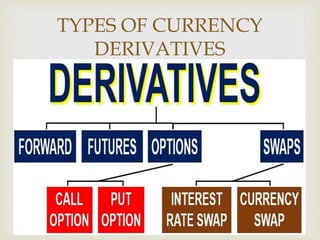

Currency derivatives are financial instruments whose value is derived from an underlying currency. The most common types of currency derivatives are currency futures and options contracts, which allow investors to buy or sell a specific amount of a currency pair, such as USD/INR, at a future date. Currency derivatives provide benefits like leverage, liquidity, and risk management. They allow risk to be transferred between entities with different risk tolerances, like companies and speculators. Speculators take on risk for a potential higher reward, while companies use derivatives to hedge and stabilize their costs. This shuffling of risk has positive impacts on the real economy.