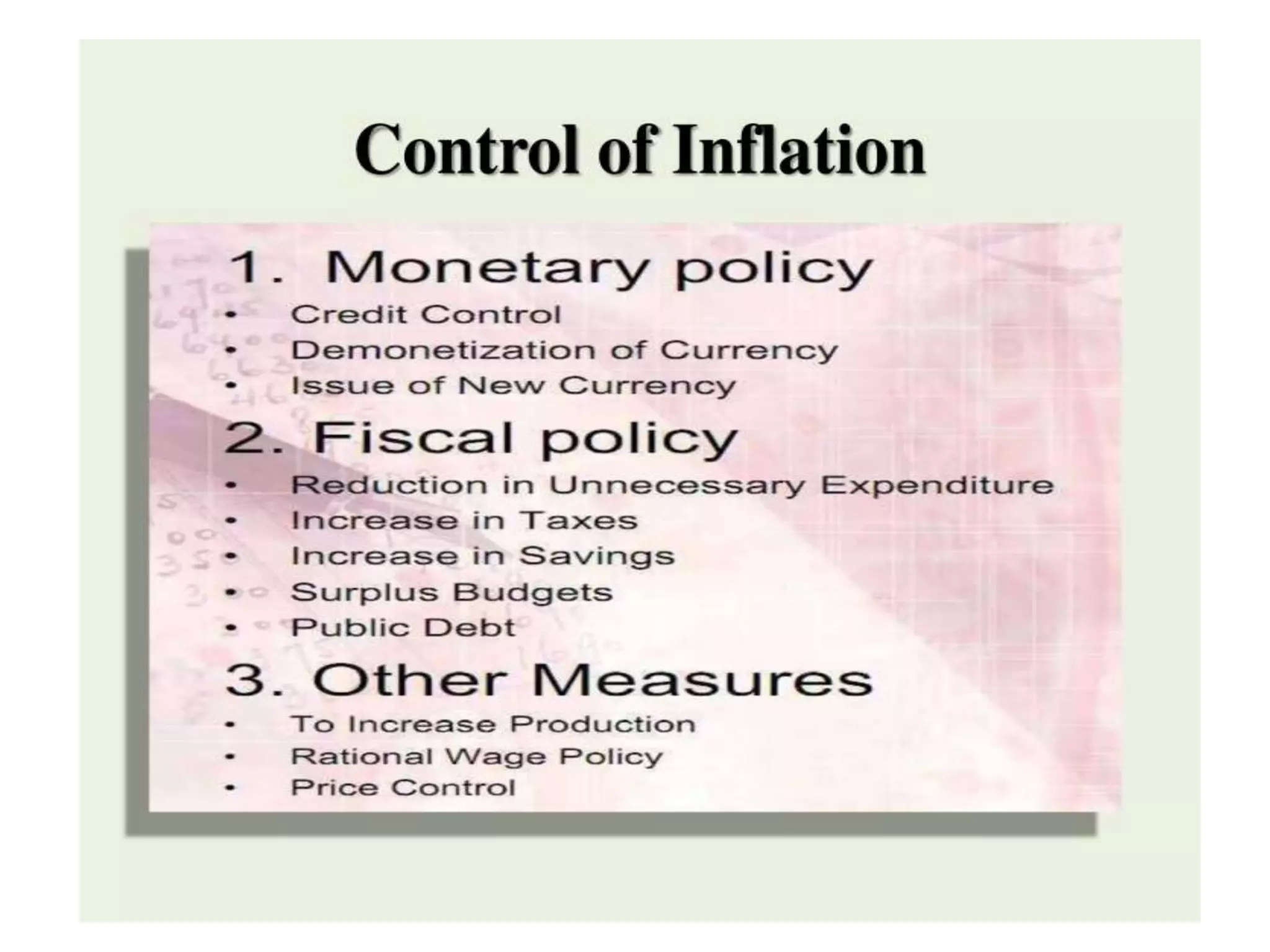

This document discusses inflation and deflation in India. It defines inflation as a general increase in the prices of goods and services, while deflation is a general decrease. The Reserve Bank of India works to maintain a balance between the two through monetary policy actions like interest rate adjustments. Inflation can have both advantages and disadvantages. It identifies several common causes of inflation, like demand outpacing supply, rising input costs, and wage/price spirals. Deflation is considered harmful as it can reduce incomes, production, and increase unemployment for the national economy.