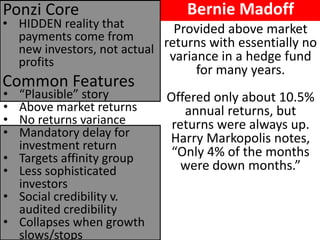

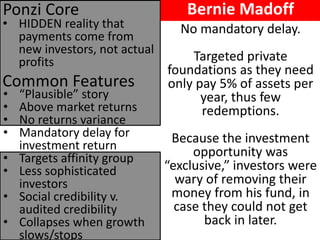

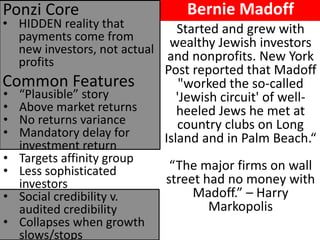

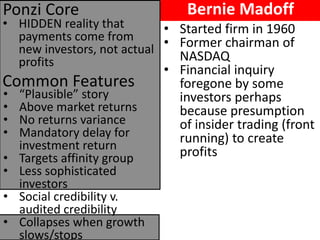

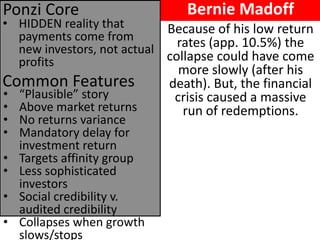

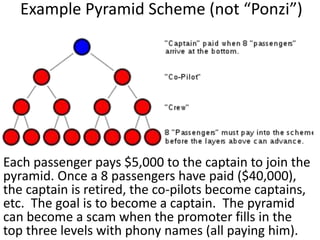

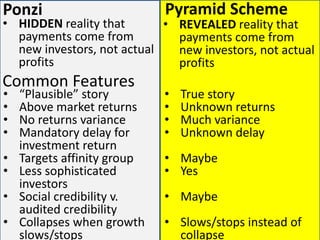

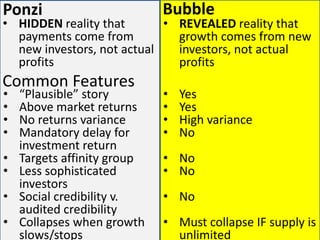

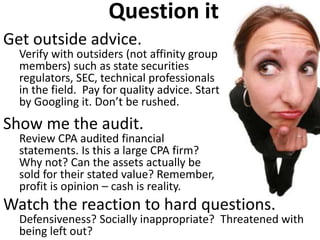

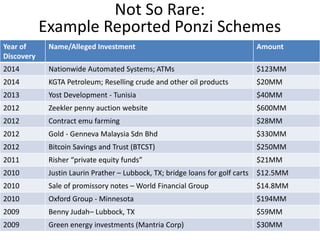

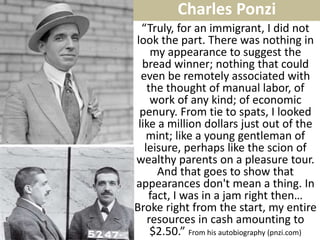

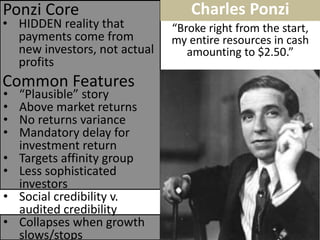

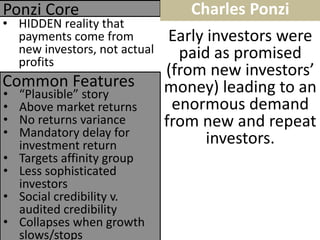

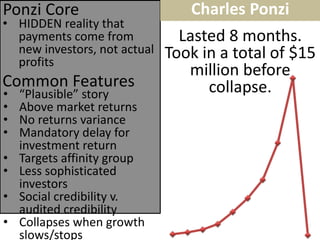

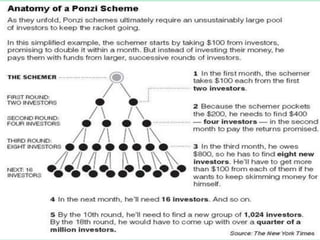

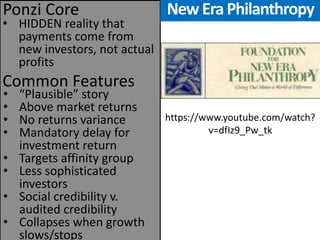

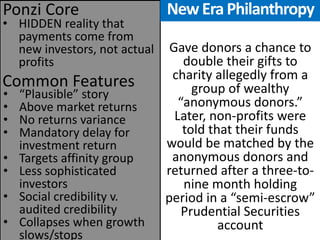

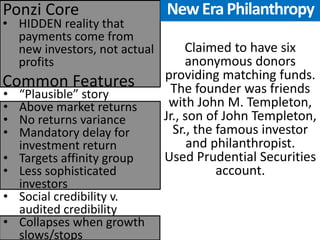

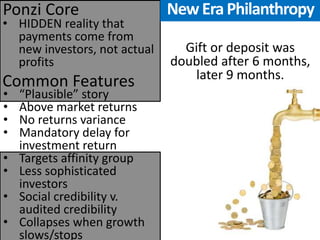

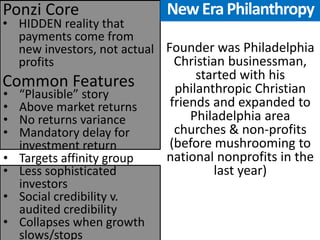

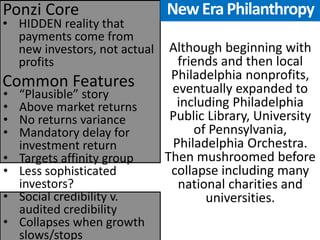

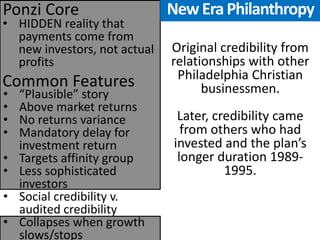

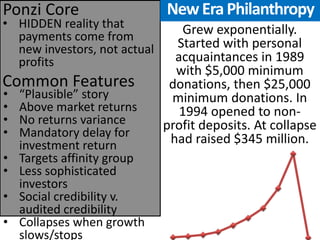

The document discusses the characteristics and realities of Ponzi schemes, highlighting that they rely on new investors' money for returns rather than actual profits. It provides historical examples, including Charles