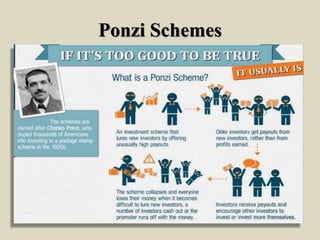

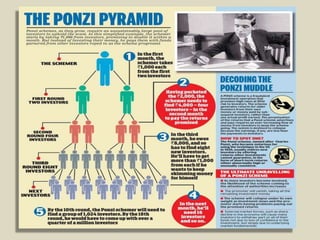

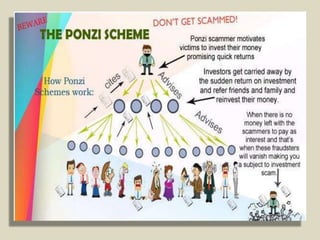

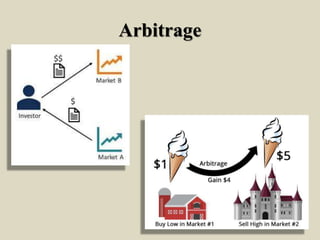

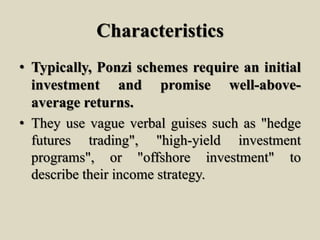

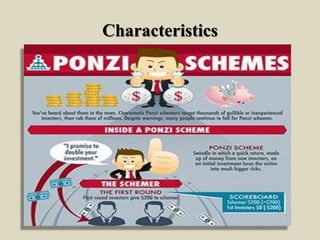

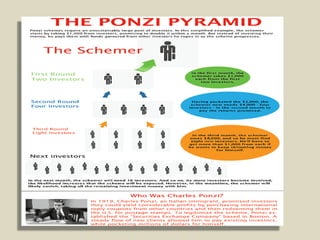

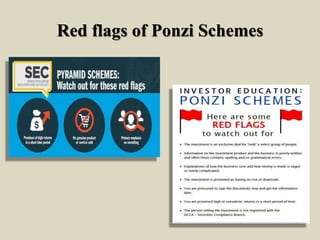

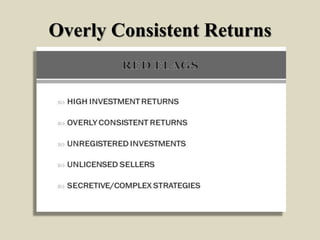

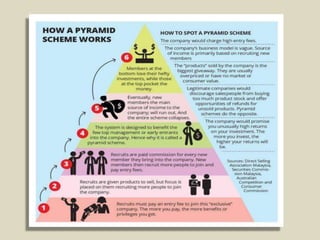

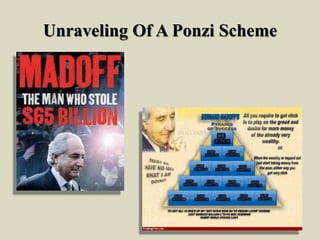

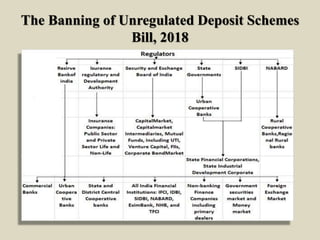

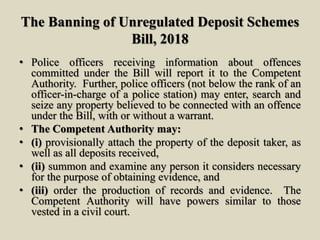

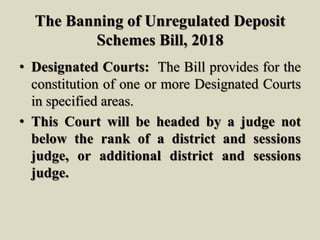

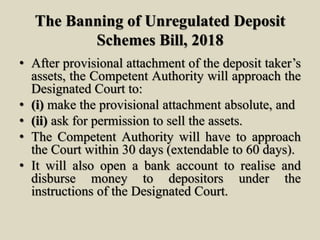

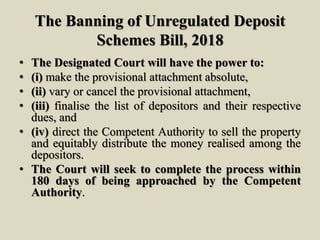

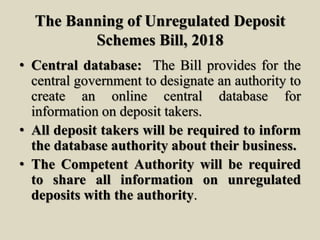

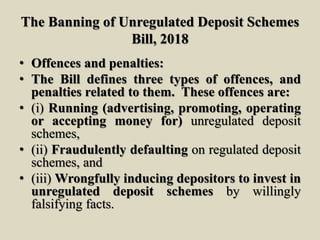

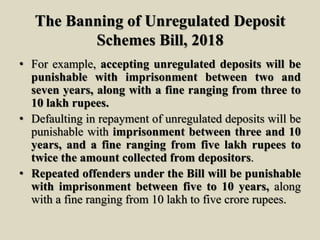

This document discusses Ponzi schemes, how they work, and efforts to curb them. It defines a Ponzi scheme as a fraudulent investing scam that pays returns to early investors through funds obtained from newer investors. The schemes often collapse when new investor money slows down. Notable red flags include unrealistically high returns, unregistered investments, and inconsistent or unavailable account statements. The document also outlines the origins of Ponzi schemes through Charles Ponzi in the 1920s. Finally, it discusses the Banning of Unregulated Deposit Schemes Bill, 2018 introduced by the Indian government to regulate deposits and impose jail time for Ponzi scheme operators.