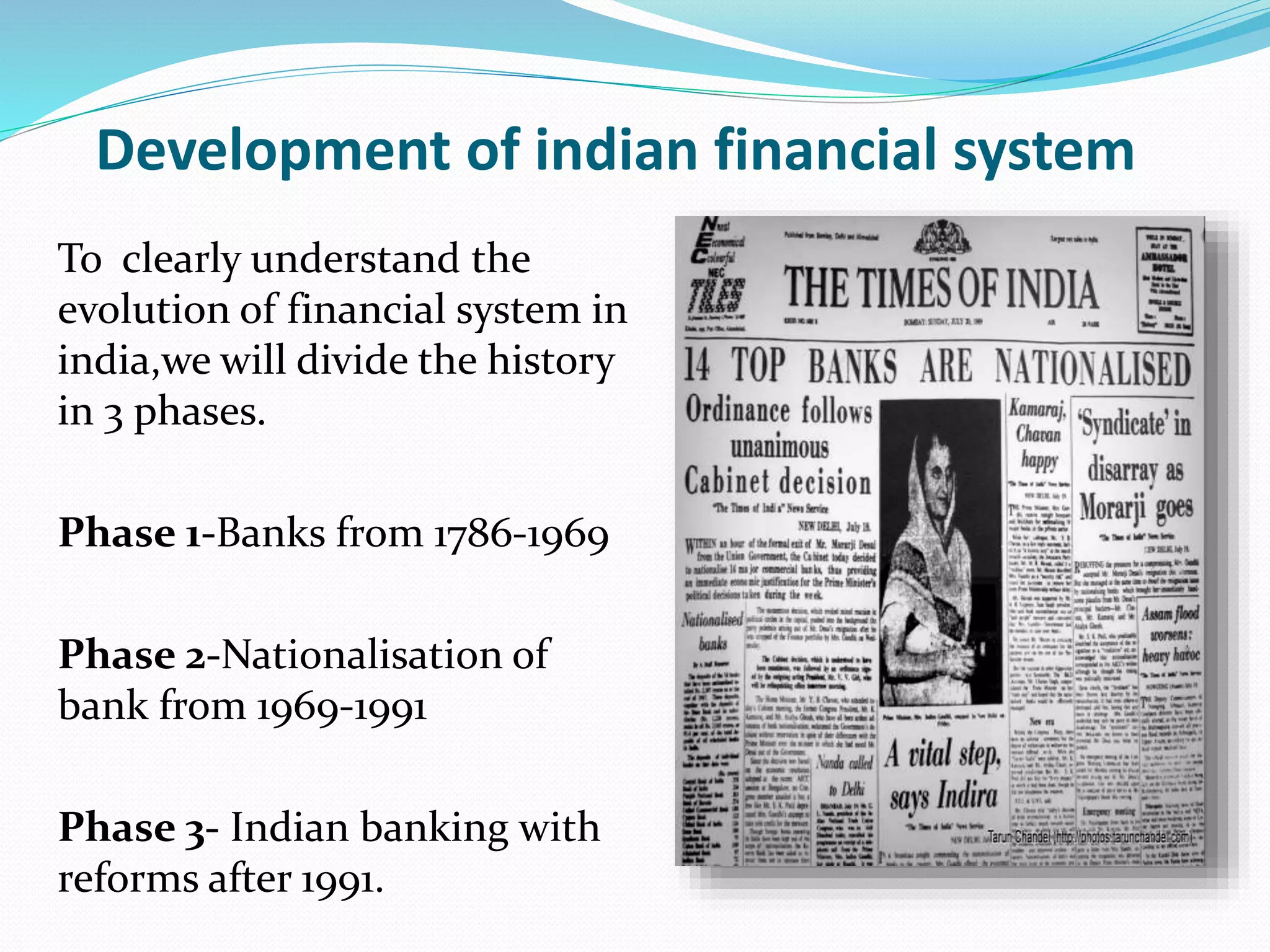

The document outlines the structure and components of the Indian financial system, including its institutions, markets, instruments, and services. It discusses the historical development of the financial system through three phases, the impact of global financial crises, and key reforms aimed at enhancing financial inclusion and stability. The document concludes with projections about the growth of banking assets and the positioning of India as a significant global economy.