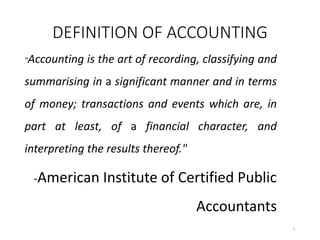

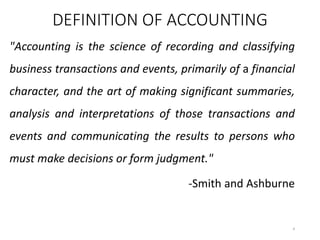

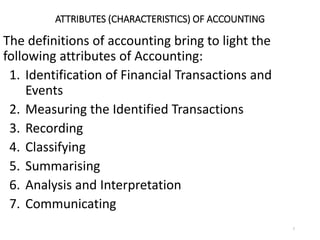

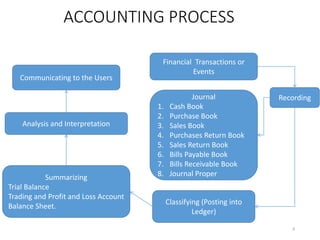

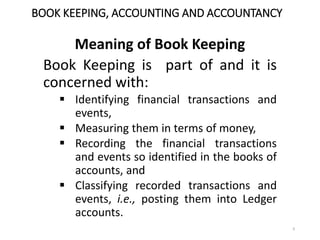

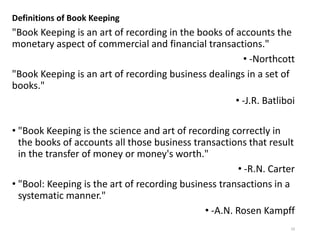

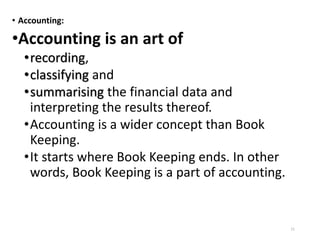

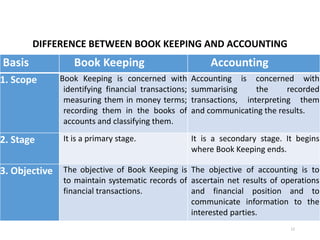

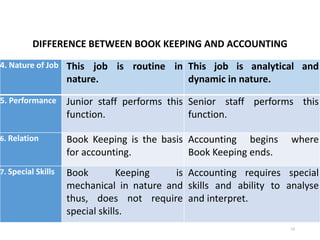

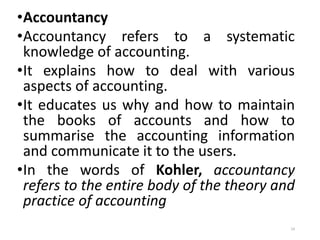

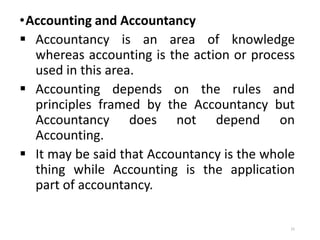

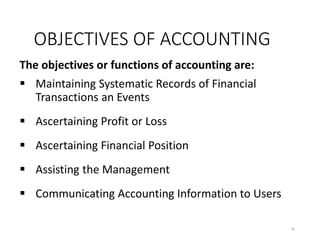

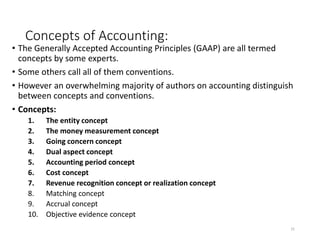

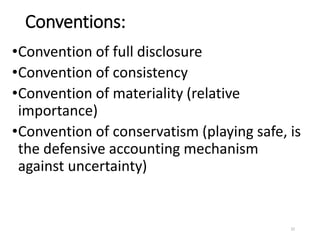

The document serves as an introduction to accounting, detailing its definitions, processes, and objectives. It differentiates between bookkeeping and accounting, explaining that bookkeeping is a subset focused on record-keeping, while accounting encompasses broader functions like analysis and reporting. Various accounting systems, concepts, and conventions are outlined, emphasizing the importance of accurate financial communication and decision-making.