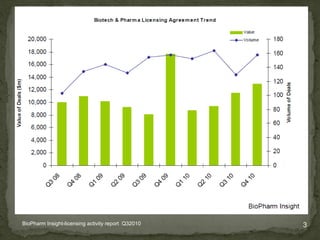

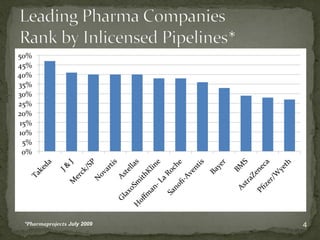

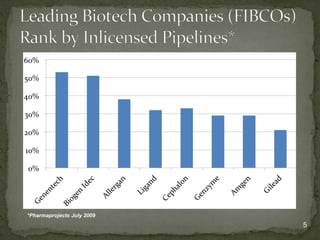

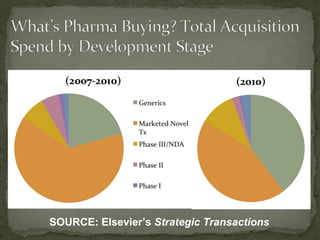

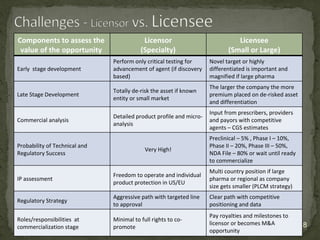

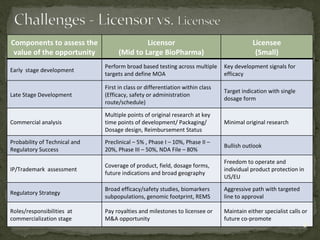

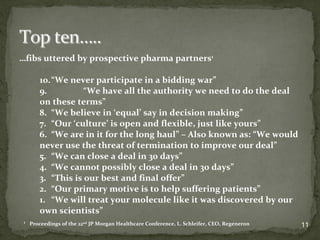

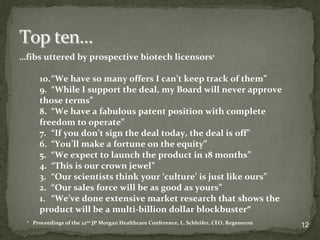

The document discusses strategic deal-making in the biopharma industry, focusing on the perspectives of licensors and licensees during the licensing process. It highlights trends in licensing activity, value assessments, and the importance of commercial analysis, regulatory strategy, and intellectual property considerations. Additionally, it includes quotes illustrating common misconceptions and promises made by both pharma partners and biotech licensors.