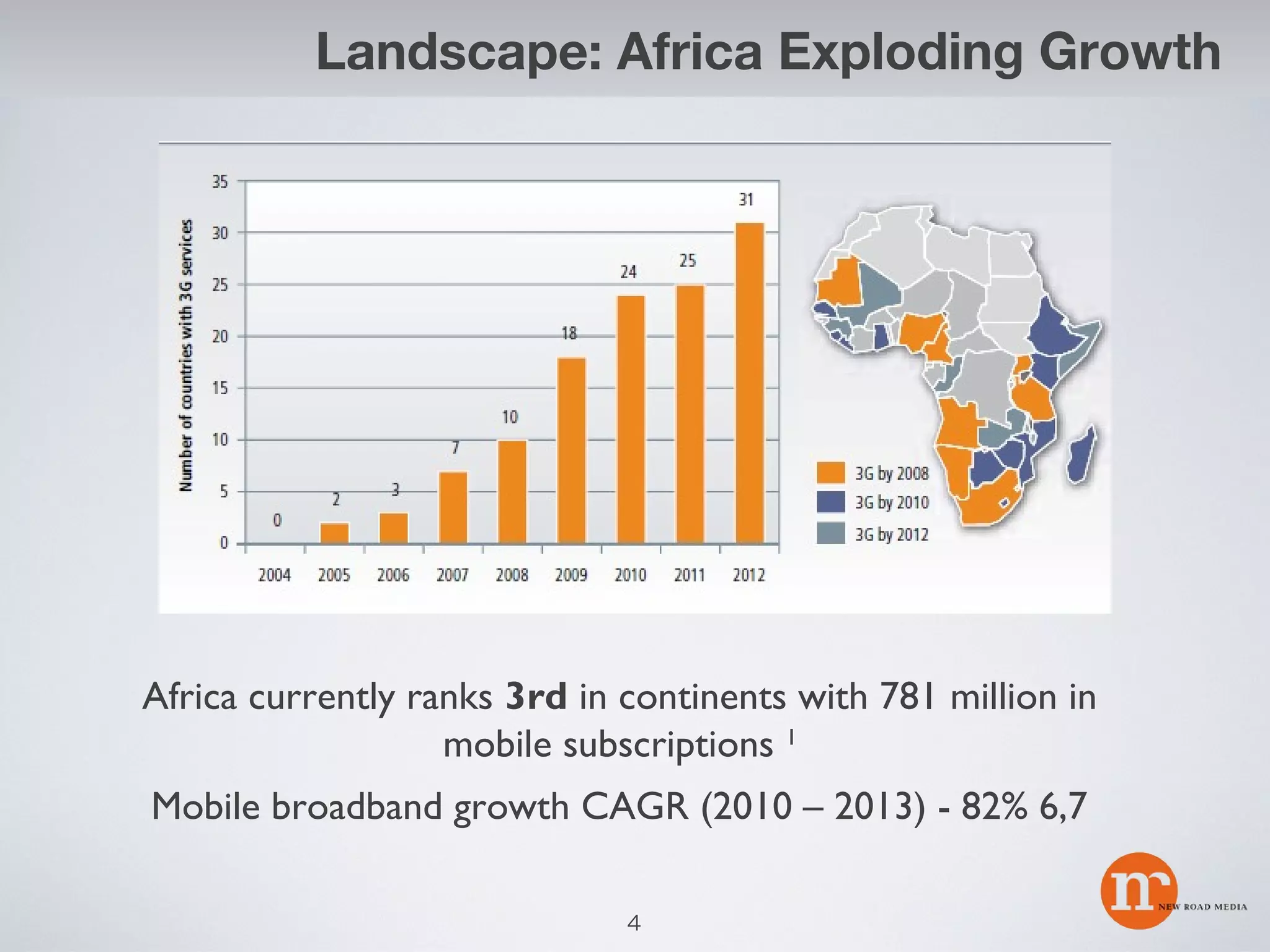

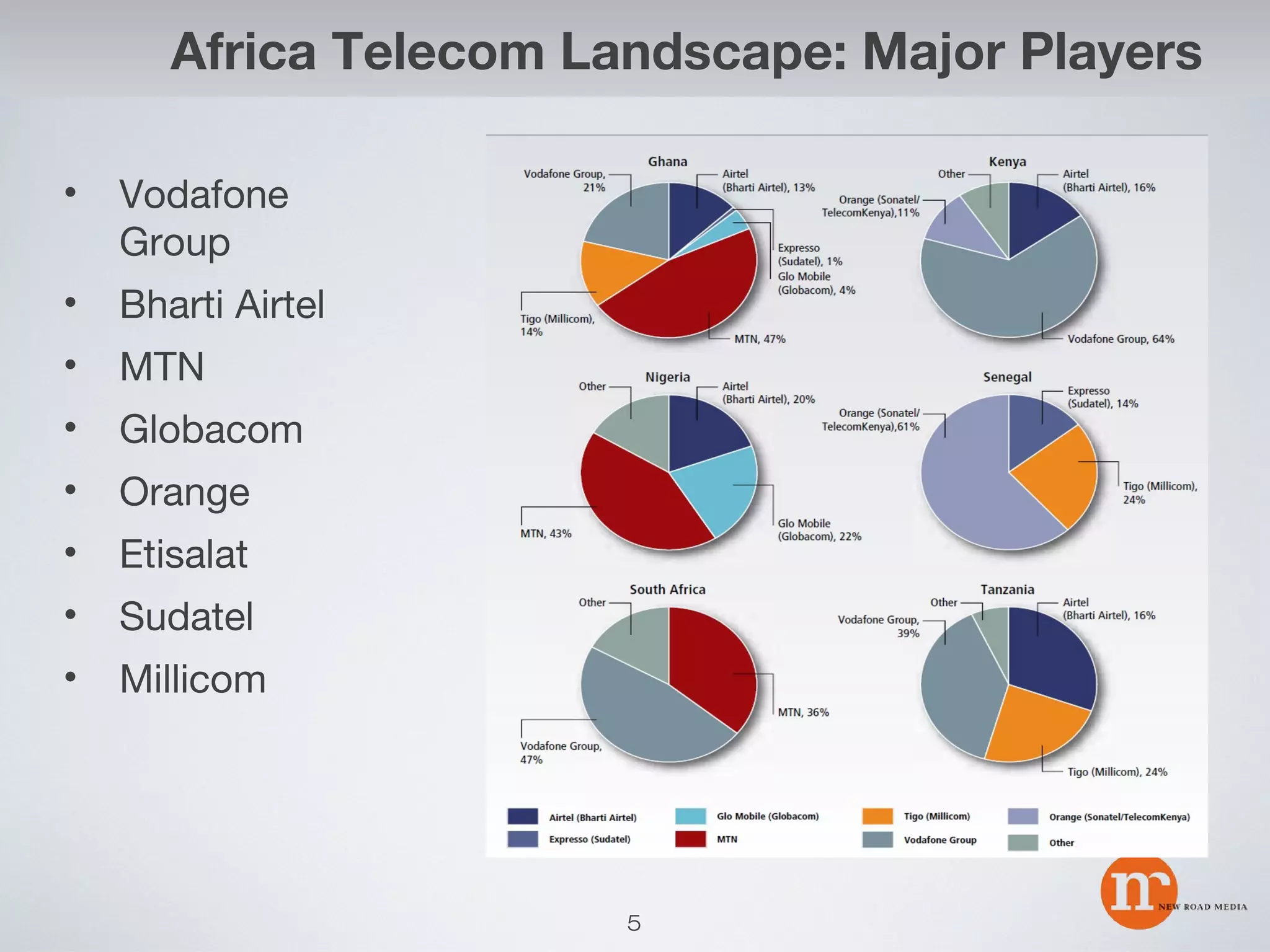

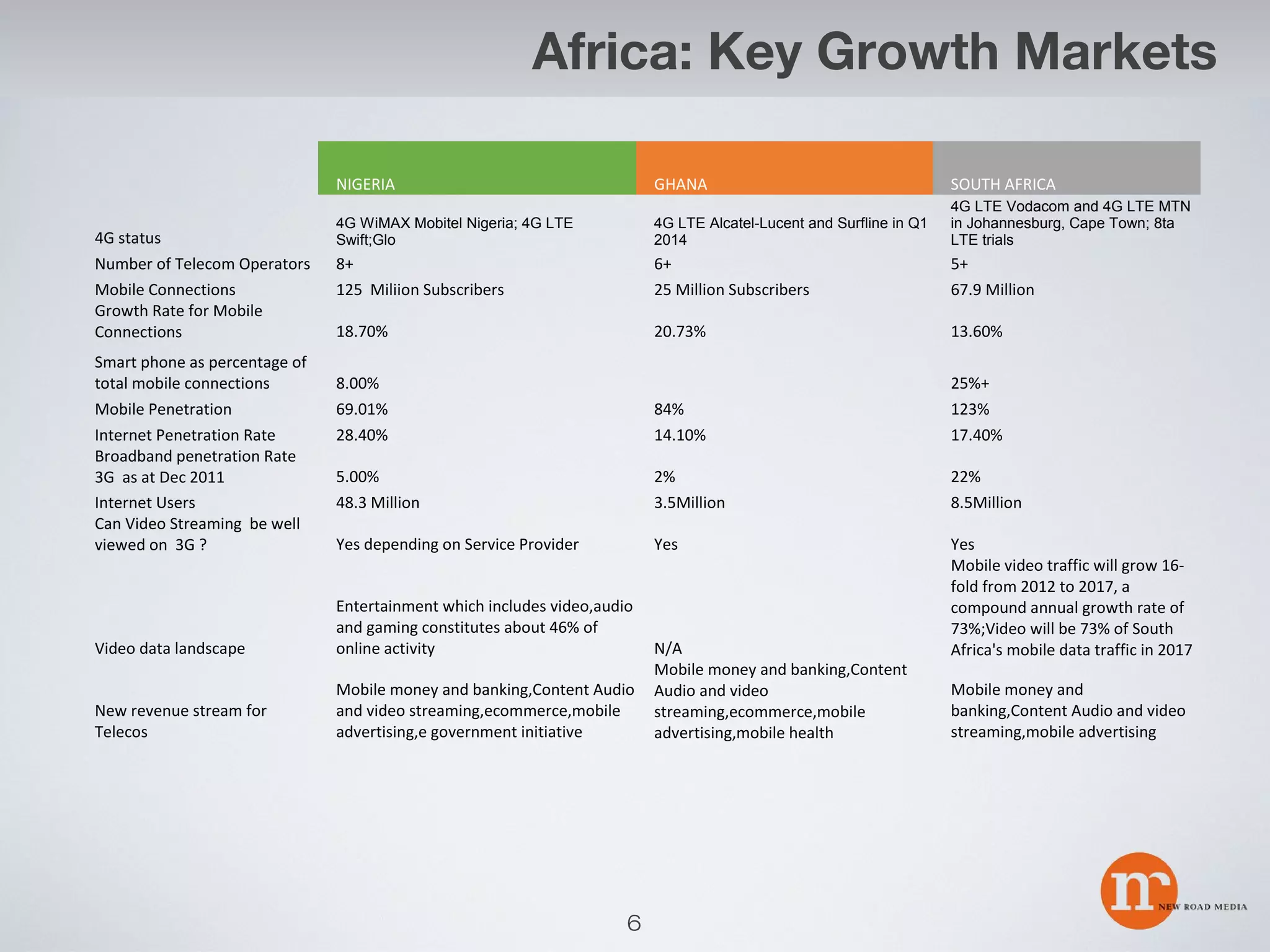

