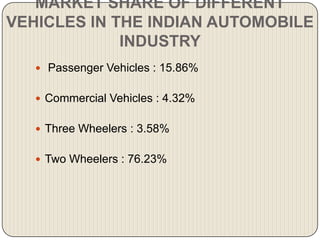

The Indian automobile industry has evolved significantly over the past century. In the early years, vehicles were scarce and the industry was tightly regulated. Liberalization in the 1990s opened the industry to more foreign participation and competition. Major players like Maruti Suzuki and Hyundai now dominate the market. The industry faces challenges like rising costs and competition from China but is growing with rising incomes. Passenger vehicles account for about 15% of the market while two-wheelers make up the majority.