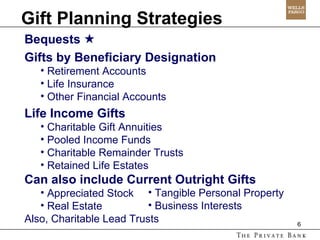

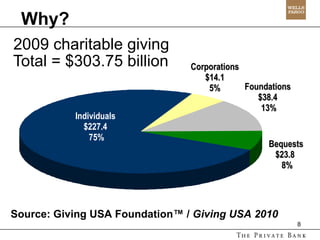

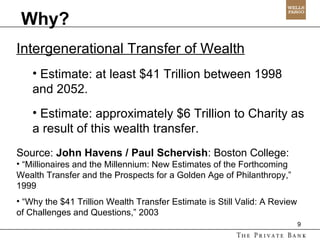

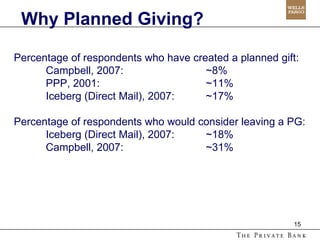

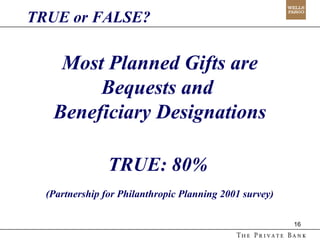

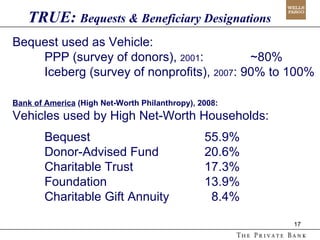

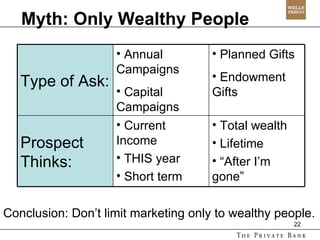

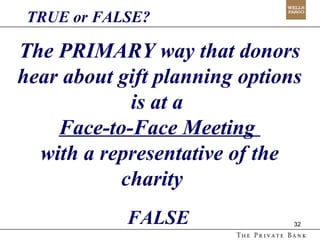

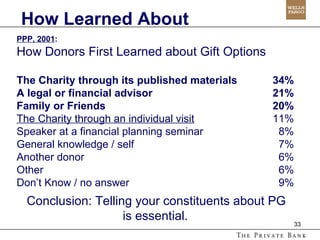

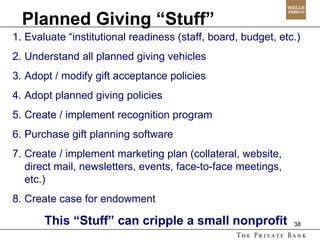

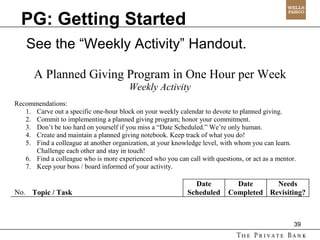

The document outlines a plan for establishing a planned giving program aimed at smaller and newer nonprofit organizations, emphasizing that it is accessible and not exclusive to larger organizations. It defines planned giving, highlights its significance as a funding source, and presents various gift planning strategies including bequests and beneficiary designations. Additionally, it dispels common myths about who can participate in planned giving and provides practical steps for organizations to implement a successful program with minimal time commitment.

![A Planned Giving Program in One Hour per Week April 6, 2011 Wells Fargo Private Bank provides financial services and products through Wells Fargo Bank, N.A. and its affiliates. Wells Fargo & Company cannot provide tax advice. Please consult your professional tax advisor to determine how this information may apply to your own situation. Dan Harris Senior Vice President, Regional Manager Wells Fargo Philanthropic Services 720-947-6775 [email_address]](https://image.slidesharecdn.com/apgprograminonehourperweek-mn-6-4-11-110419130609-phpapp02/75/WEBINAR-Planned-Giving-on-One-Hour-Per-Week-1-2048.jpg)

![“ Big Donation Saved Bit by Bit” Grand Junction, Colorado The Daily Sentinel, February 10, 2008 Lena Sammons Read died at the age of 96 on Feb. 19, 2007, preceded in death by her husband Clarence. “ She lived very frugally in a small trailer in Crawford, about 12 by 5 feet, which she and her husband bought,” [the estate executor] said. “She lived there for 40 years or more, close to the school, and most of the time she walked.” She left $565,000 in scholarships to help Crawford students pay for higher education for the next 50 years. Also left bequests for Crawford’s ambulance service , library , fire department , Methodist church , and cemetery district . Crawford, Colorado. Delta County. Population 366 in 2000 census.](https://image.slidesharecdn.com/apgprograminonehourperweek-mn-6-4-11-110419130609-phpapp02/85/WEBINAR-Planned-Giving-on-One-Hour-Per-Week-13-320.jpg)

![Dan Harris Senior Vice President, Regional Manager Wells Fargo Philanthropic Services 720-947-6775 [email_address] Questions? Please Email or Call With Additional Questions! See accompanying paper for list of resources.](https://image.slidesharecdn.com/apgprograminonehourperweek-mn-6-4-11-110419130609-phpapp02/85/WEBINAR-Planned-Giving-on-One-Hour-Per-Week-51-320.jpg)