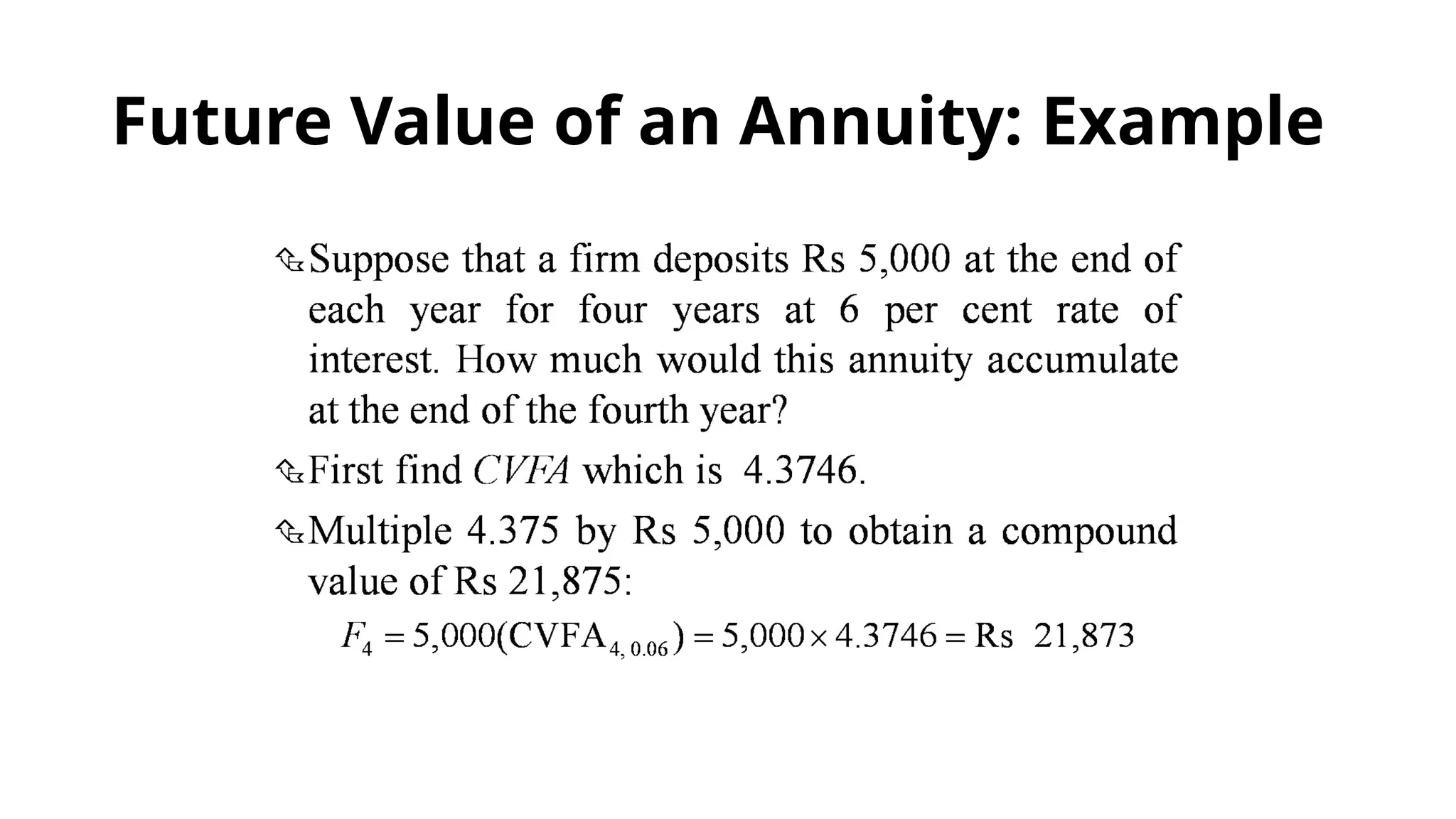

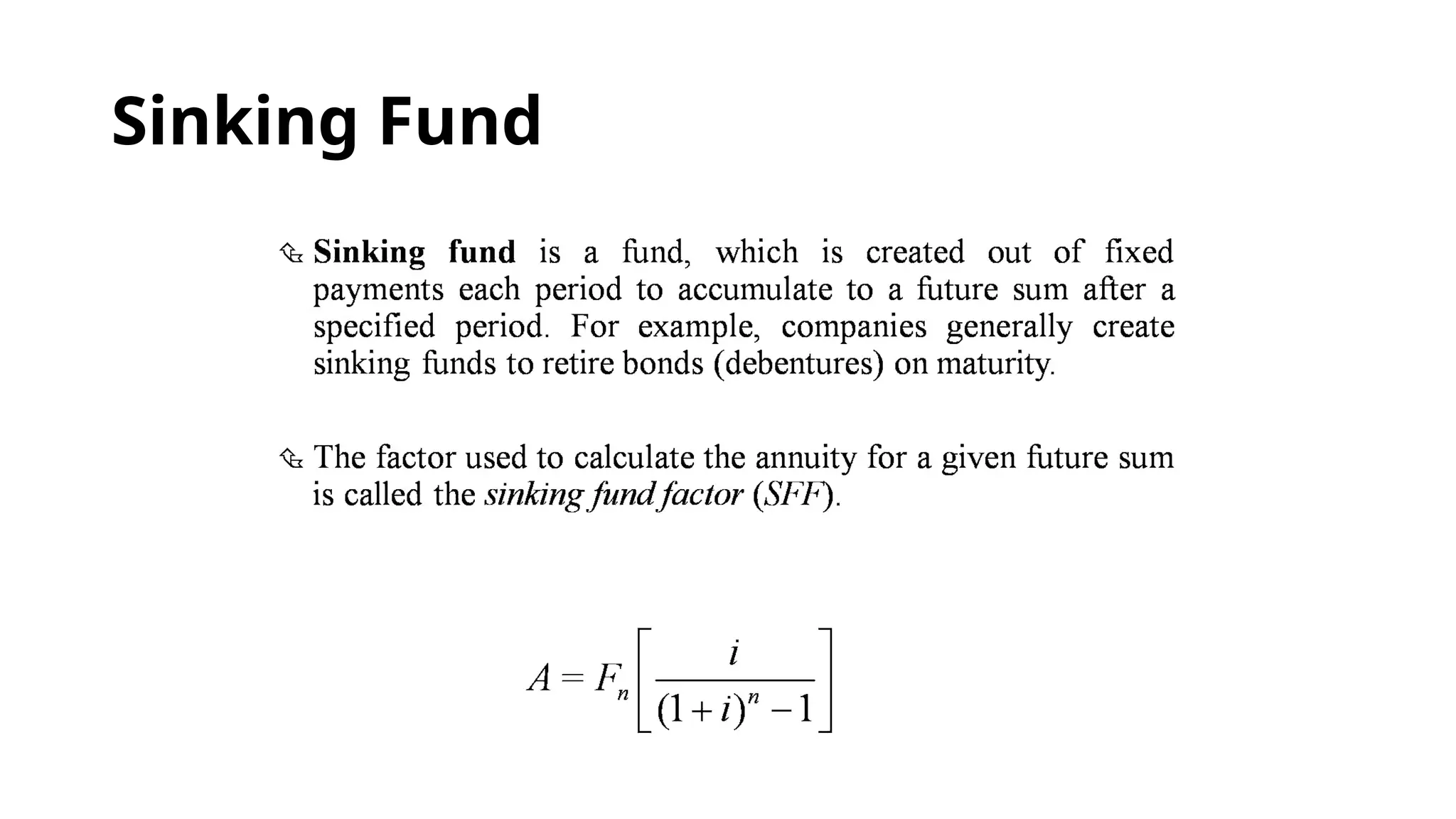

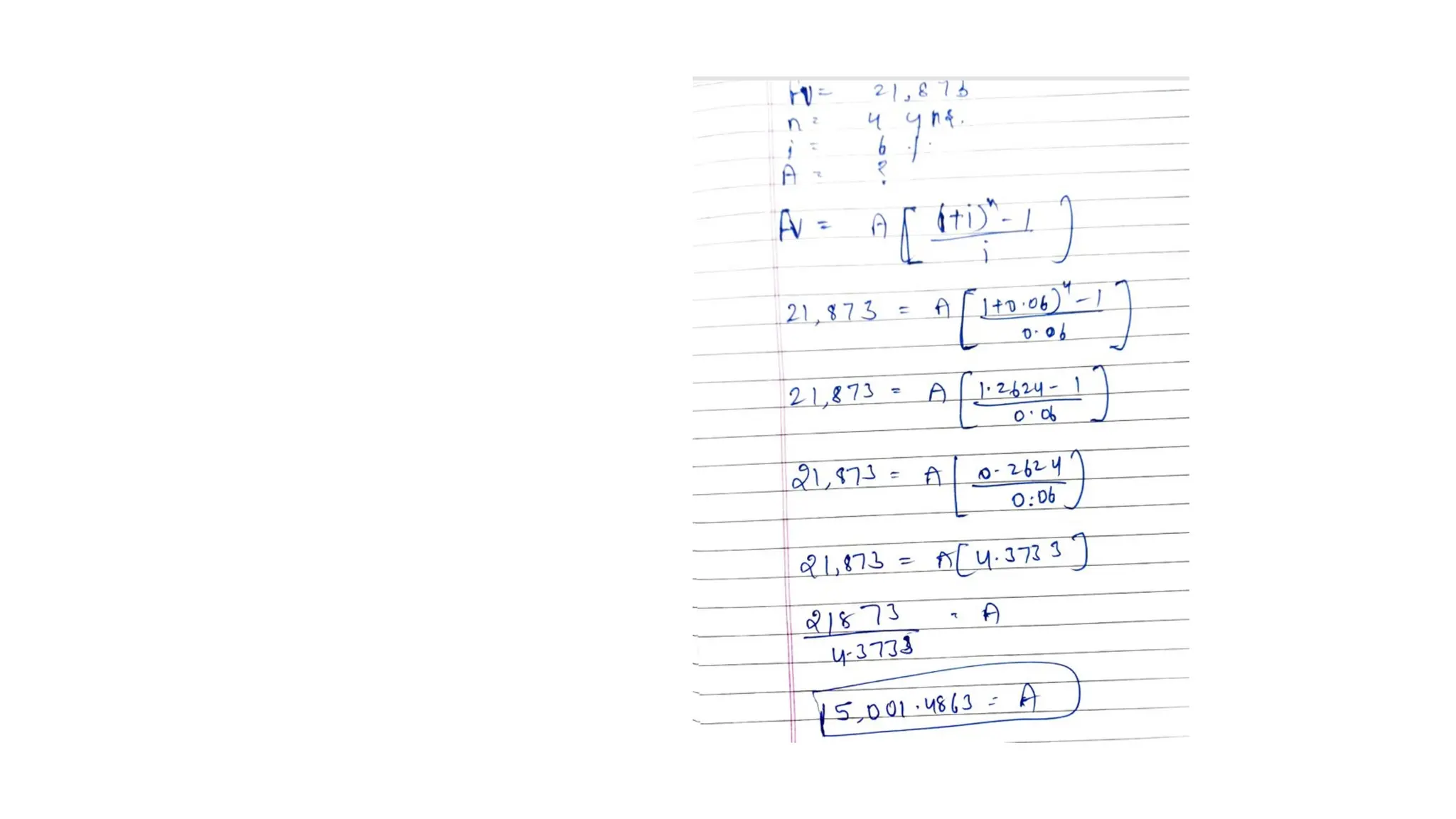

