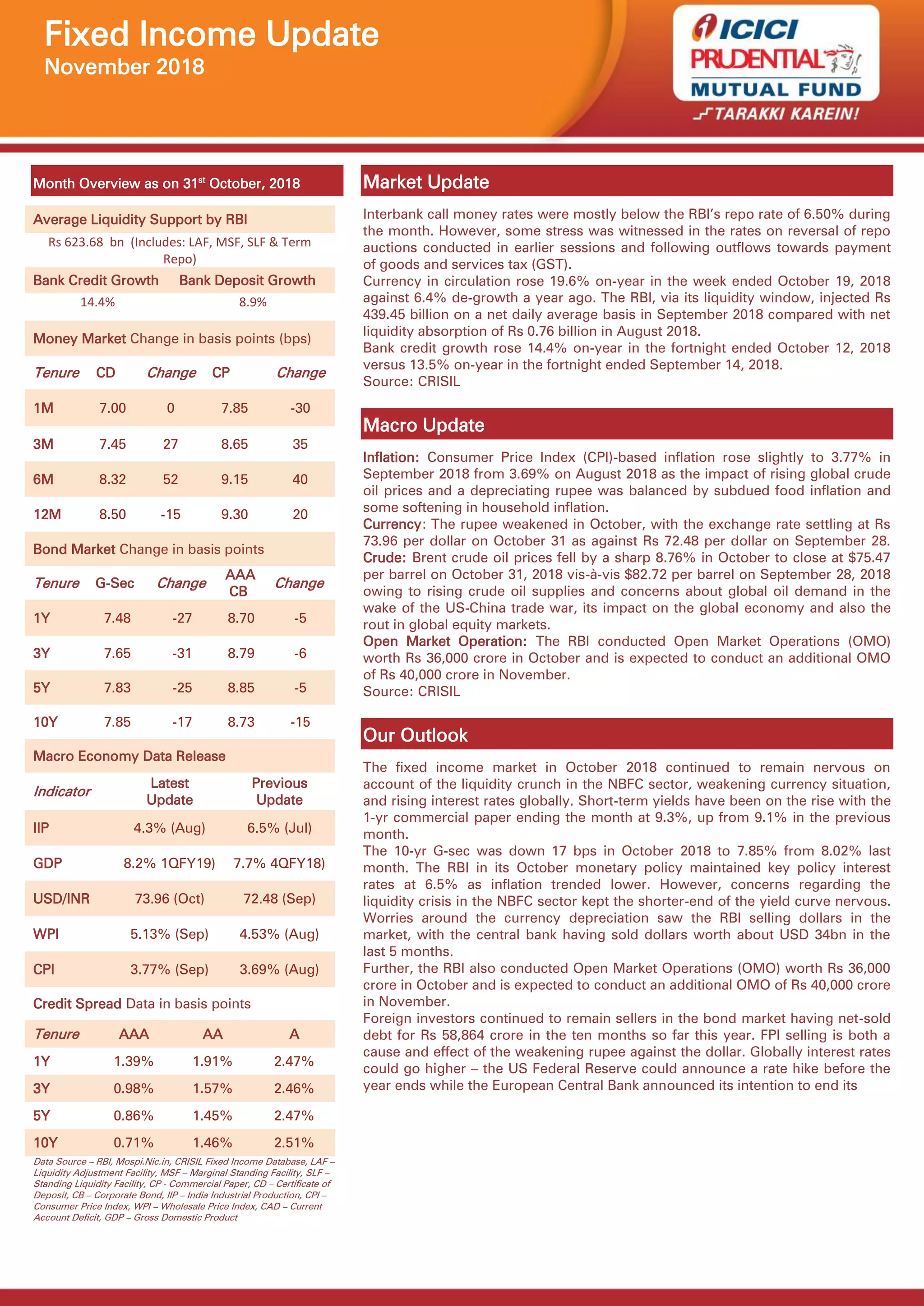

The fixed income update for November 2018 highlights significant liquidity support from the RBI, along with growth in bank credit and deposits. It notes rising inflation rates, a depreciating rupee, and changes in bond and money market yields, while also addressing the nervousness in the market due to a liquidity crunch in the non-banking financial sector. The report recommends various debt fund schemes for investors to consider, reflecting on the broader economic and market conditions.