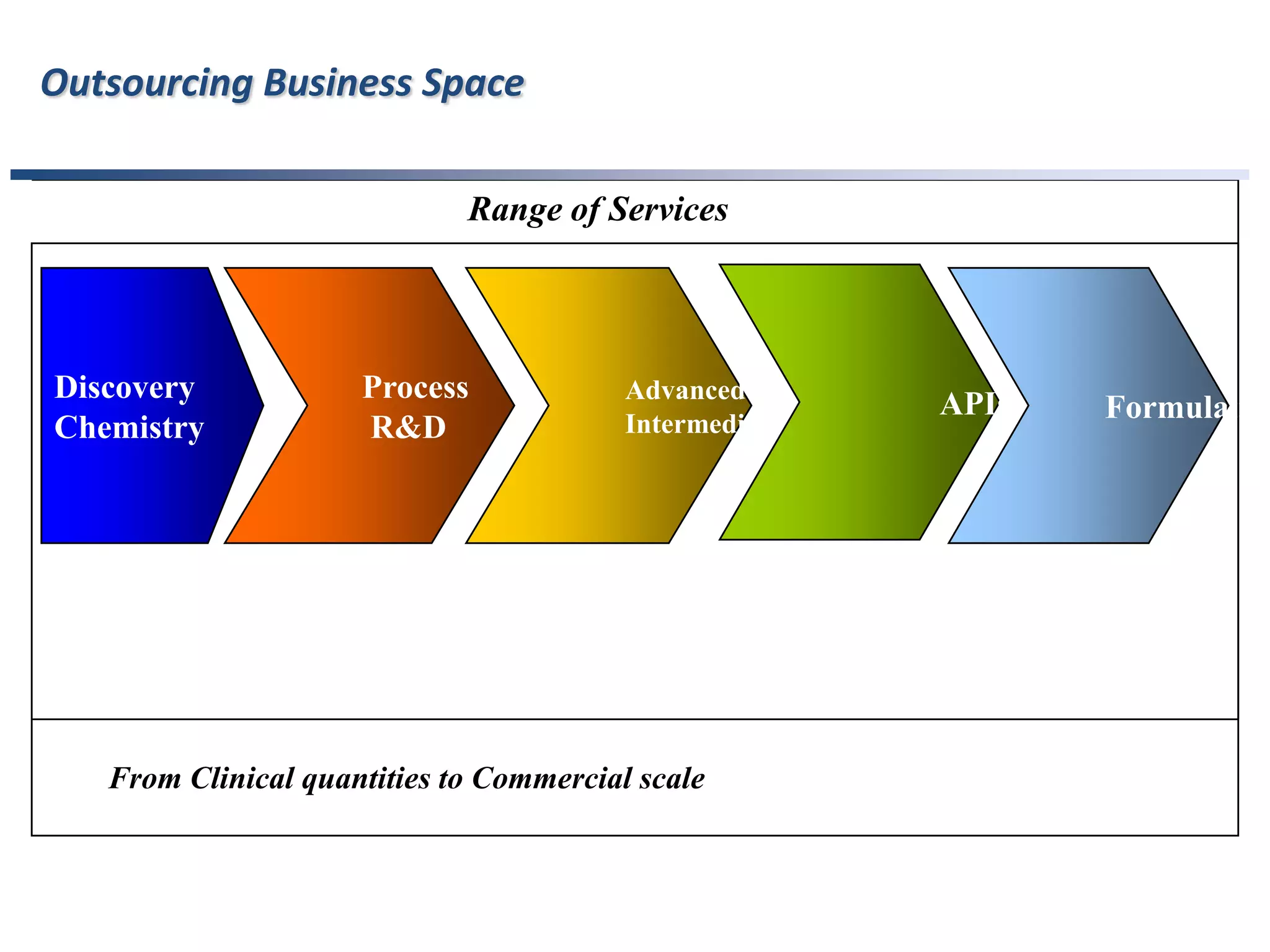

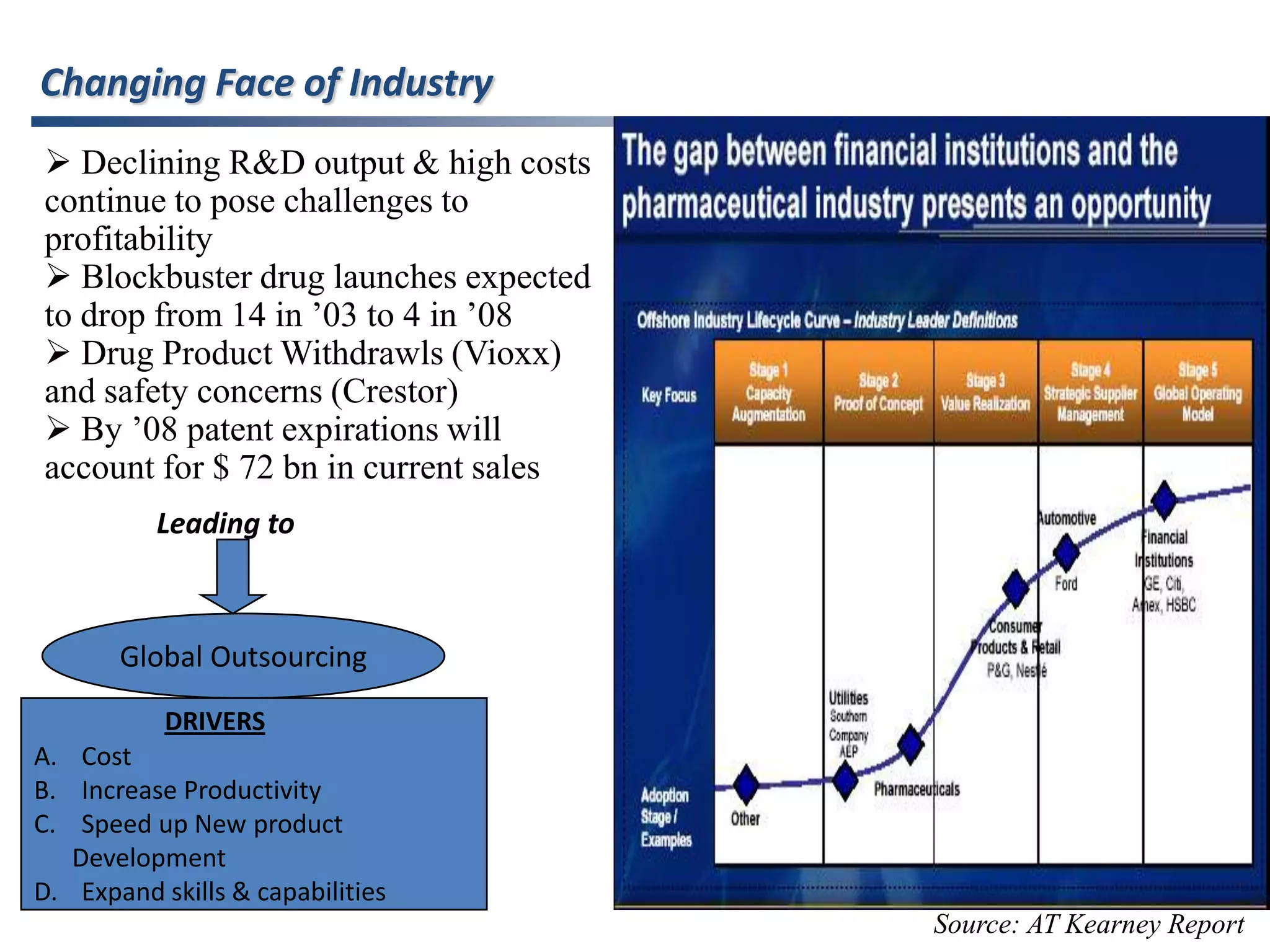

