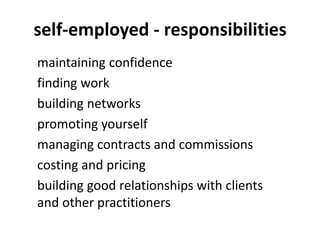

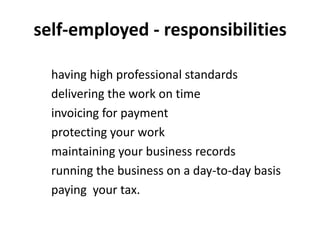

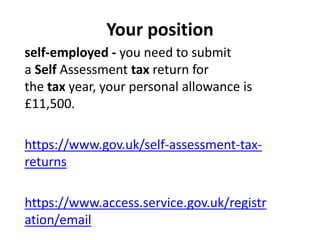

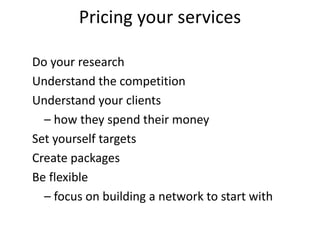

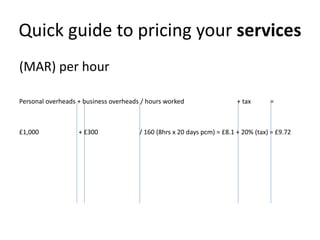

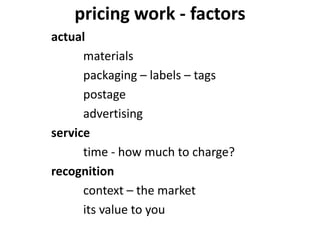

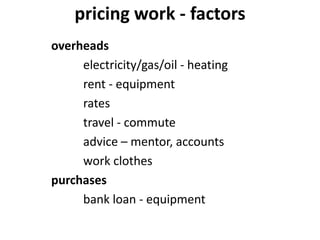

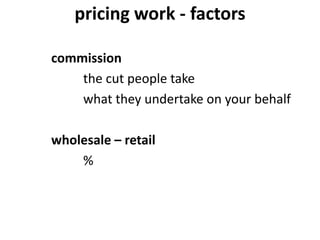

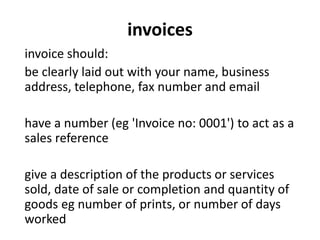

This document provides information for individuals who are self-employed or working for themselves. It discusses responsibilities like maintaining professional standards, managing contracts, costing and pricing work, and maintaining business records. It also covers topics like finding work, building relationships, invoicing clients, and paying taxes. Pricing work involves factors like materials, time, overheads, and commissions. The document provides guidance on creating invoices, payment options, credit terms, and dealing with late payments. It also includes links to external toolkits and resources.