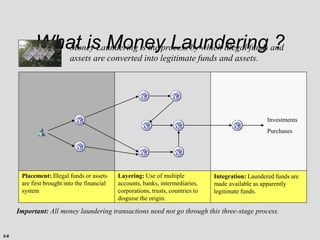

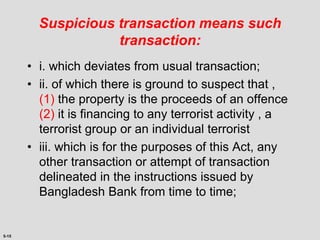

The document provides a comprehensive overview of money laundering, including its definition, processes, and the legal framework surrounding it as per the Money Laundering Prevention Act of 2012 in Bangladesh. It explains the three stages of money laundering: placement, layering, and integration, and discusses various predicate crimes and the critical role of anti-money laundering measures. Additionally, it highlights the importance of 'Know Your Customer' (KYC) protocols for financial institutions to combat money laundering effectively.