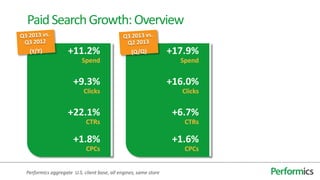

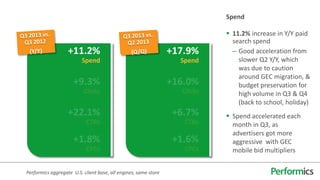

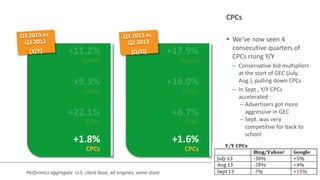

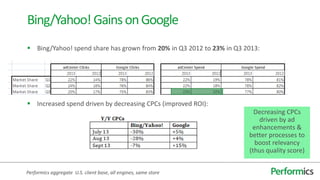

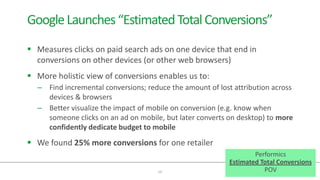

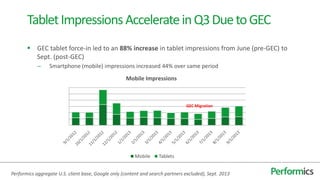

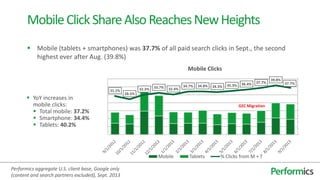

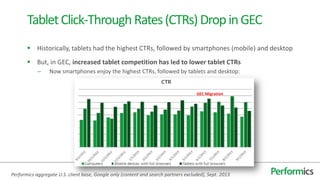

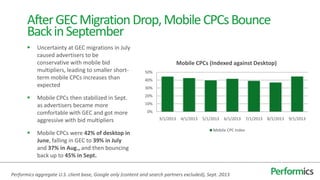

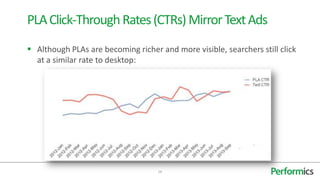

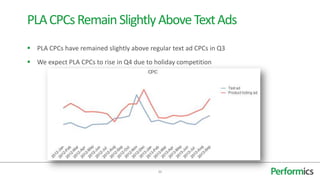

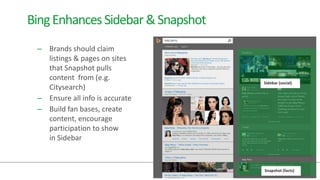

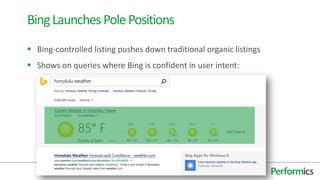

This document summarizes key performance metrics and industry developments in paid search marketing in Q3 2013. It found that paid search spend, clicks, and click-through rates all increased year-over-year in Q3 according to Performics' aggregate US client base. Mobile search spend and clicks both significantly increased. Product listing ad spend and clicks also grew. It also reviewed trends in social/display advertising, and algorithm updates from Google and Bing.