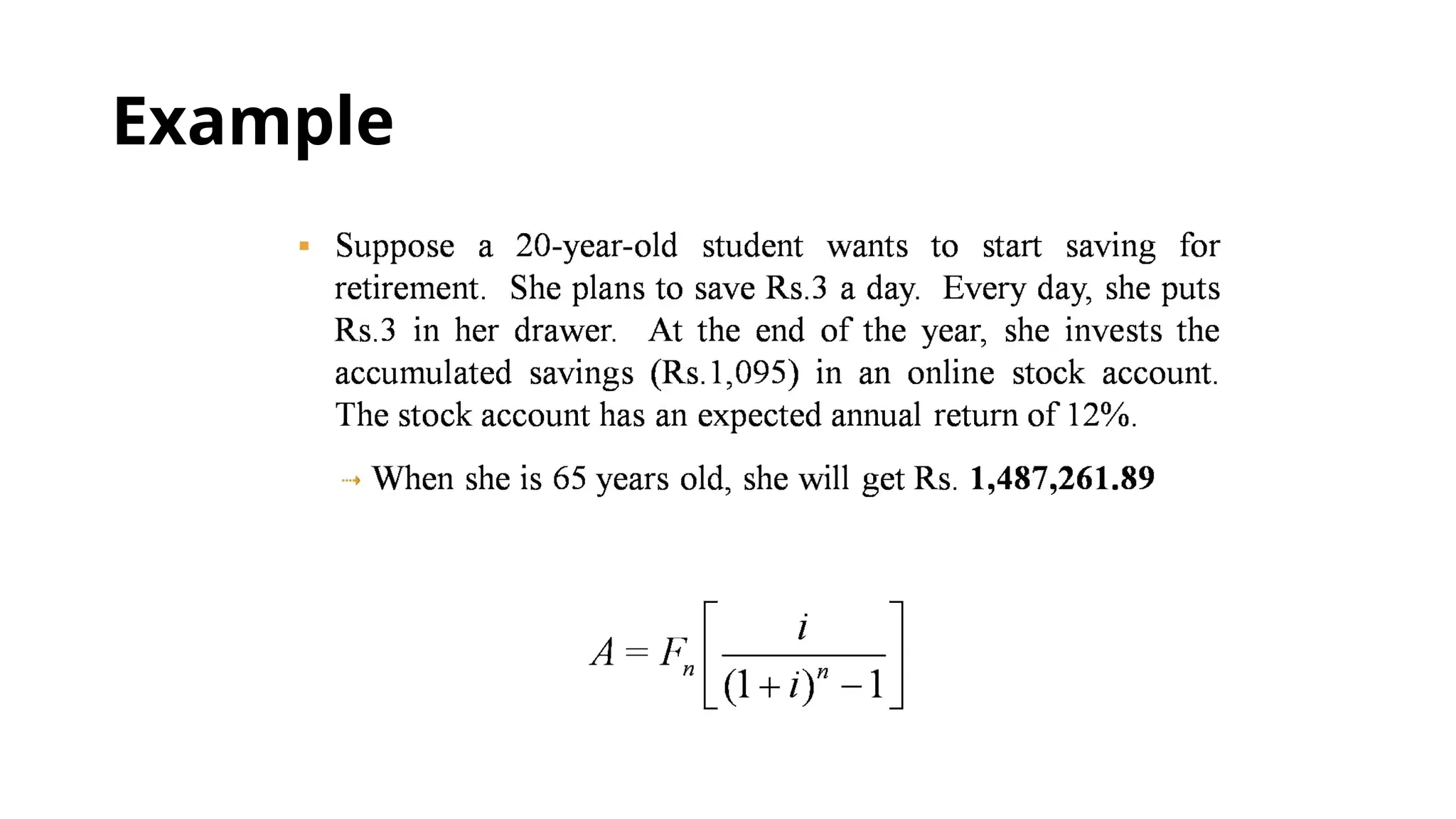

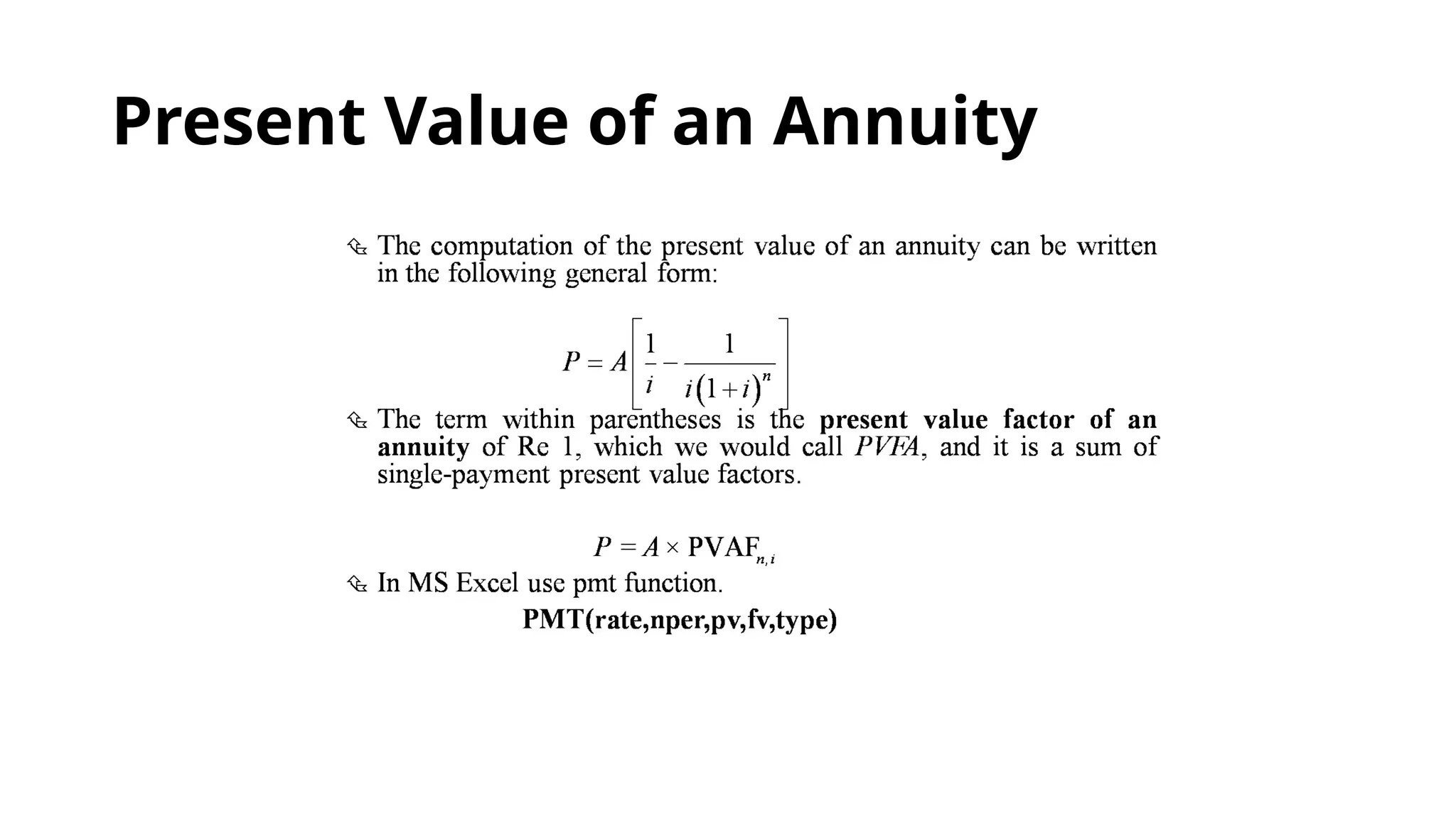

