The document discusses key concepts in banking law and practices related to negotiable instruments. It covers three main topics:

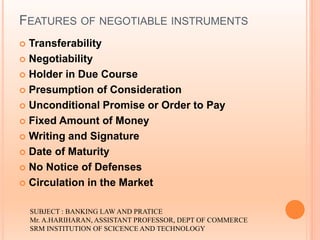

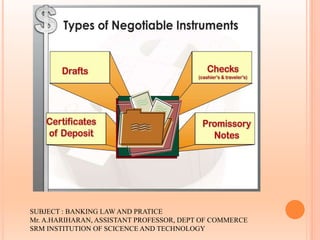

1. Negotiable instruments are financial documents like promissory notes, bills of exchange, and cheques that are governed by the Negotiable Instruments Act. They facilitate commerce through features like transferability and standardized rules.

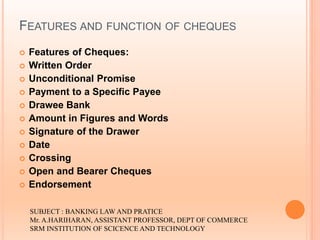

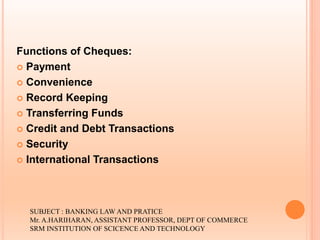

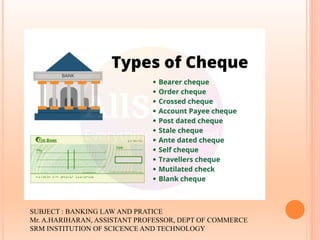

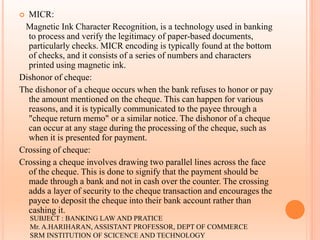

2. Cheques are a type of negotiable instrument that allow customers to pay others through their bank account. The document defines cheques and covers related concepts like crossing, dishonor, and errors/rectification.

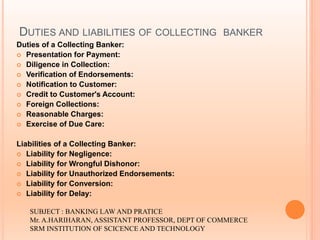

3. The duties and liabilities of paying bankers are explained. As the entity responsible for honoring customer payments, paying bankers must follow rules regarding signatures