The document summarizes an investment analysis of Owens Corning (OC), a building materials company. Key points include:

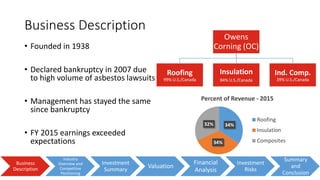

- OC has 3 business segments: roofing, insulation, and composites, with composites making up 30% of total earnings on average.

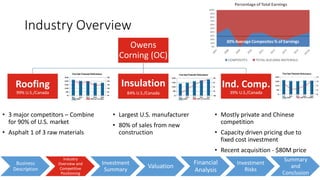

- The building materials industry is consolidated with the top 3 companies controlling 90% of the US market. OC is the largest US manufacturer.

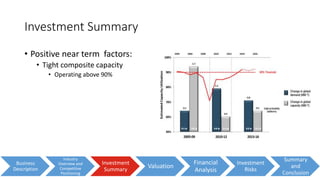

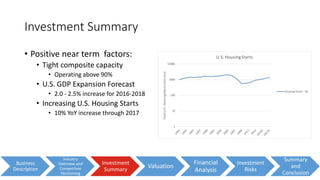

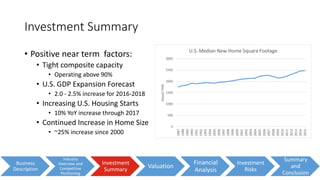

- Near term factors are positive for OC including tight composite capacity, operating above 90% utilization, forecasted US GDP and housing starts growth, and low oil prices.

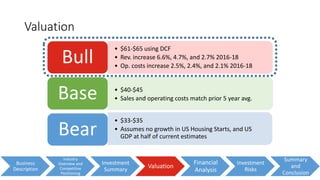

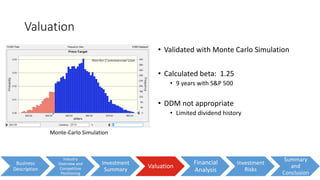

- Valuation ranges from $33-65 per share based on DCF and comparable company analyses, with $61+ the price