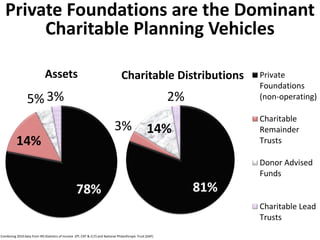

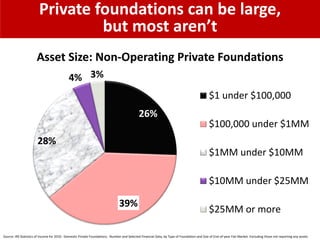

1. Private foundations and donor advised funds hold money and distribute grants to charities. Private foundations are the dominant charitable planning vehicles, holding 81% of assets compared to 3% for donor advised funds.

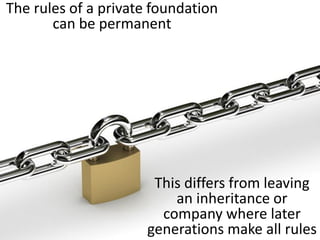

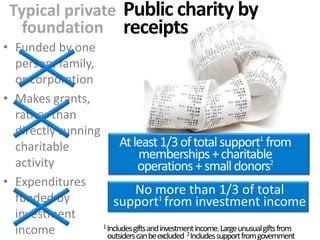

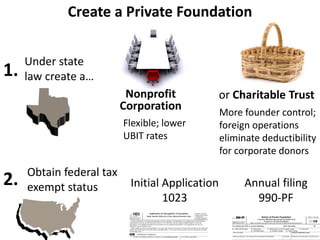

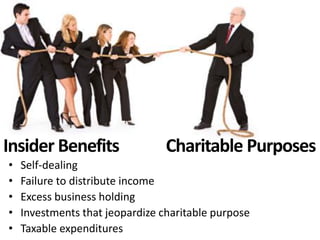

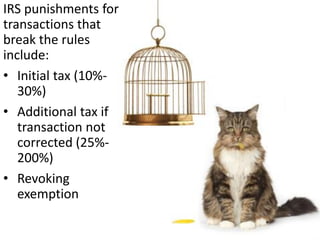

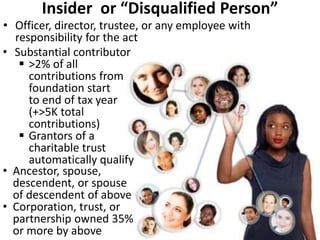

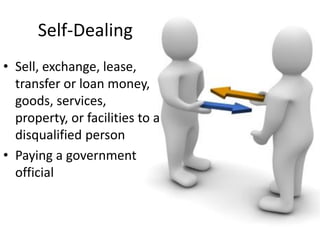

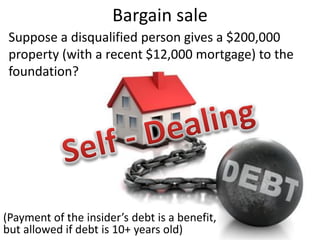

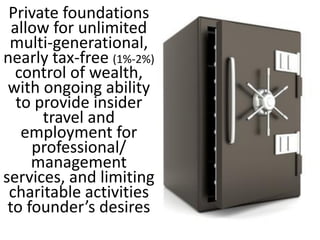

2. Private foundations are typically funded by an individual, family, or corporation. They make grants to charities rather than directly conducting charitable activities. Private foundations are subject to a 2% tax on net investment income and strict rules around insider benefits and payouts.

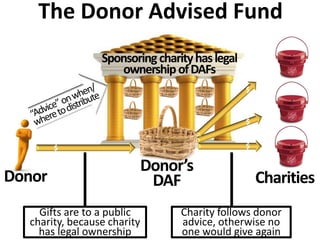

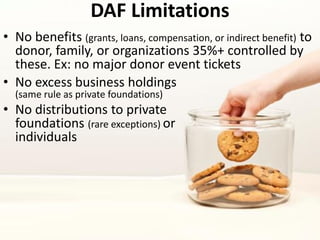

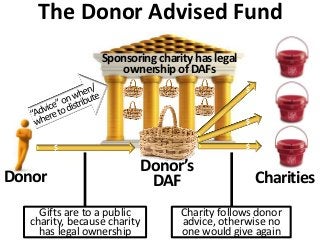

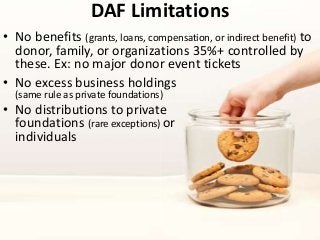

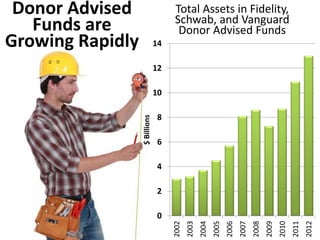

3. Donor advised funds are accounts housed within public charities. They offer donors similar tax benefits to private foundations with less complexity and cost. However, donors do not have legal control over grants from donor advised funds.

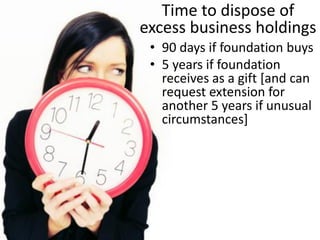

![Time to dispose of

excess business holdings

• 90 days if foundation buys

• 5 years if foundation

receives as a gift [and can

request extension for

another 5 years if unusual

circumstances]](https://image.slidesharecdn.com/privatefoundationsanddonoradvisedfunds-141118144903-conversion-gate01/85/Private-foundations-and-donor-advised-funds-69-320.jpg)