Ponzi, New Era Philanthropy, and Bernie Madoff, illustrating common features such as above-market returns, mandatory delay for returns, and targeting vulnerable investors. Additionally, it outlines ways to protect oneself from such schemes by being skeptical of too-good-to-be-true investments and seeking external verification.

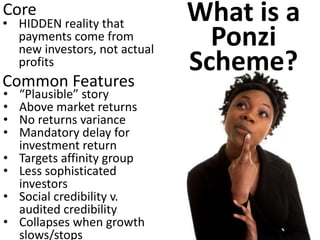

![•HIDDEN reality that payments come from new investors, not actual profits

Common Features

Ponzi Core

•“Plausible” story

•Above market returns

•No returns variance

•Mandatory delay for investment return

•Targets affinity group

•Less sophisticated investors

•Social credibility v. audited credibility

•Collapses when growth slows/stops

Fake trades were “recorded” after the fact to match indicated returns. Because he operated a trading company and was former chairman of NASDAQ, some assumed he had insider trading ability. [E.g., “front running” where stockbroker buys ahead of customer’s large buy orders then sells immediately afterwards]

Bernie Madoff](https://image.slidesharecdn.com/ponzi-141202135816-conversion-gate01/85/Ponzis-Pyramids-and-Bubbles-An-introduction-to-financial-fraud-23-320.jpg)