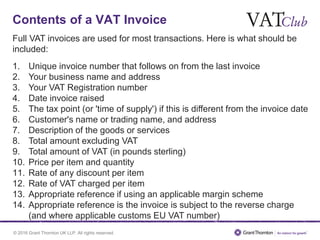

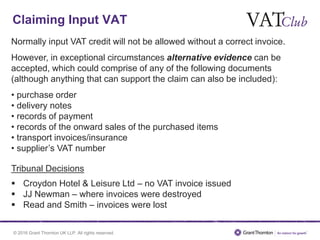

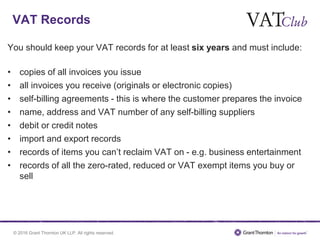

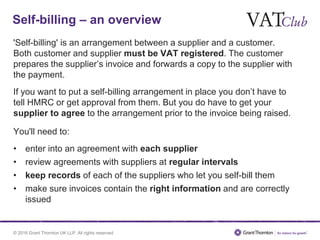

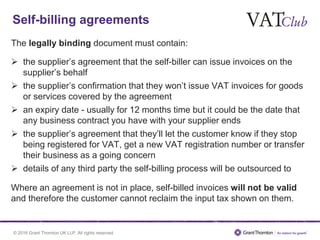

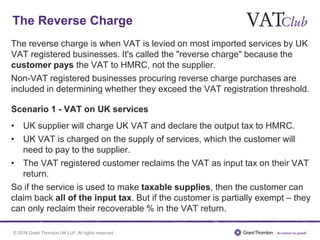

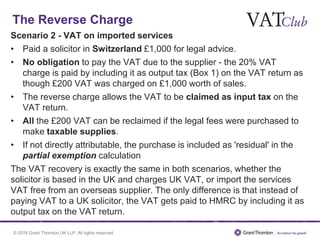

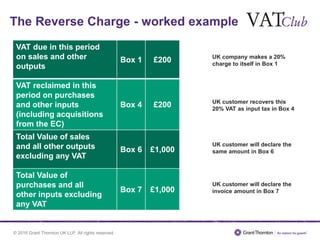

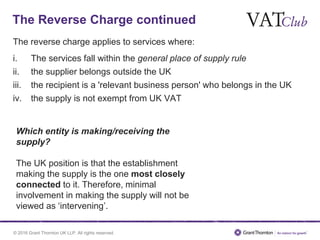

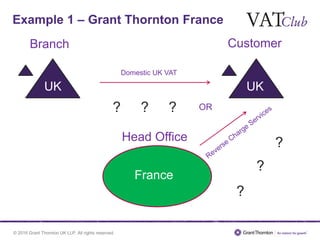

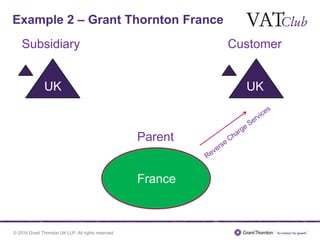

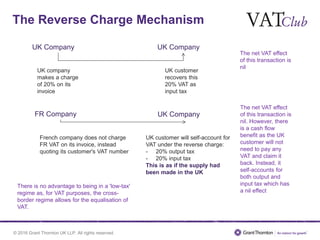

This document discusses VAT invoicing and the reverse charge mechanism in the UK. It provides information on the contents required for a valid VAT invoice and the record keeping requirements. It also explains how the reverse charge works for imported services, where the UK customer accounts for the VAT on their VAT return rather than paying the foreign supplier. In some cases, the customer can prepare the supplier's invoice through a self-billing arrangement if an agreement is in place. The reverse charge ensures the equalization of VAT whether the supply is made by a UK or foreign supplier.