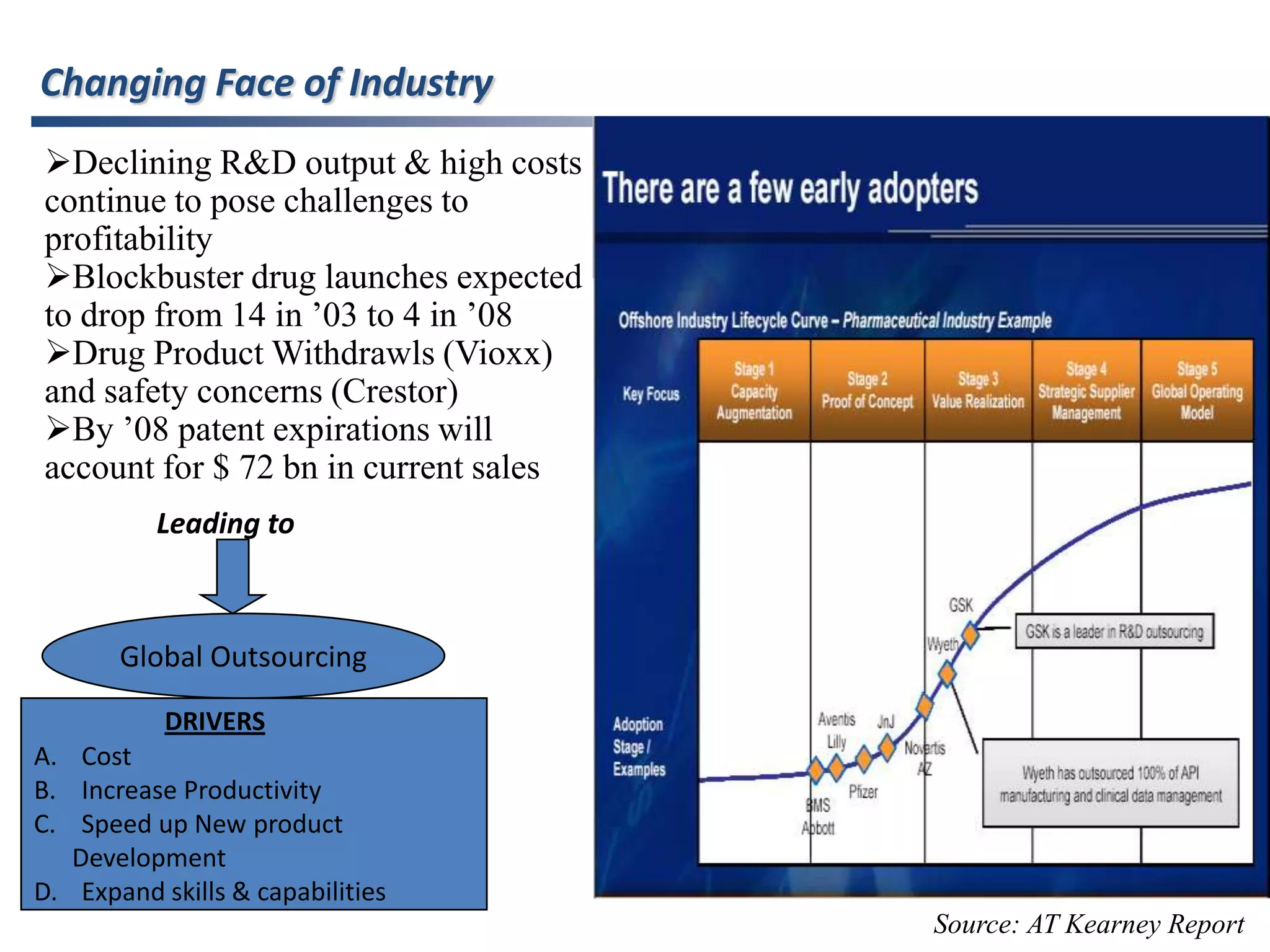

