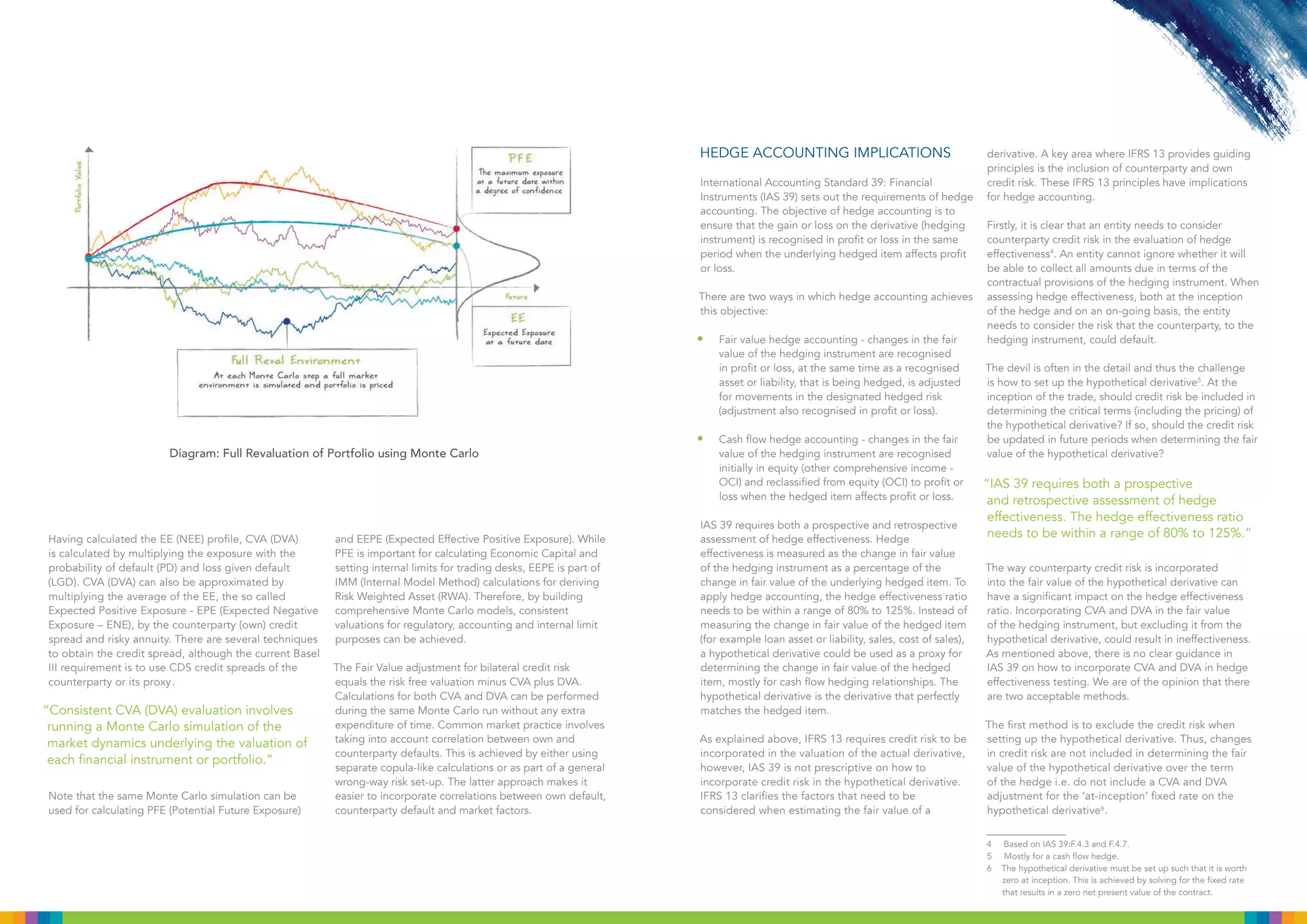

The document discusses IFRS 13, which establishes a framework for fair value measurement, clarifying factors for estimating fair value and replacing inconsistent guidance in other IFRS standards. It highlights the importance of considering counterparty credit risk and adjustments for CVA (Credit Valuation Adjustment) and DVA (Debit Valuation Adjustment) when evaluating derivatives and hedge effectiveness under IAS 39. The paper also examines methodologies for calculating CVA and DVA, their implications for hedge accounting, and the role of Monte Carlo simulations in achieving accurate valuations.