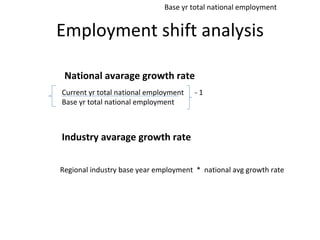

The document discusses various tools and methods for analyzing industries, including qualitative and quantitative approaches. Qualitative approaches include analyzing the strengths, weaknesses, opportunities, and threats (SWOT) of an industry and its competitive landscape over the industry life cycle. Quantitative approaches include analyzing employment data, emolument (pay) data, and input-output relationships to understand industry performance and risk over time. The goal of industry analysis is to identify investment opportunities and understand how industries will perform in the future economic environment.

![Employment share of sub industry = Employment in sub industry *100 Total employment in industry Employment in wools=2000 Total in textile =11500 % Share =2000/11500*100 ie 17.39% Change in employment Current yr no. Of employes _1 *100 Base yr no. Of employes Current employes:1500 Base yr employes:1200 % change : [(1500/1200)-1]*100 ie 25 %](https://image.slidesharecdn.com/industryanalysis-091029230649-phpapp02/85/Industry-Analysis-28-320.jpg)

![Location quotient: Measure concentration of industry’s concentratio in an area relative to rest of nation Industry location quotient Industry share of regional employment Industry share of national employment or Industry’s regional employment Total national employment Industry national employment Total national employment % change in location quotient [ (Current yer LQ/Base yr LQ)1 ] *100 LQ = location quotient](https://image.slidesharecdn.com/industryanalysis-091029230649-phpapp02/85/Industry-Analysis-29-320.jpg)