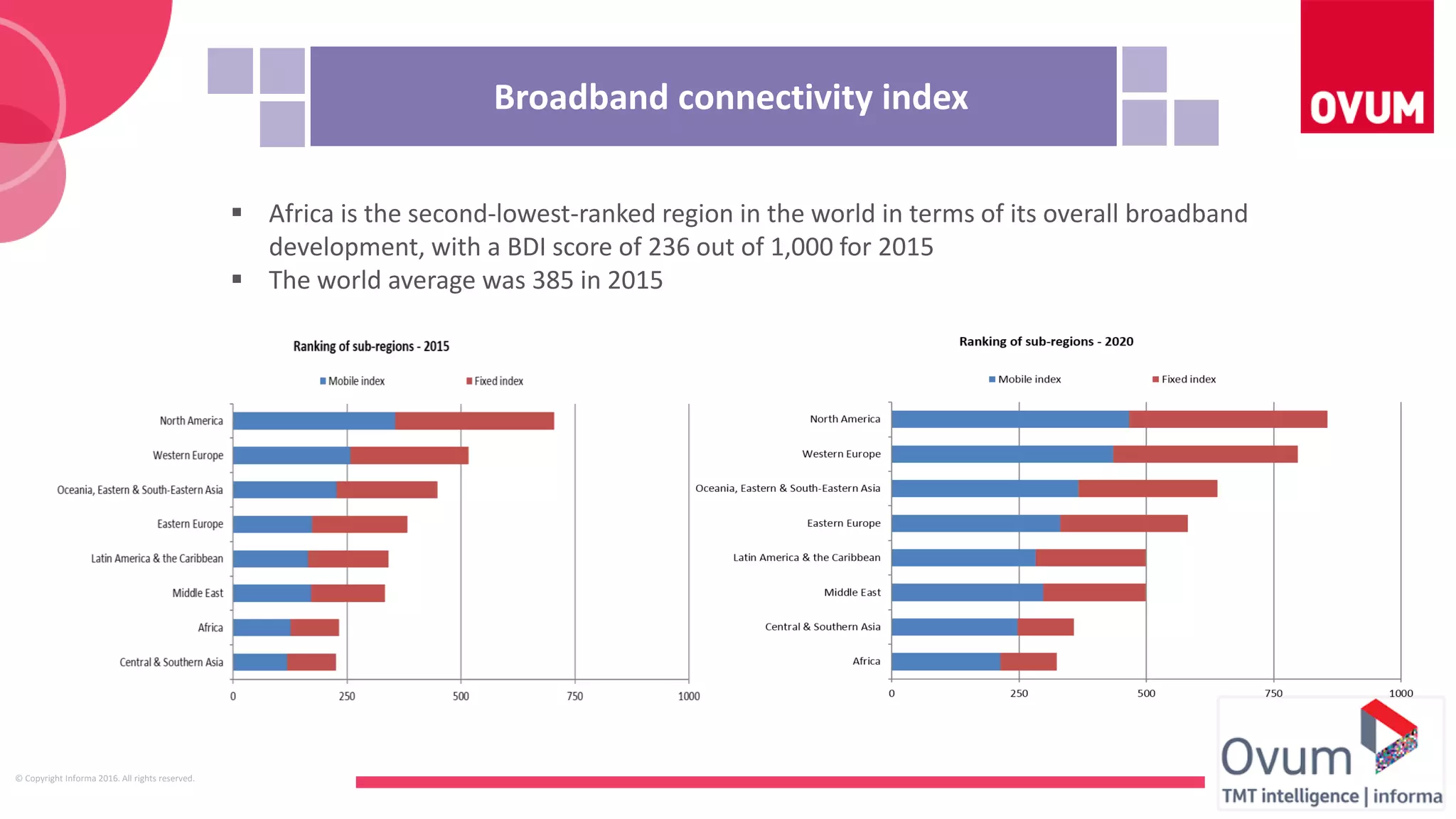

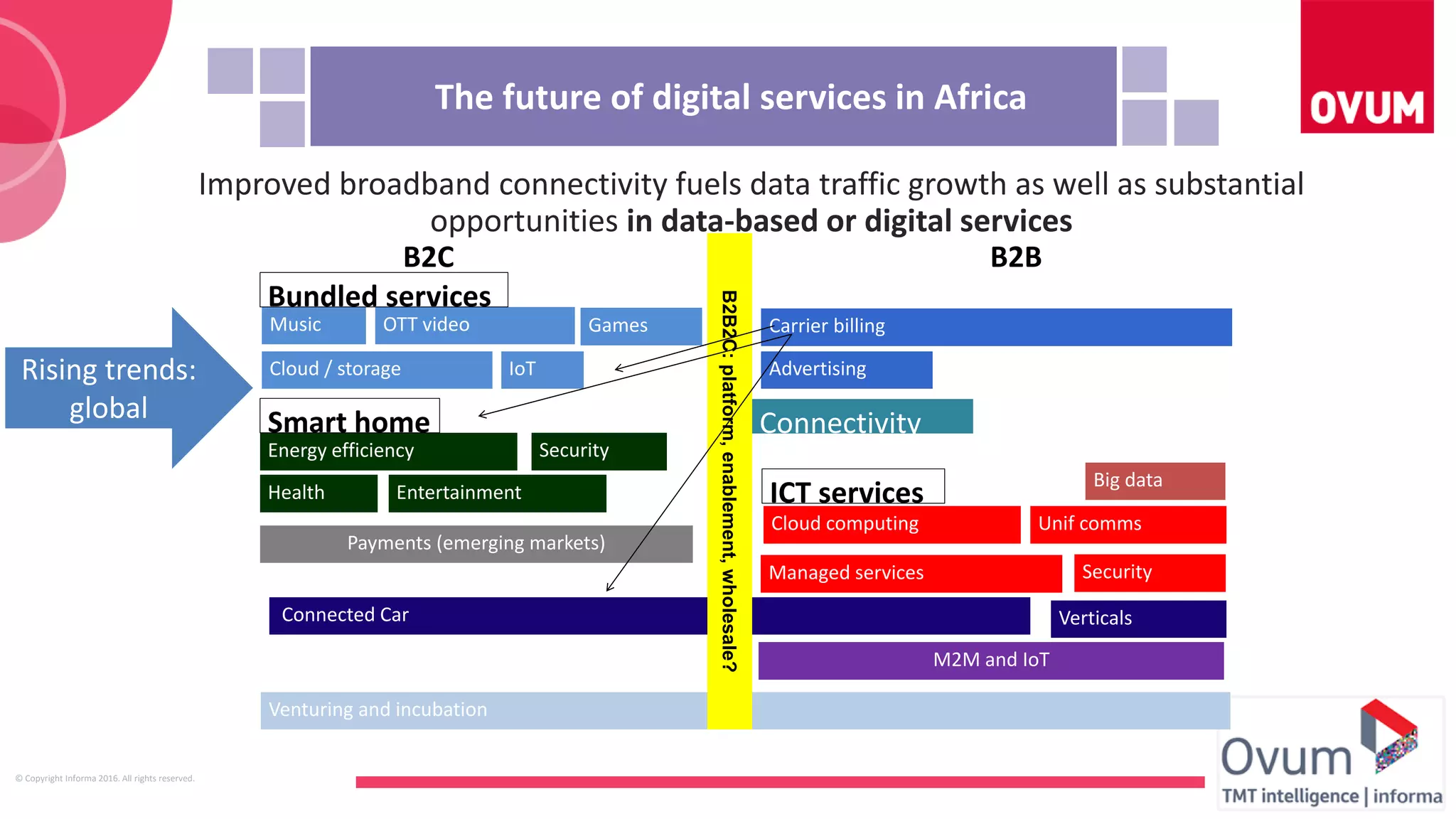

Africa has the second-lowest broadband connectivity index in the world according to a 2015 study. Southern and Northern African markets have the highest index scores, with Mauritius ranked highest in Africa. 4G networks are a major driver of improved broadband connectivity on the continent. Increased connectivity is fueling growth in digital services and data usage in Africa.