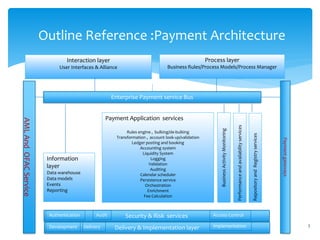

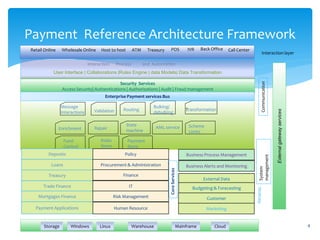

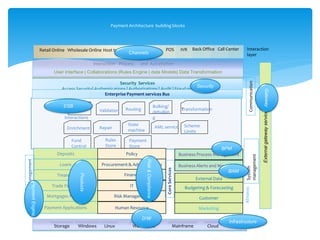

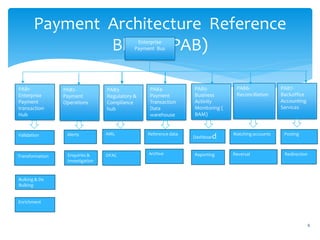

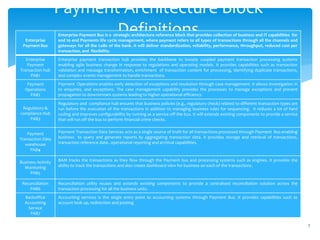

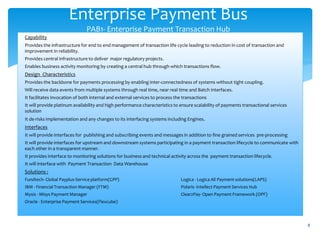

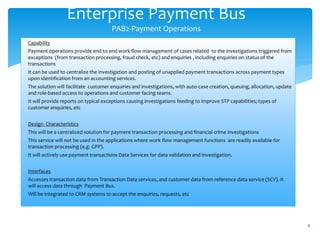

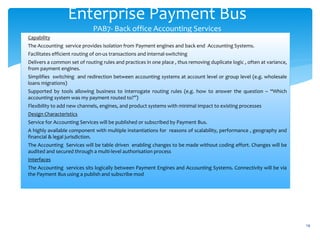

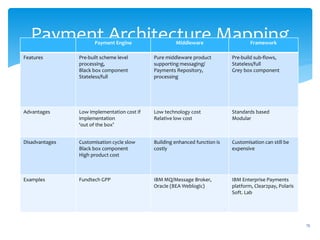

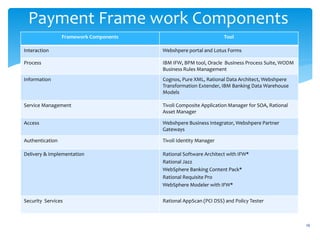

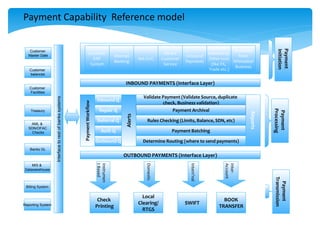

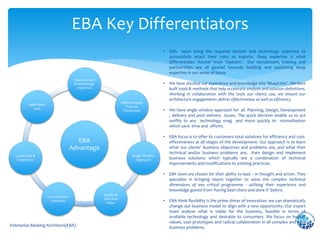

The document outlines the Payment Reference Architecture, detailing frameworks, building blocks, and capabilities necessary for enterprise payment systems. It discusses components like transaction hubs, compliance checks, data warehouses, and business monitoring to enhance payment processing efficiency and reliability. Additionally, it highlights key differentiators and agile approaches for implementing effective banking solutions by the enterprise banking architects.