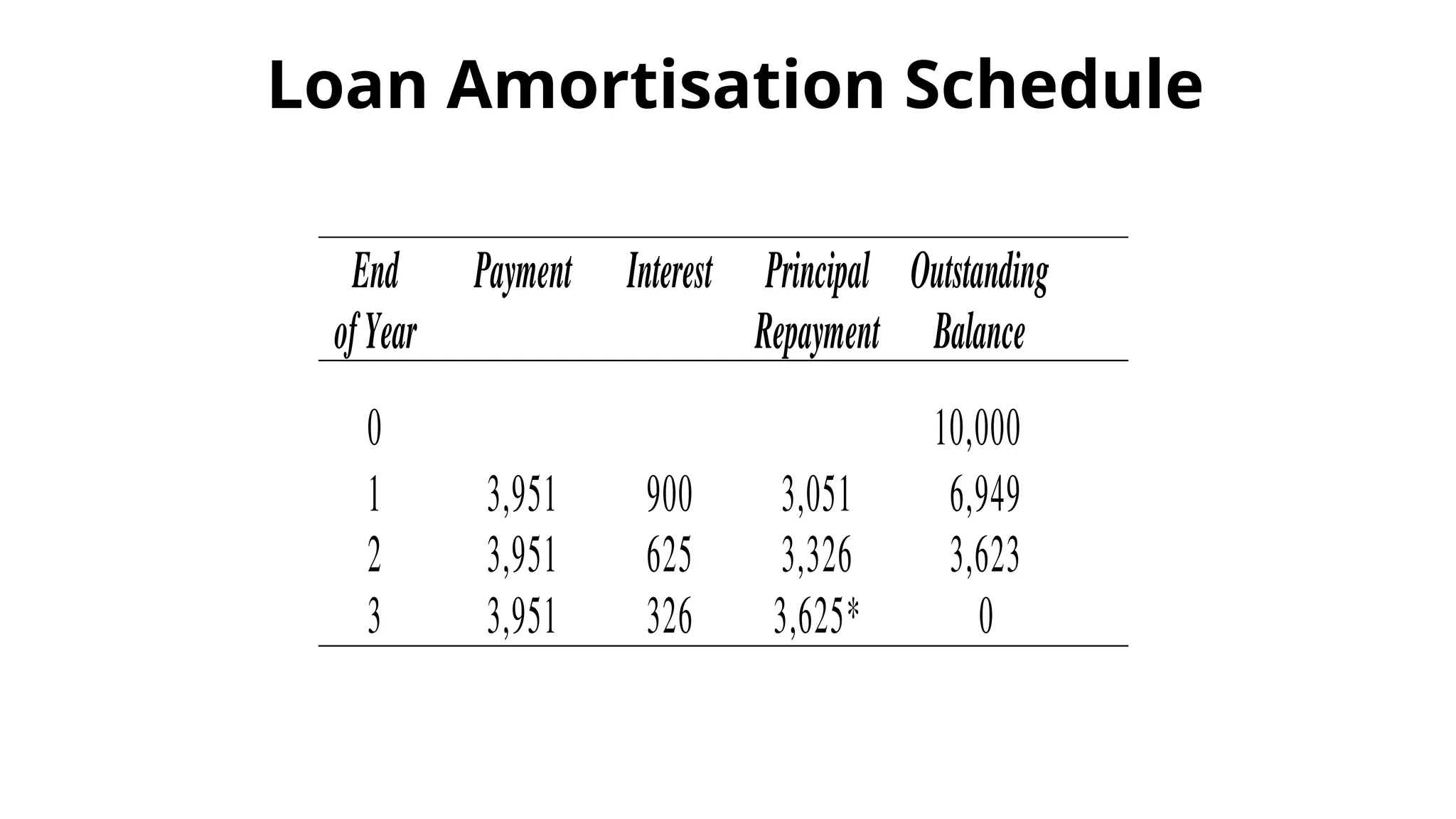

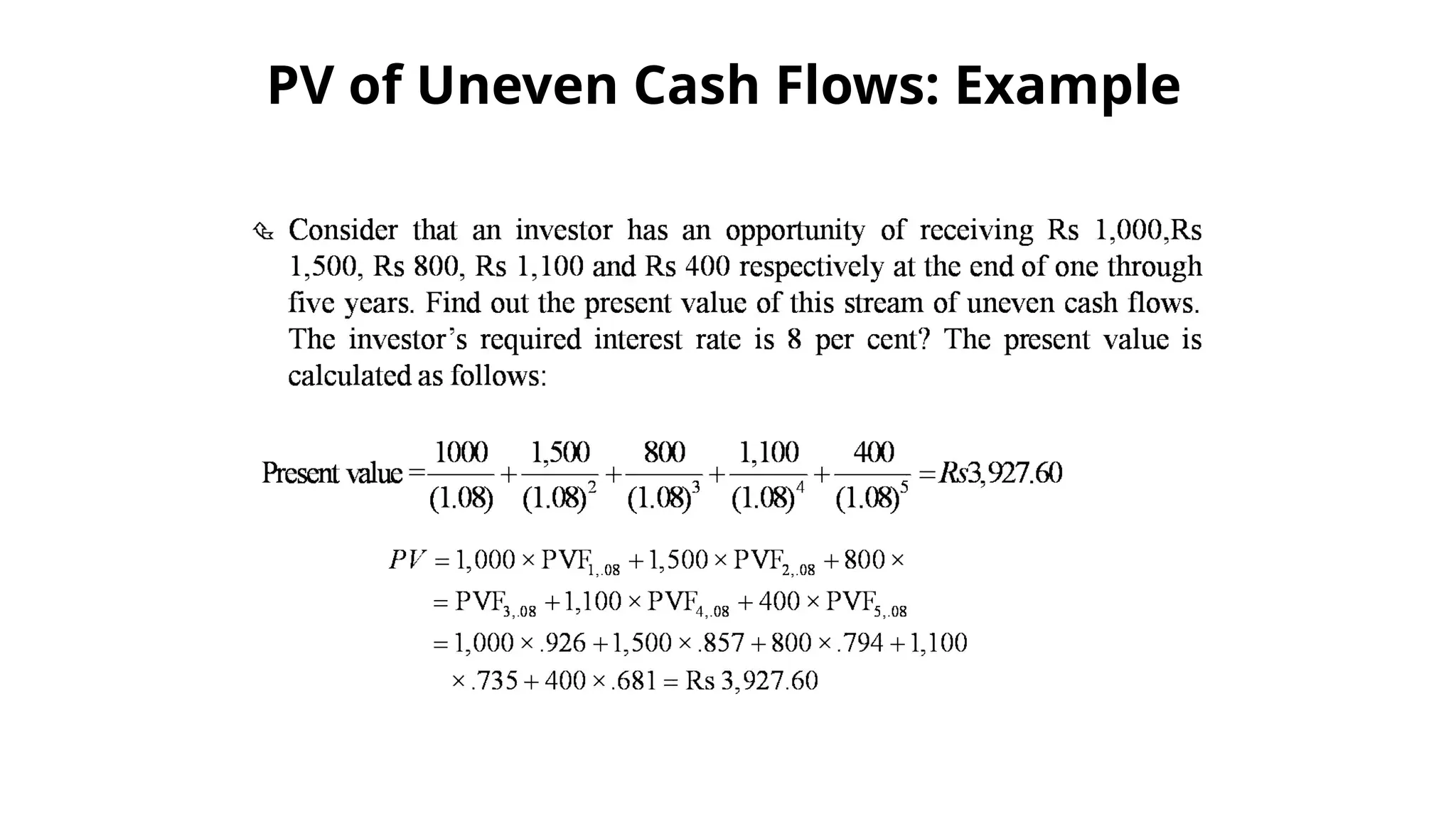

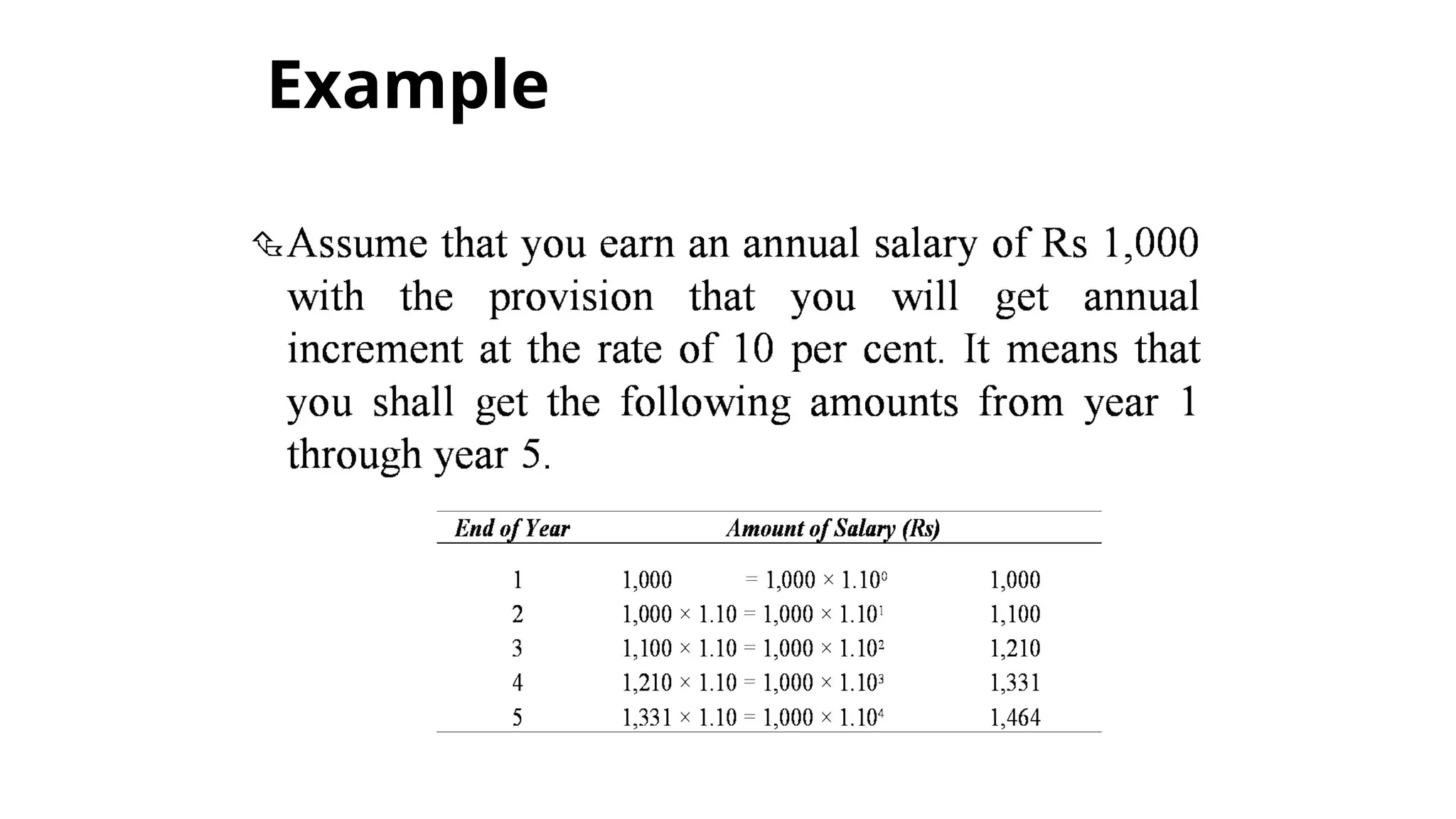

