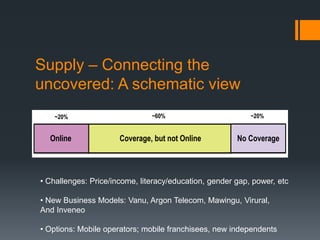

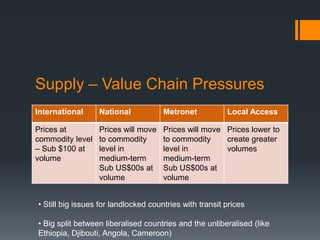

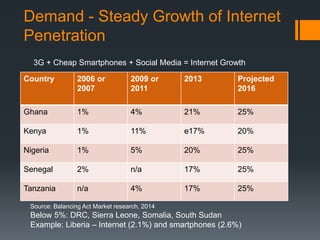

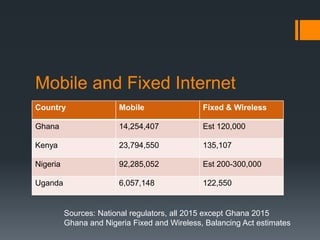

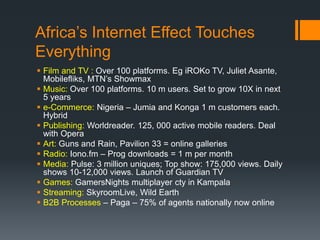

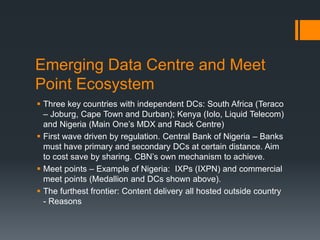

The document discusses Africa's digital transformation focusing on the transition from traditional mobile voice services to data-oriented applications facilitated by improved infrastructure such as fiber optics. It highlights the increased connectivity and the emergence of a digital economy, driven by a growing number of users and demand for data services, while identifying challenges like affordability, digital literacy, and infrastructure gaps. Additionally, it explores the evolving business models and competition among mobile operators and content providers amidst the changing landscape of data consumption and access.