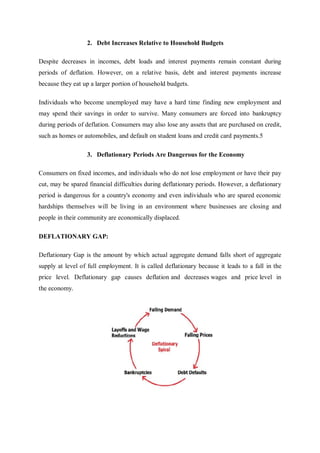

The document discusses inflation and deflation, detailing types, causes, and economic effects of inflation while presenting various methods of measurement and control. It highlights different inflation typologies, such as creeping, walking, and hyperinflation, and discusses terms like the Phillips curve and rational expectations theory. Additionally, it explores consequences of deflation, including increased unemployment and debt burdens, and contrasts deflationary gaps with inflationary gaps.