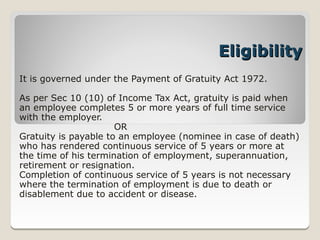

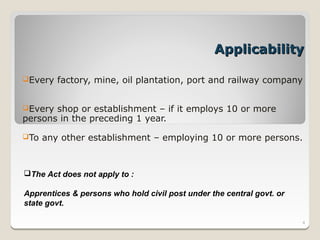

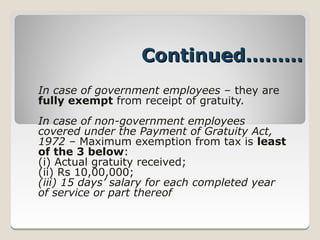

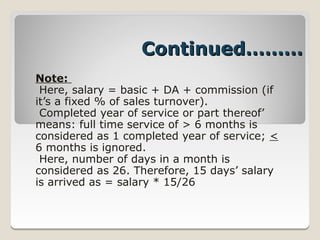

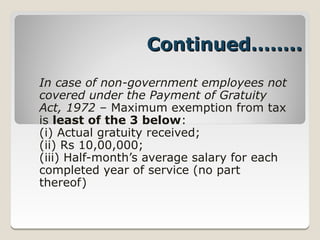

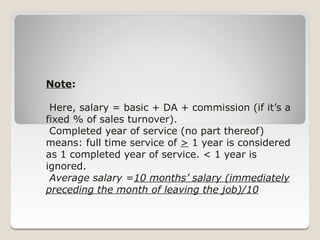

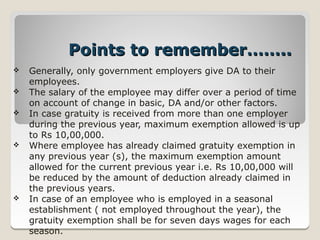

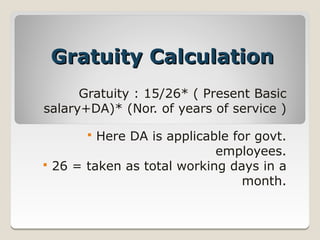

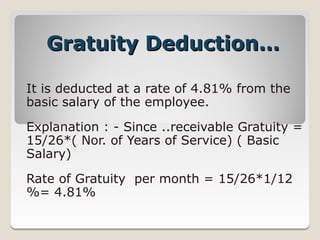

Gratuity is a lump sum payment given to employees in recognition of long and continuous service. It is paid when an employee leaves a job after working for at least 5 years. [1] Gratuity is calculated based on an employee's salary and length of service. [2] The Payment of Gratuity Act of 1972 governs gratuity in India and applies to companies with 10 or more employees. [3] Gratuity received is partially tax exempt depending on the type of employer and number of years served.