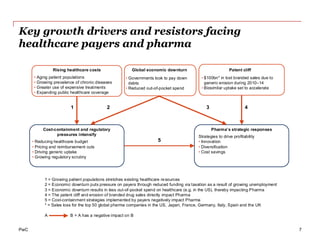

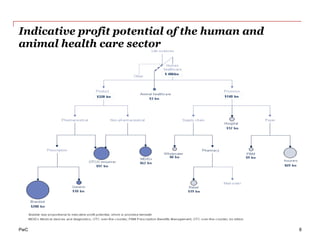

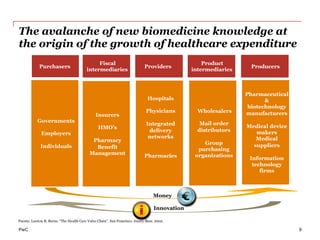

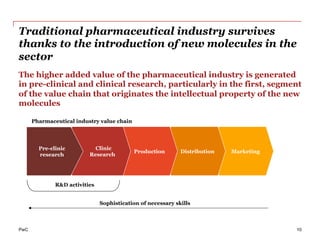

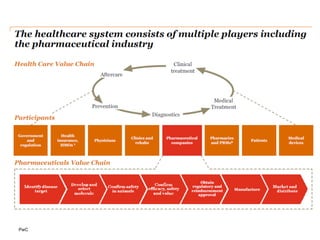

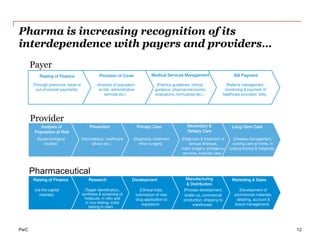

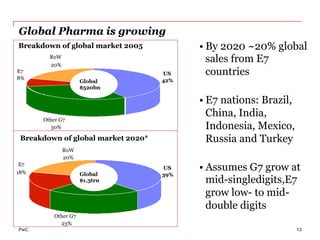

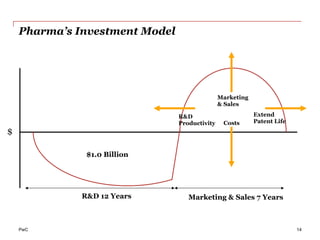

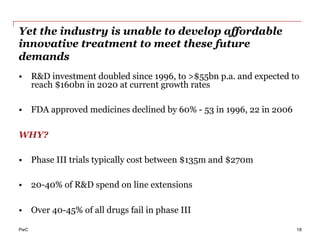

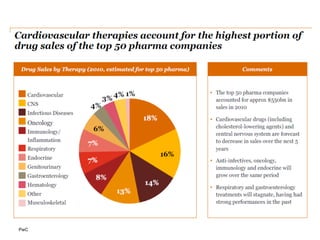

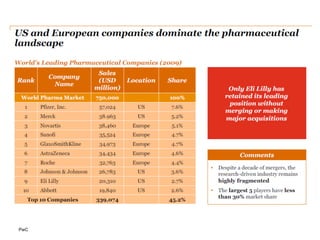

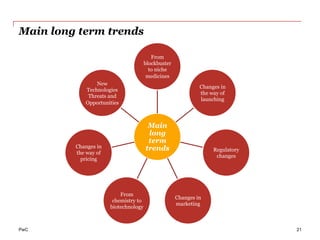

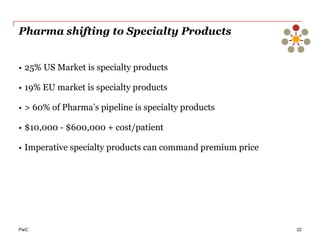

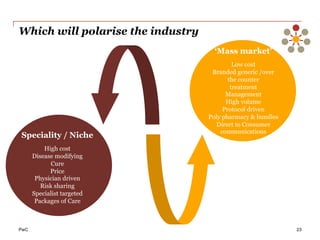

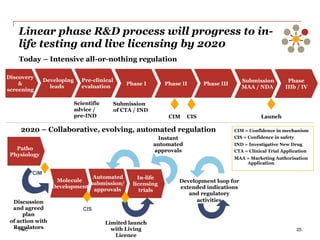

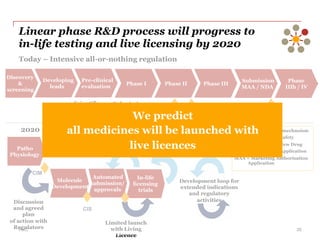

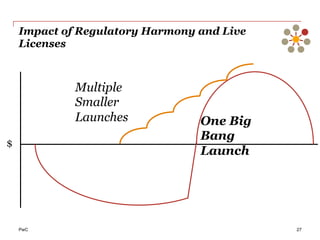

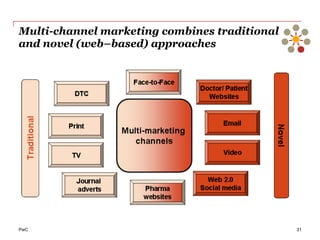

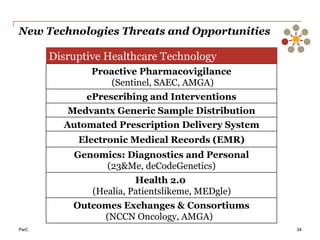

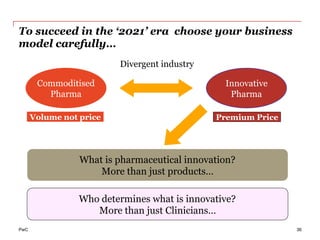

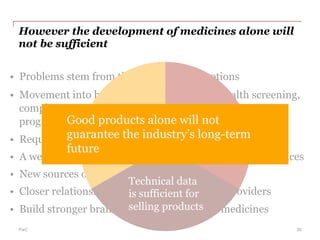

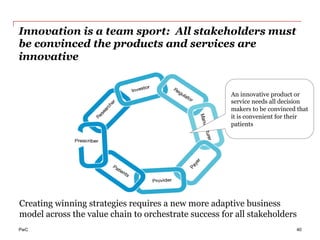

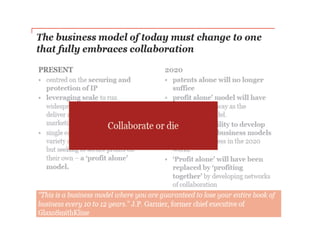

The document discusses the challenges and trends in the pharmaceutical industry as of November 2012, emphasizing the impact of economic downturns, patent expirations, and regulatory pressures on profitability. It highlights the shift towards specialty products and innovative therapies, addressing the need for adaptive business models and collaborative strategies to meet the evolving healthcare landscape. Additionally, it outlines the importance of integrating various stakeholders in the healthcare value chain to drive sustainable growth and innovation.