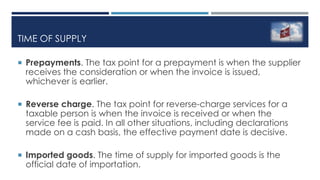

The document summarizes key aspects of value-added tax (VAT) in Switzerland. It discusses the scope of VAT, who is liable, group registration rules, reverse charge mechanisms, applicable tax rates of standard 8%, reduced 2.5%, and special 3.8% rates. It also covers examples of tax-exempt supplies with and without credit, time of supply rules, input tax recovery, invoicing requirements, and VAT returns and payments.