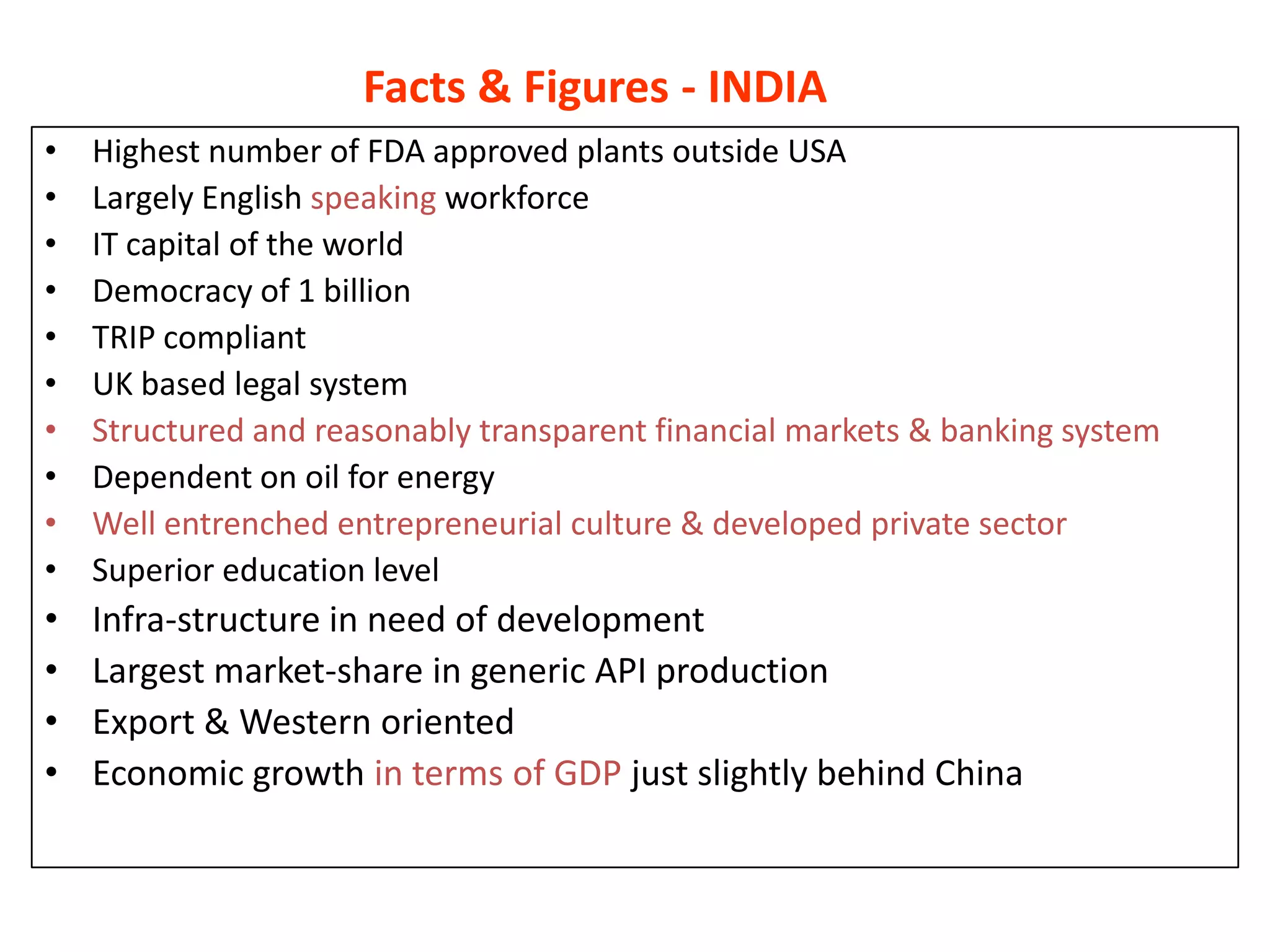

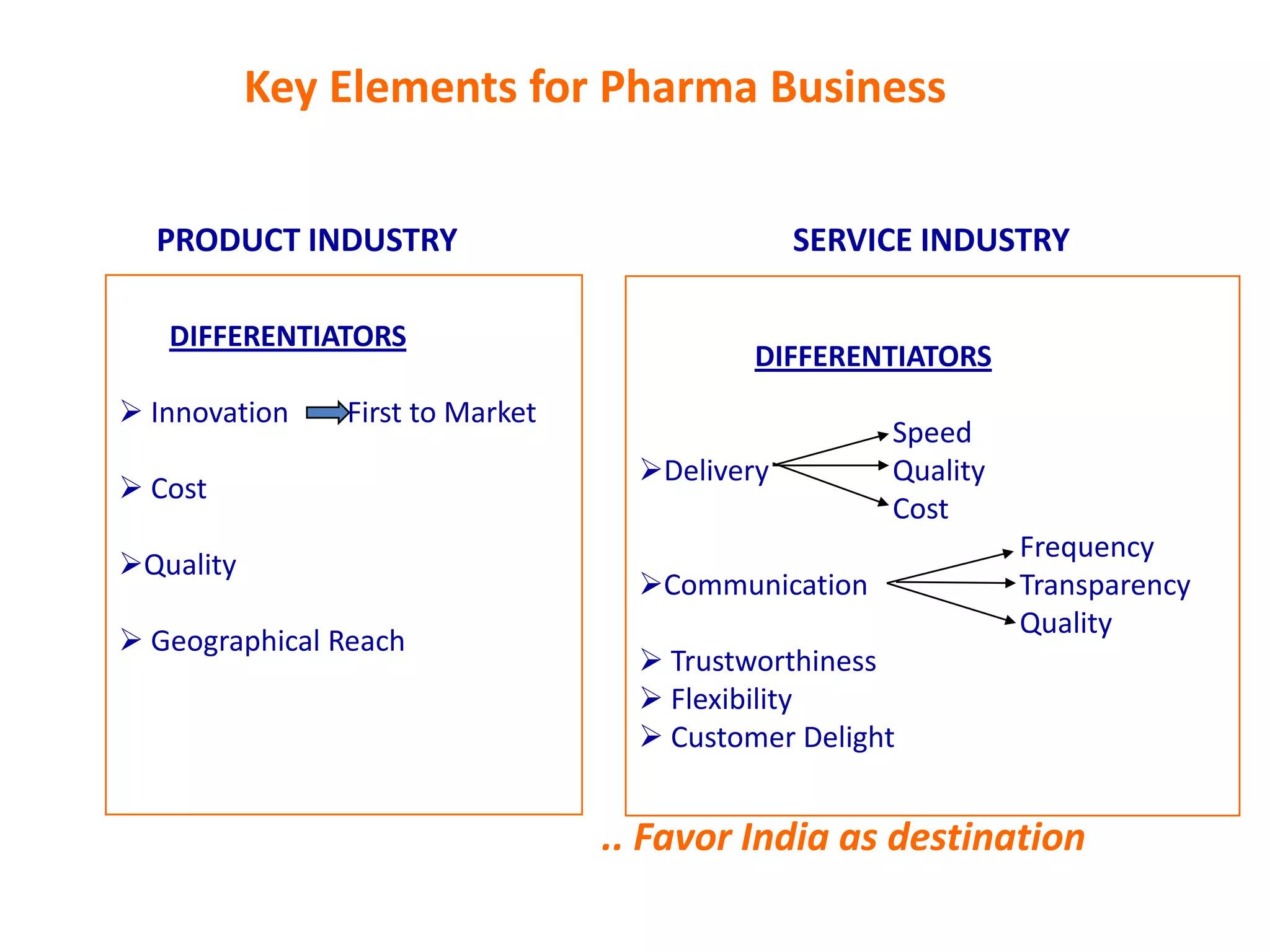