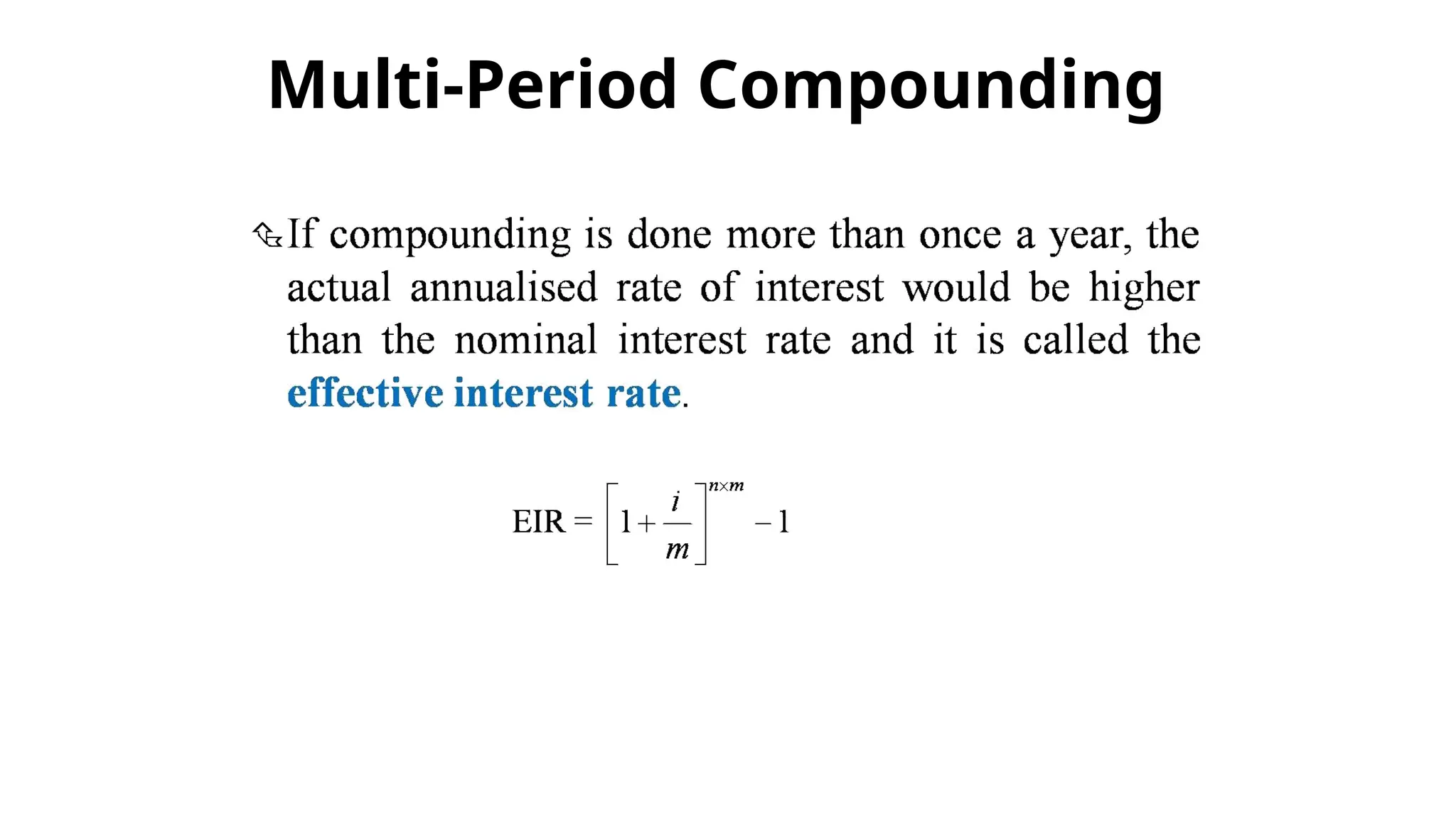

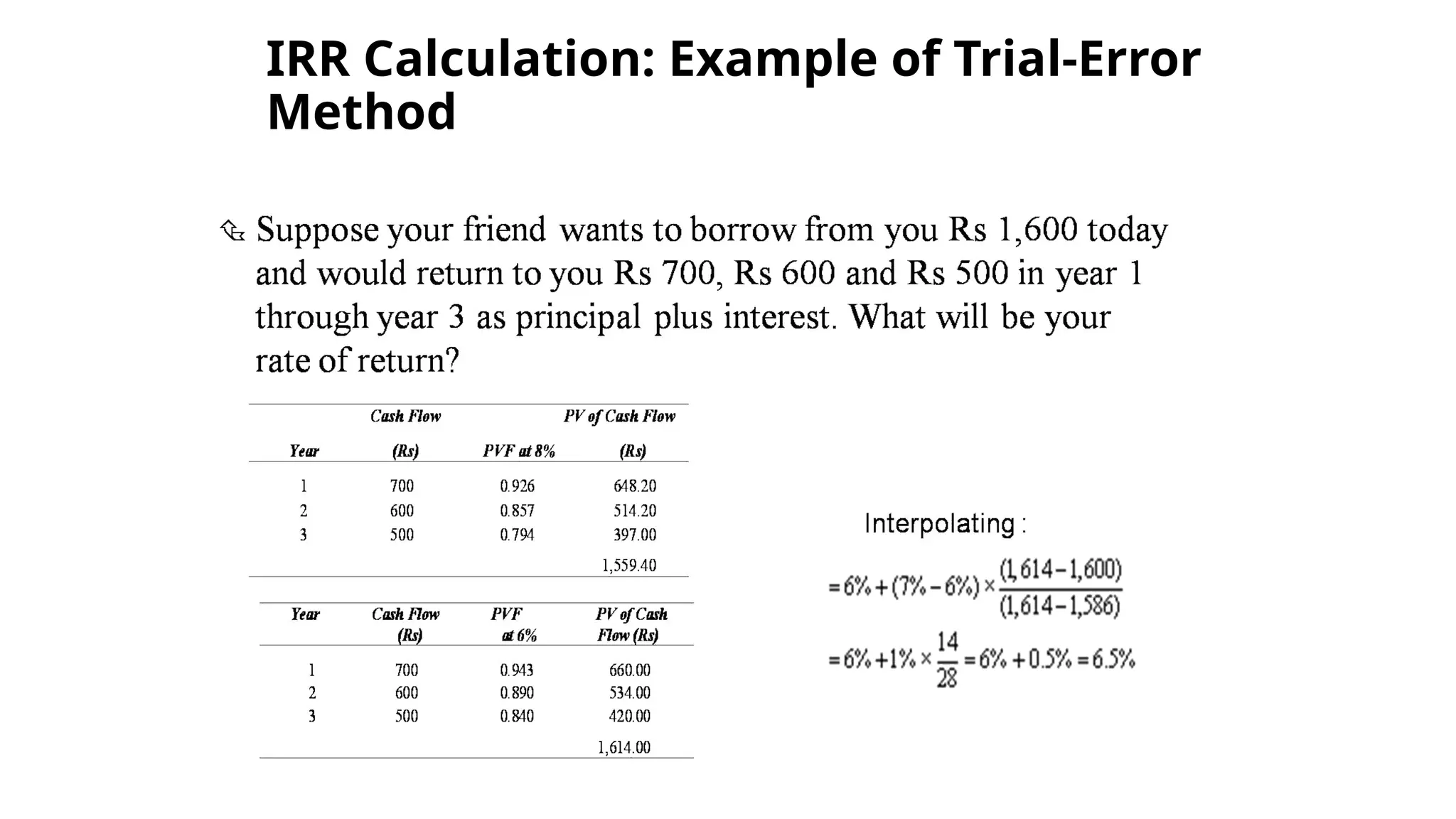

The document explains the concept of the time value of money, detailing how present and future values are calculated and the importance of adjusting cash flows for time and risk. It introduces key concepts like time preference for money, required rate of return, and methods such as compounding and discounting. Real-world examples illustrate these principles, including future and present value calculations, annuities, and internal rate of return.