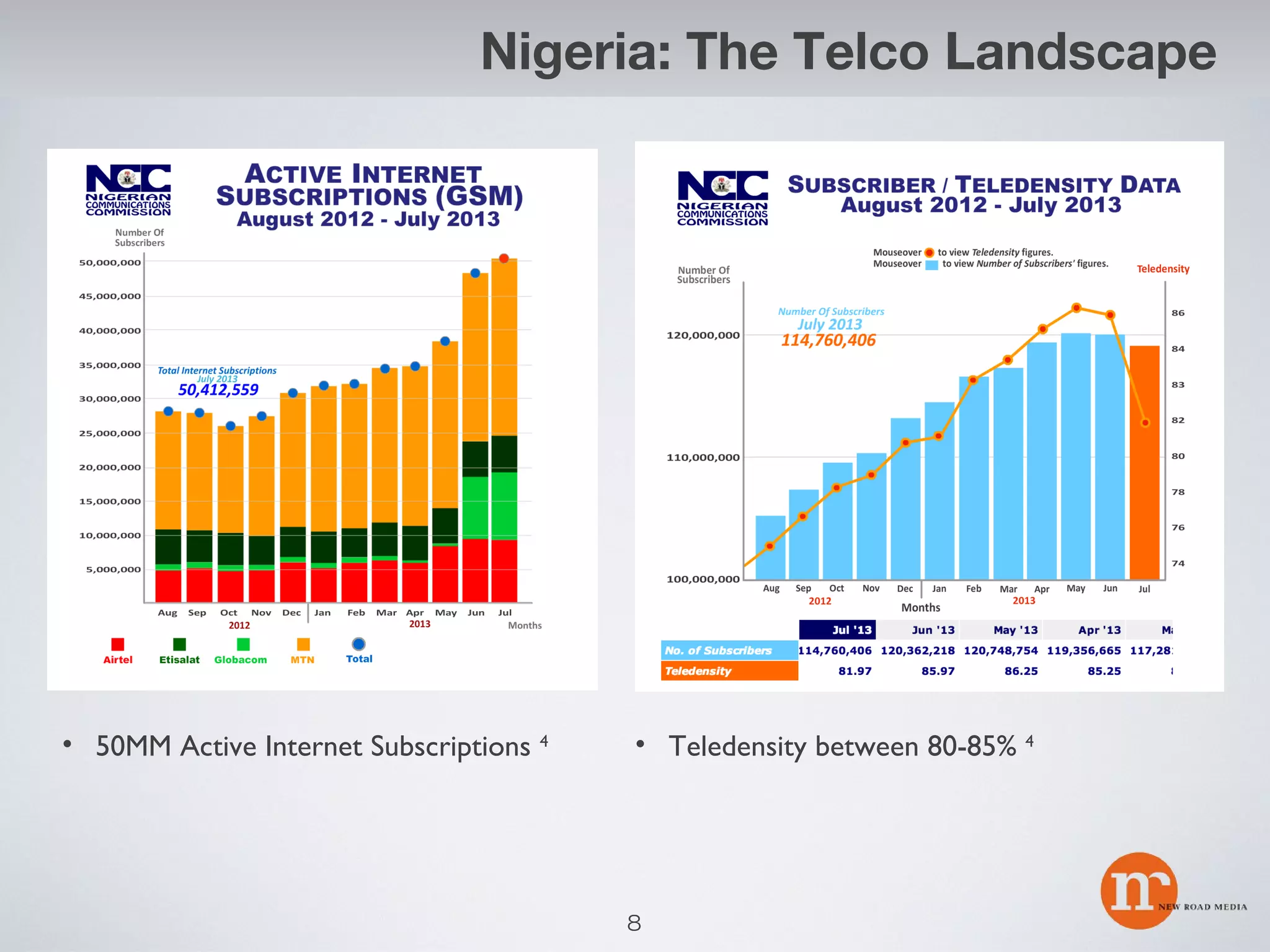

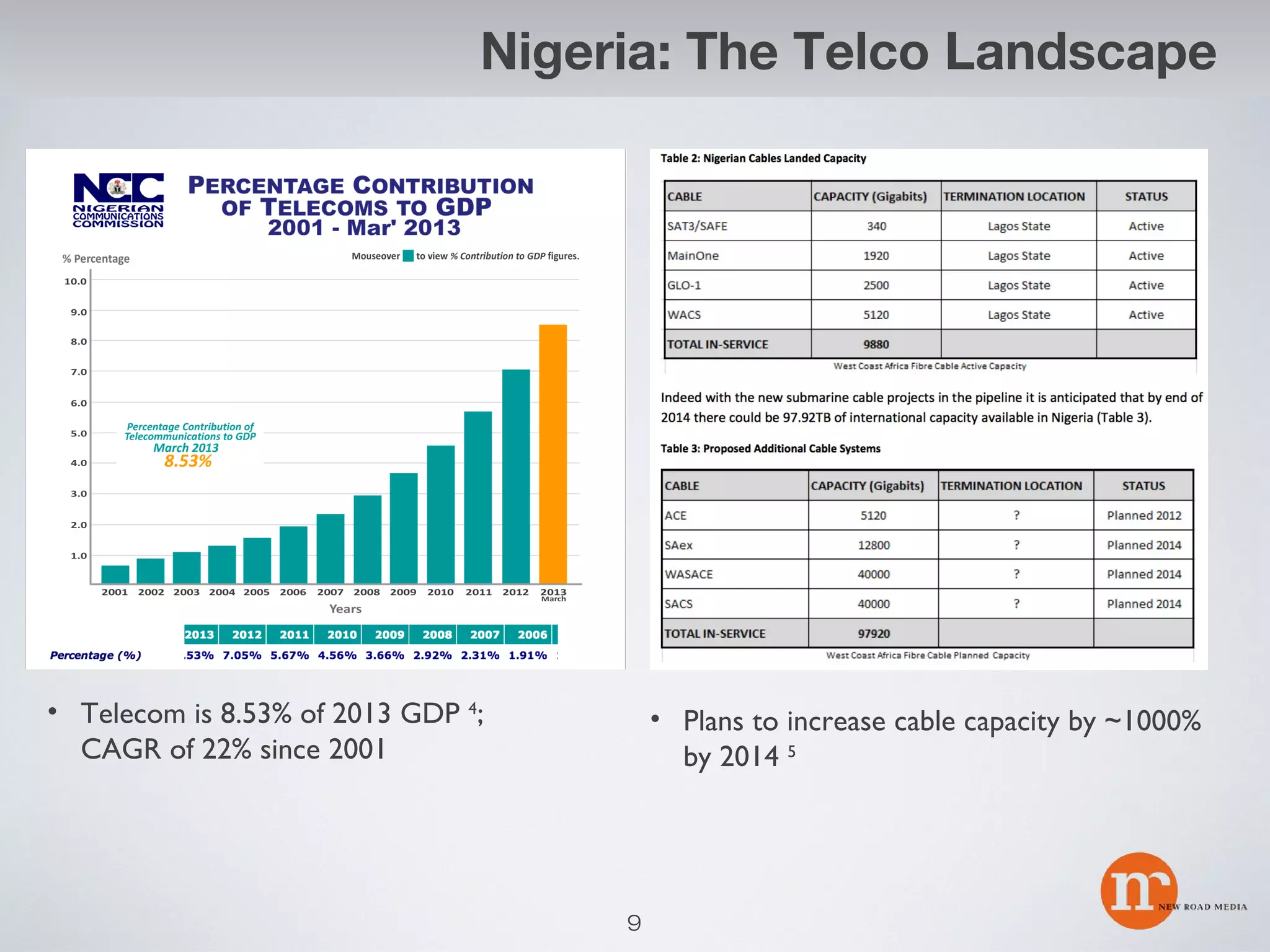