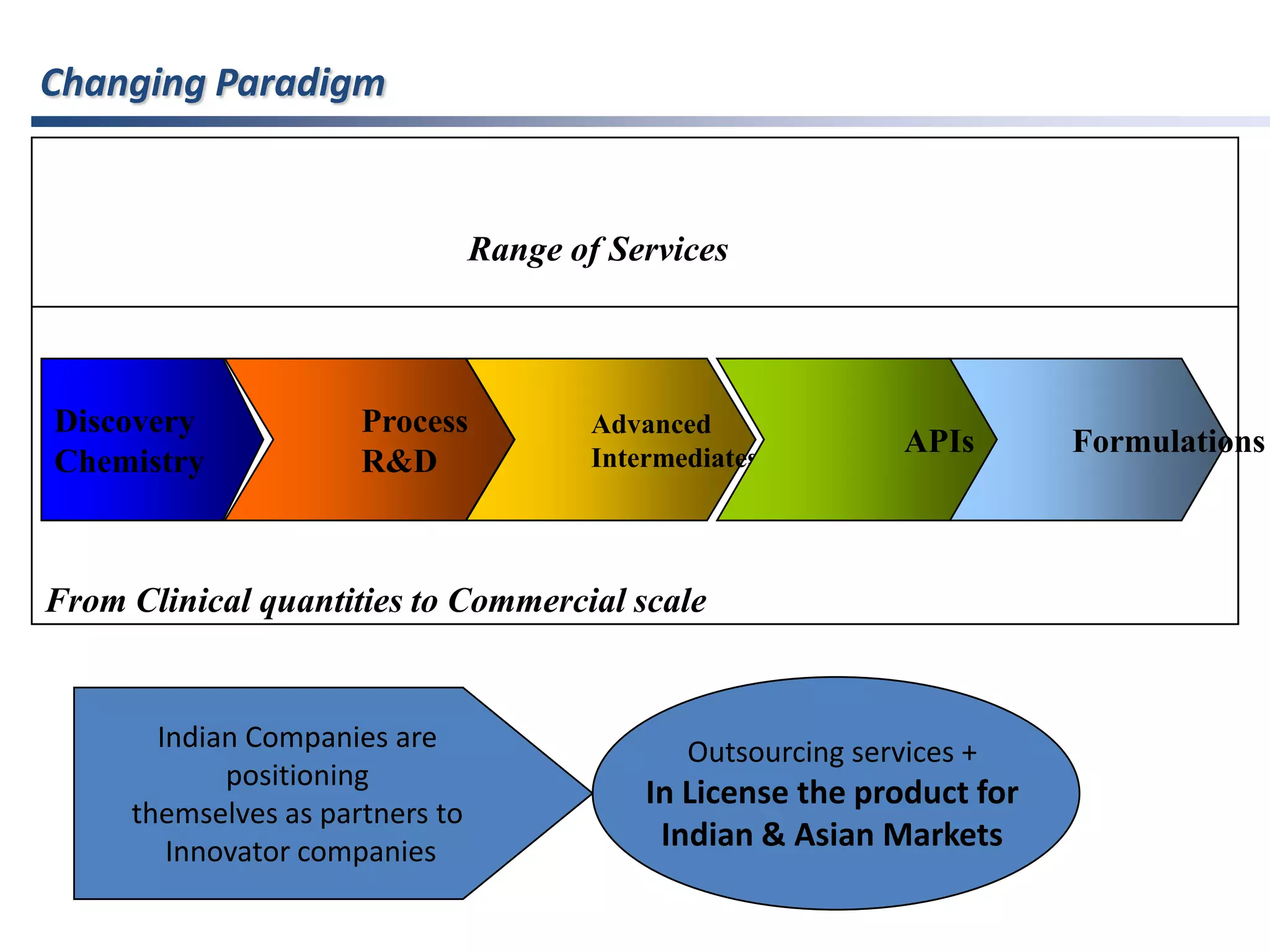

- Indian pharmaceutical companies have increased R&D spending and are targeting international companies for contract research and manufacturing deals.

