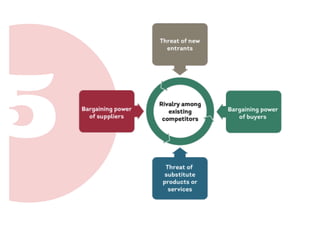

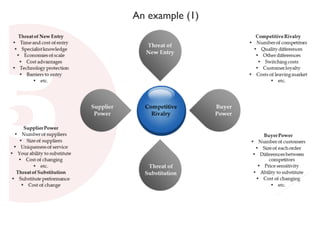

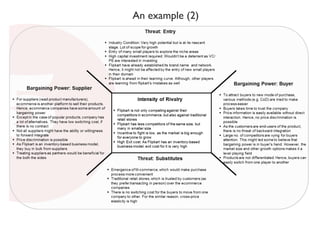

Michael E. Porter's five forces model, introduced in his 1980 book 'Competitive Strategy,' provides a framework for analyzing competitive intensity and market attractiveness. The model evaluates supplier power, buyer power, competitive rivalry, the threat of substitution, and the threat of new entrants, each influencing industry dynamics and company strategy. By using this tool, businesses can identify competitive pressures and develop strategies to strengthen their market position.