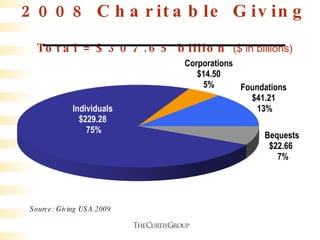

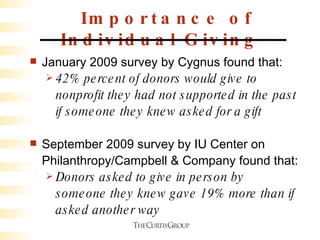

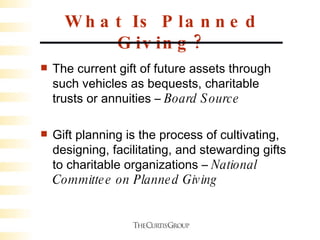

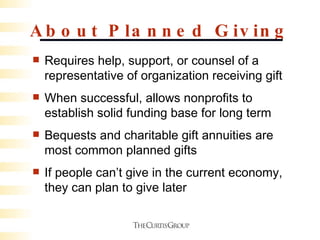

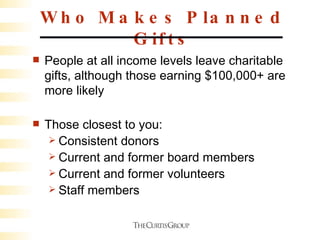

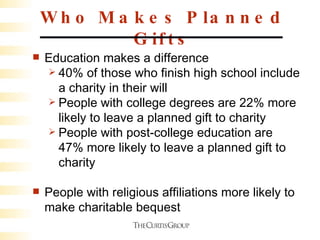

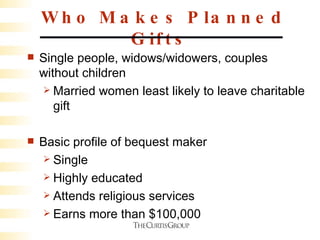

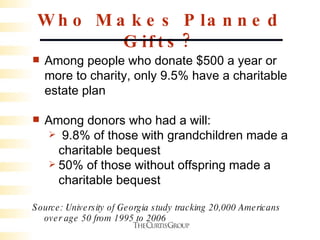

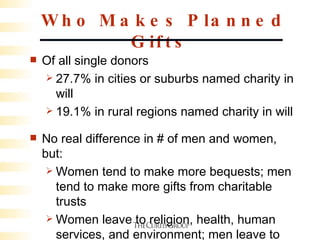

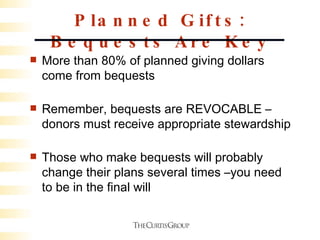

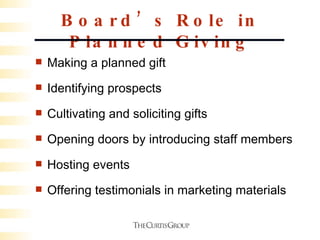

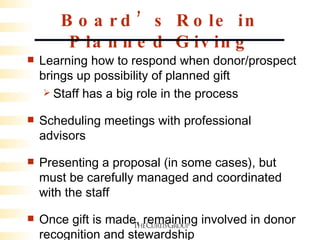

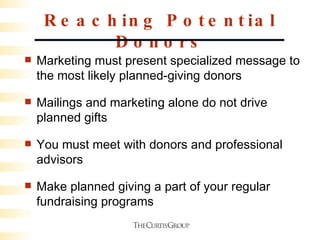

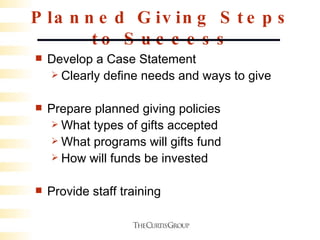

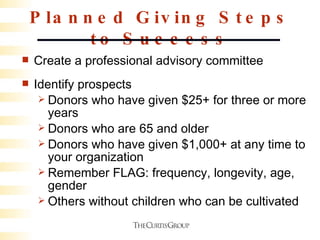

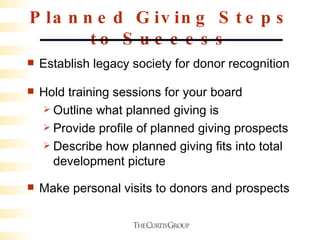

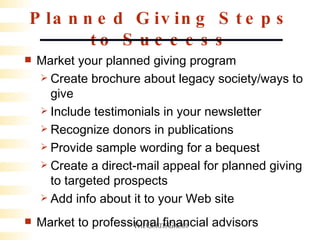

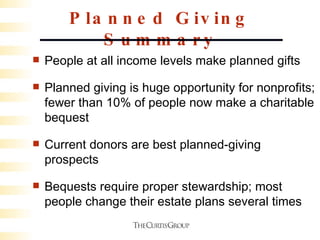

The Curtis Group, celebrating its 20th anniversary, supports nonprofits in planned giving, raising significant funds and emphasizing the role of individual contributions in philanthropy. Planned giving allows donors to contribute future assets through vehicles like bequests and charitable trusts, with a high percentage of donations coming from individuals earning over $100,000 and those with higher education levels. Effective planned giving strategies include donor cultivation, marketing targeted at potential bequests, and maintaining stewardship to ensure ongoing support.