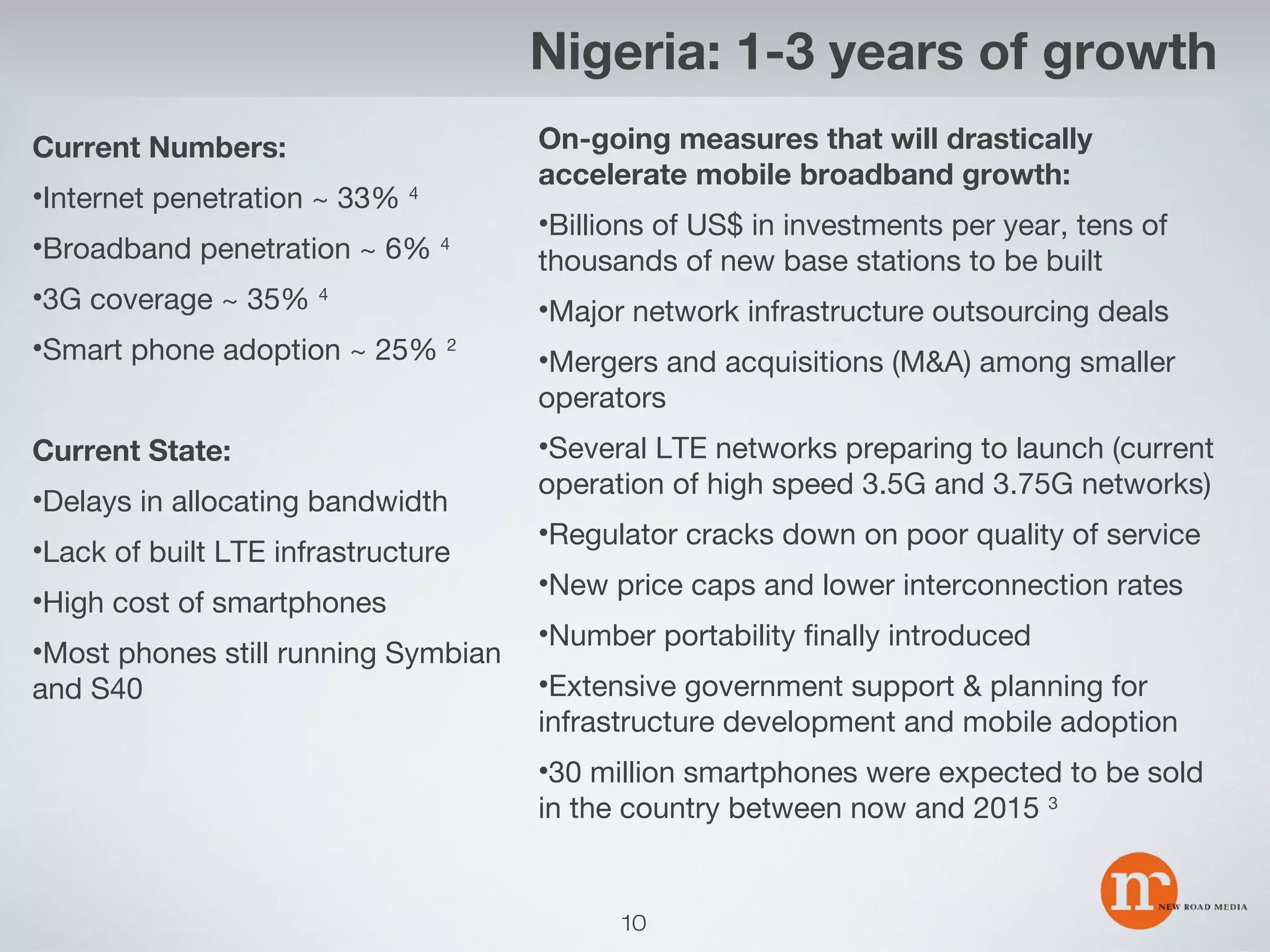

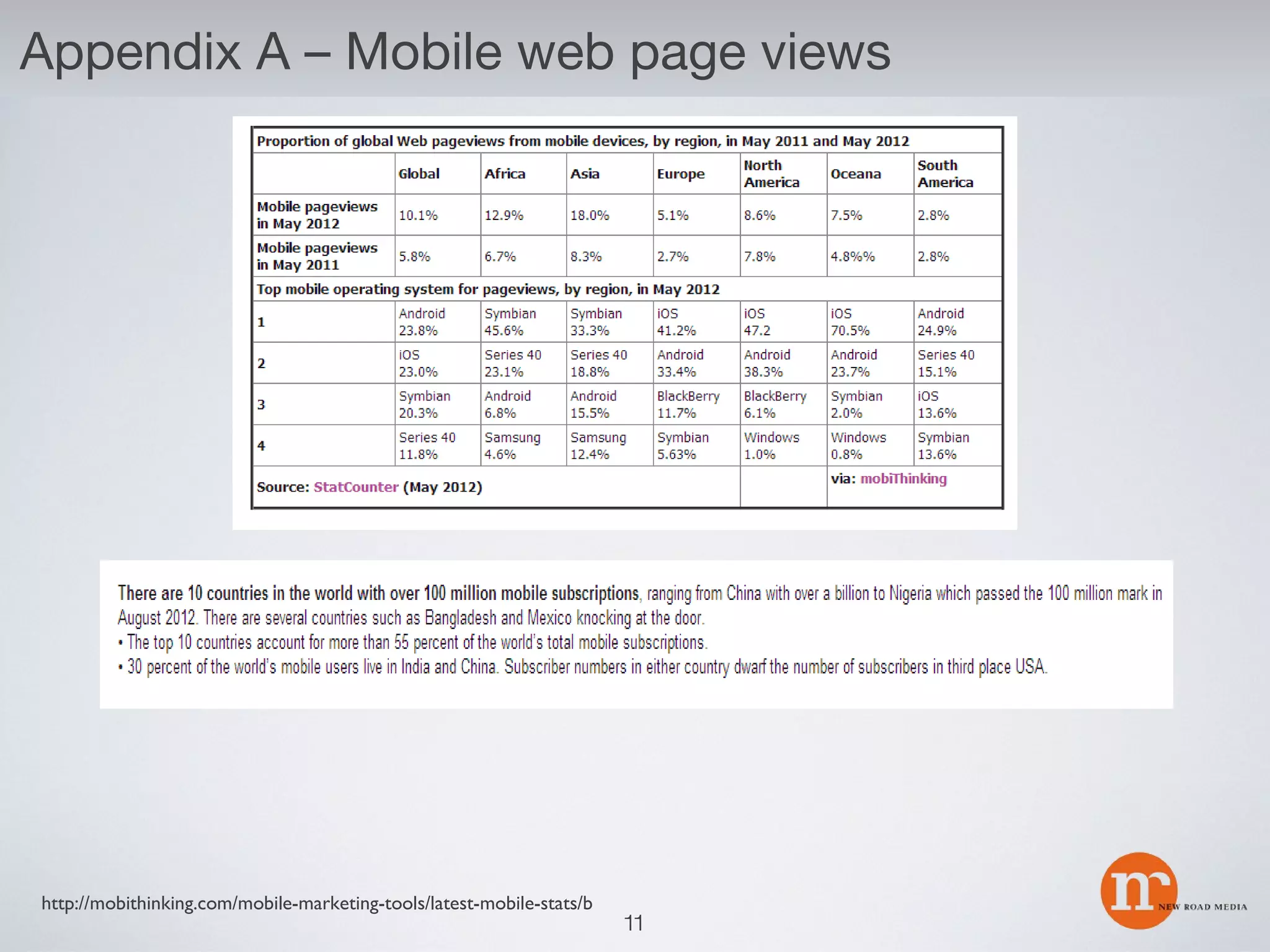

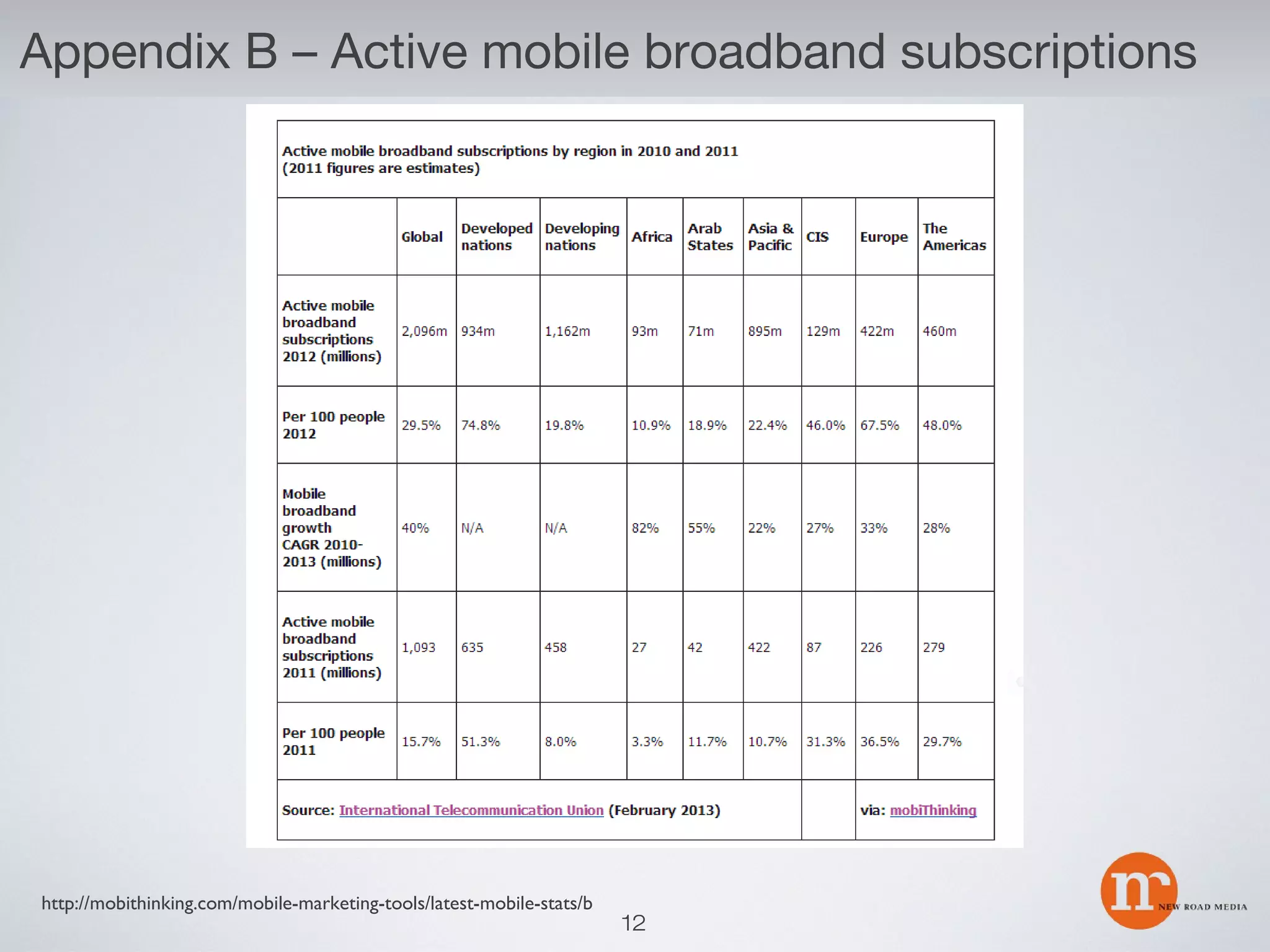