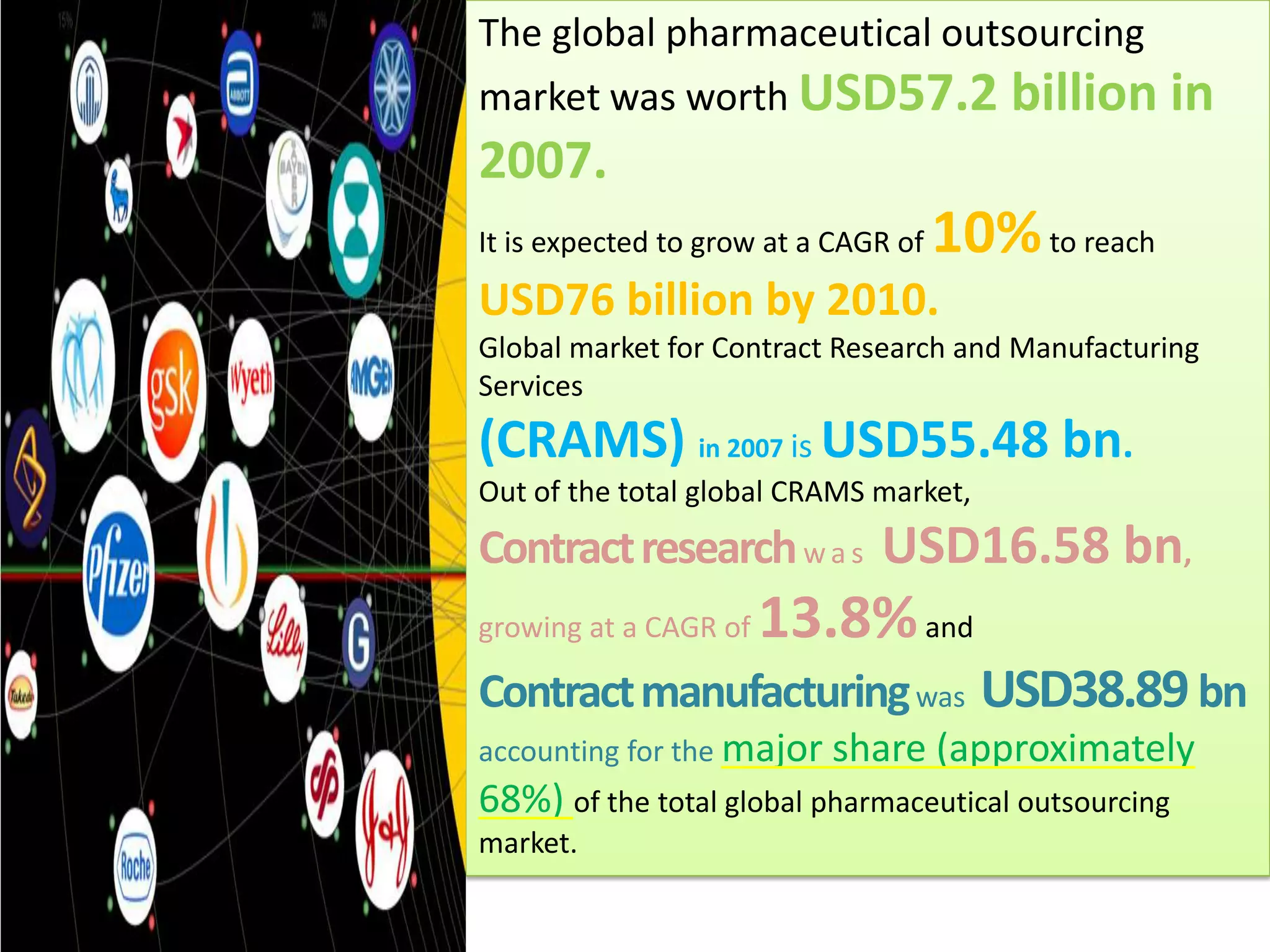

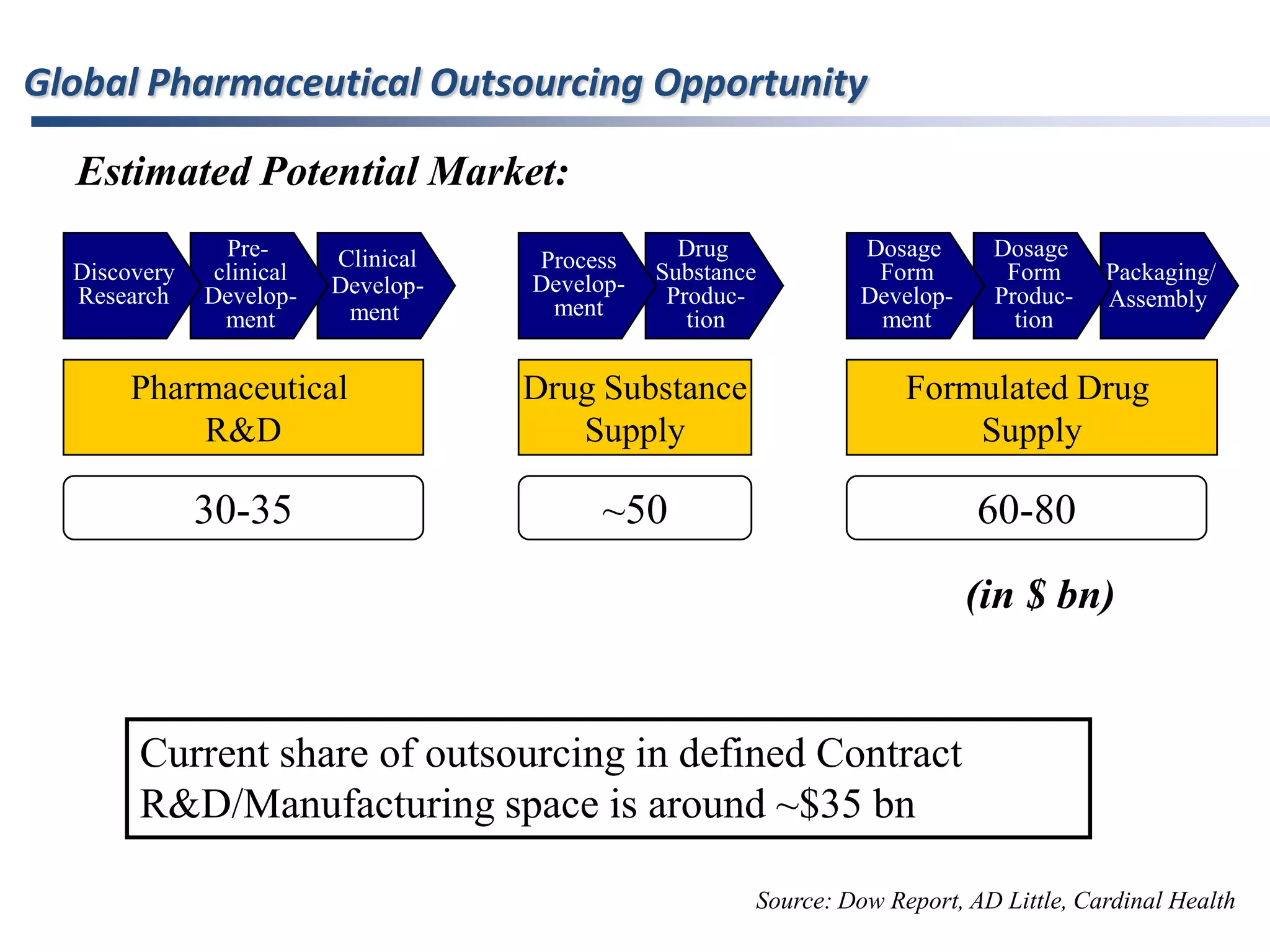

- The global pharmaceutical outsourcing market was worth $57.2 billion in 2007 and is expected to grow to $76 billion by 2010, with contract research and manufacturing services making up $55.48 billion in 2007.

- The Indian pharmaceutical outsourcing market was valued at $1.27 billion in 2007 and is projected to reach $3.33 billion by 2010, growing at a CAGR of 37.6%.