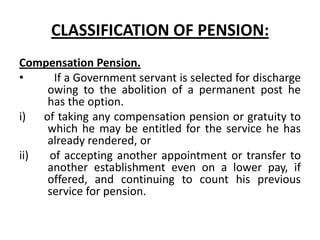

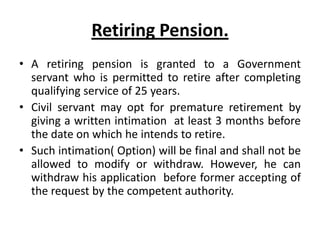

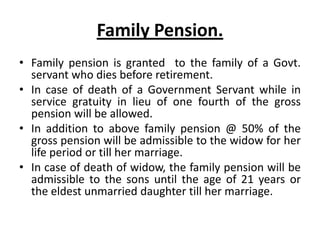

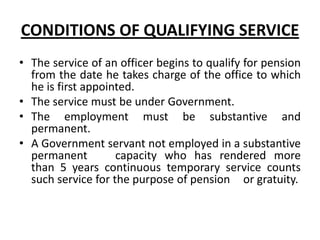

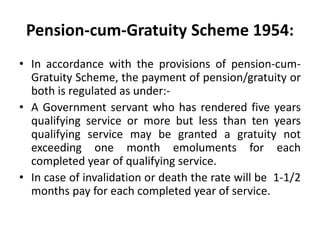

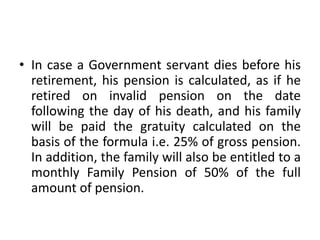

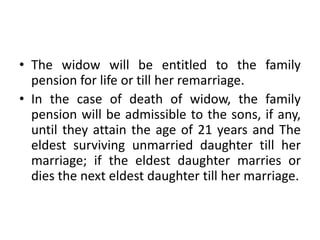

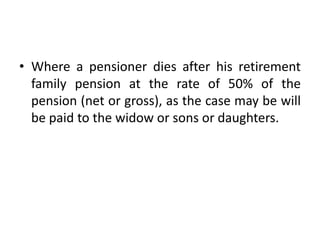

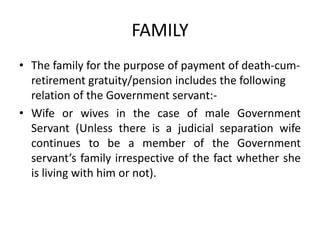

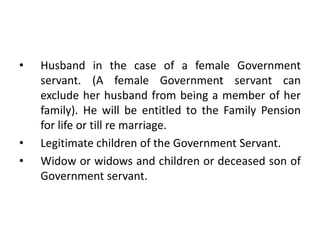

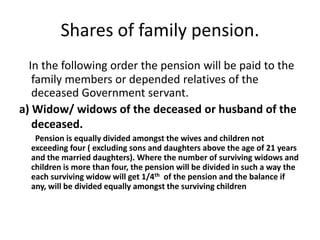

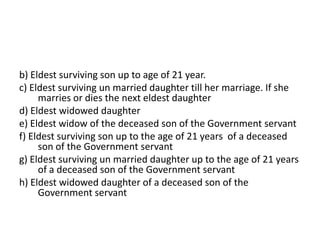

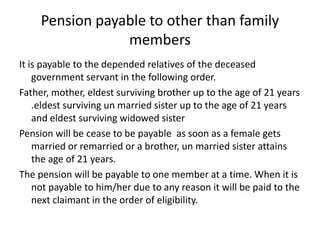

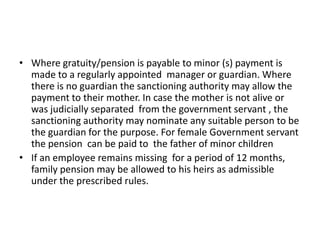

- The document outlines the various types of pensions for government servants in India, including compensation pension, invalid pension, retiring pension, and superannuating pension. It also covers family pension rules.

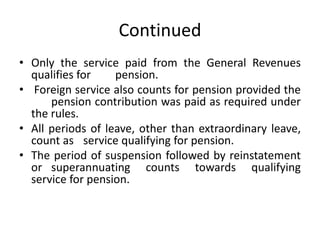

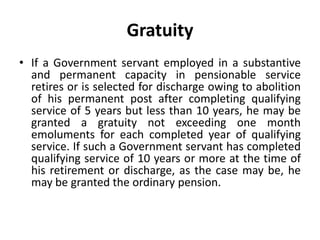

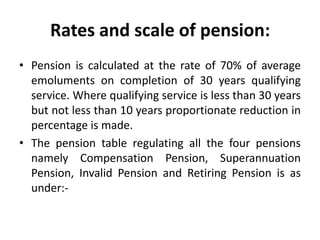

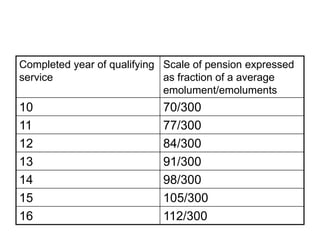

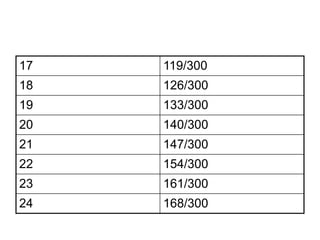

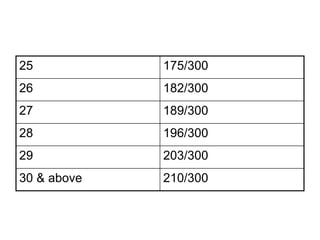

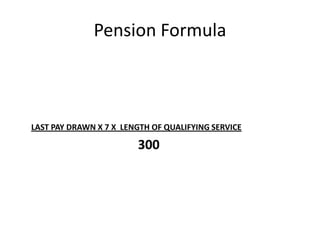

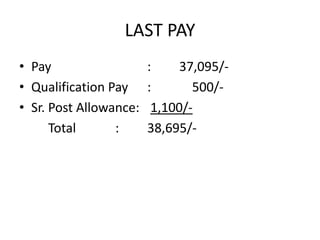

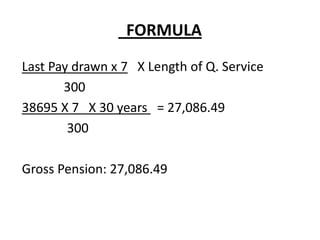

- Qualifying service must be a minimum of 10 years, and pensions are calculated based on a formula of last pay drawn multiplied by 7 and divided by 300, depending on years of qualifying service.

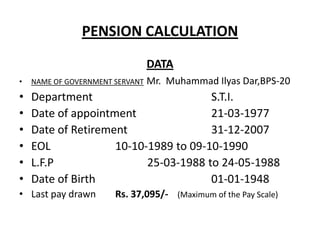

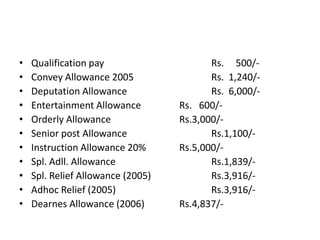

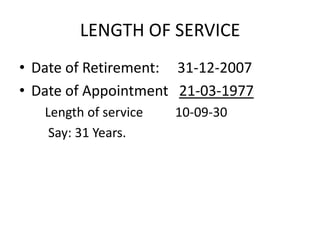

- An example calculation is provided for a government servant retiring after 31 years of service.