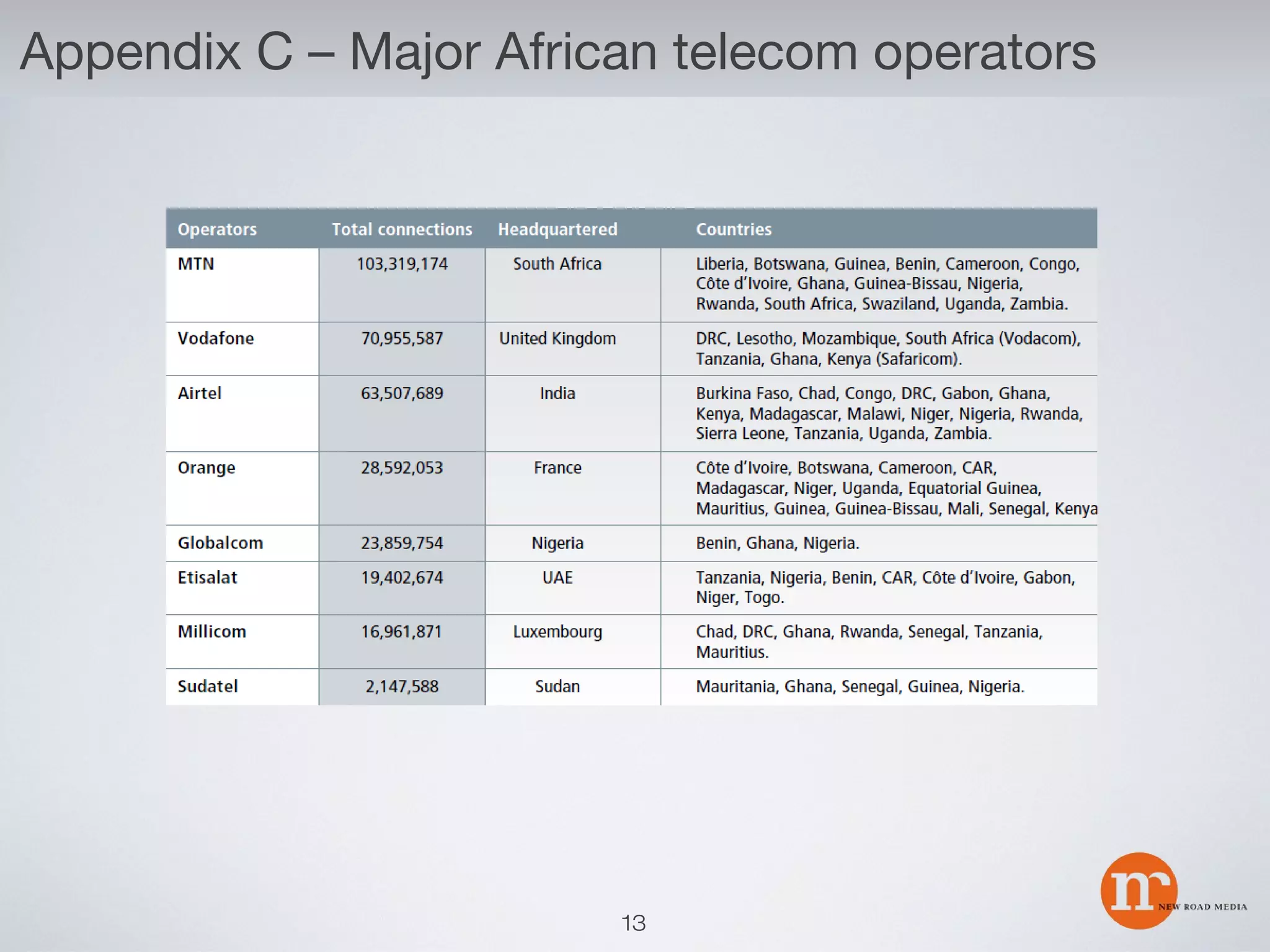

The document analyzes the broadband and mobile device landscape in Africa. It finds that Nigeria, Ghana, and South Africa are experiencing immediate growth in mobile broadband. Nigeria in particular is highlighted as a key growth market and highest value opportunity, with over 120 million mobile subscriptions and plans to increase infrastructure and drive down costs. The mobile sector in Nigeria contributes significantly to GDP and is expected to accelerate rapidly with billions in new investments in networks and devices.