This document provides an overview of bank guarantees, including:

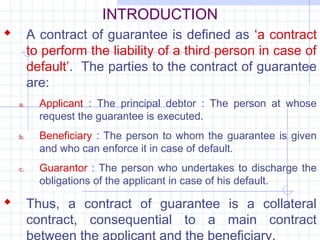

1) It defines a bank guarantee as a contract where the bank guarantees to perform a third party's liability in case of default. The parties involved are the applicant, beneficiary, and guarantor bank.

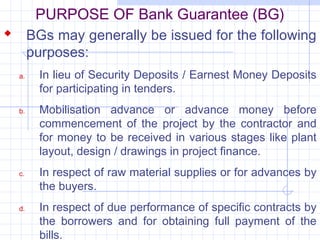

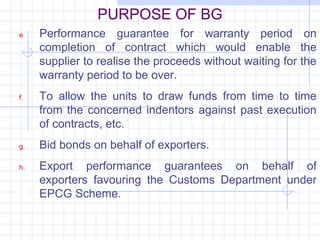

2) Common purposes of bank guarantees include providing security deposits, mobilizing funds, and ensuring performance or payment on contracts.

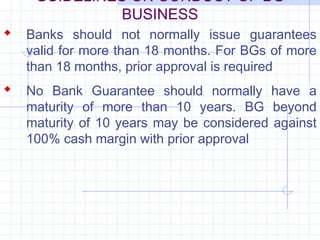

3) Guidelines state banks should exercise caution with performance guarantees and generally limit guarantees to 18 months, taking security such as cash margins from applicants.

4) Proper appraisal of guarantees is required similar to loans, examining the applicant's financial strength and purpose of the guarantee.