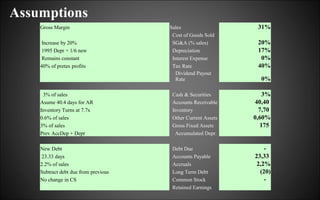

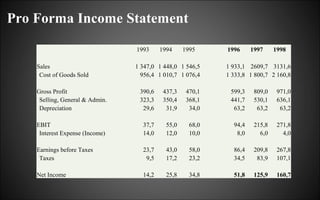

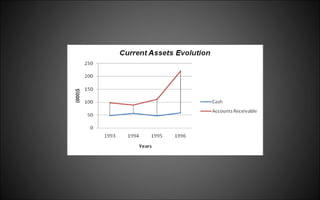

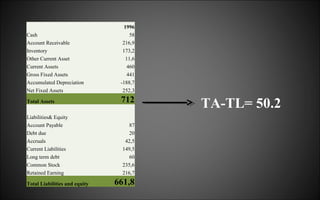

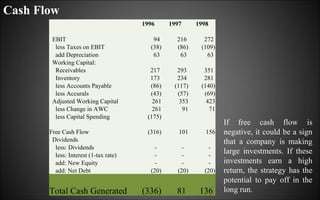

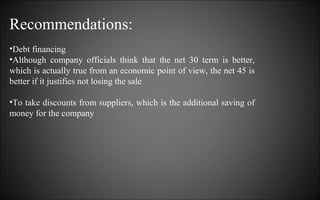

The document discusses Topeka's financial challenges, focusing on financing methods to support projected growth and improving accounts receivable management. It includes detailed financial forecasts, comparisons of cash flow projections, and analysis of potential scenarios regarding inventory management. The recommendations emphasize utilizing debt financing, optimizing payment terms with suppliers, and considering alternative accounts receivable terms for better cash flow management.