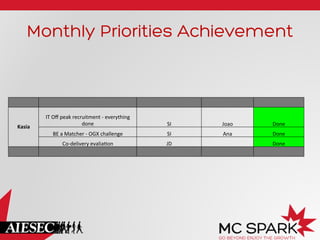

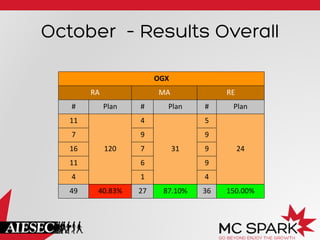

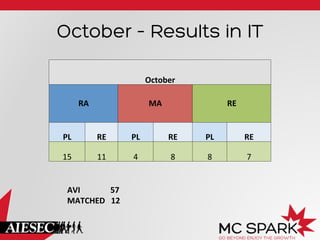

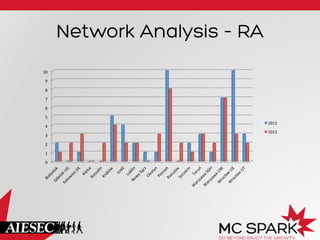

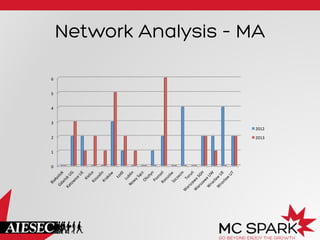

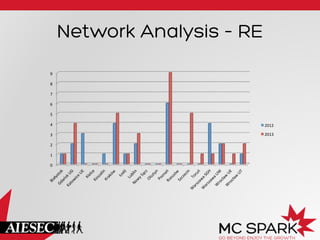

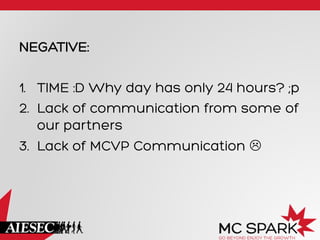

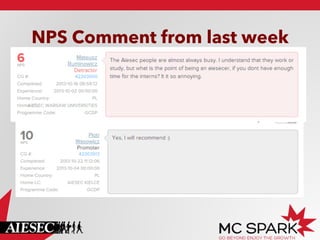

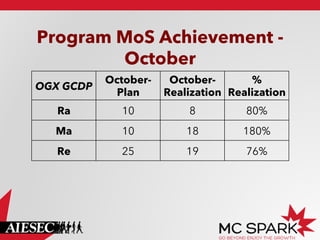

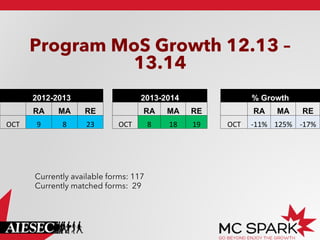

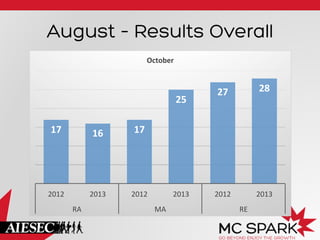

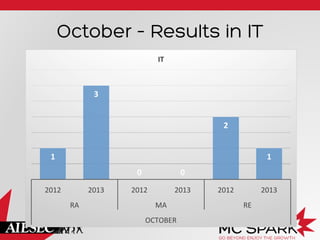

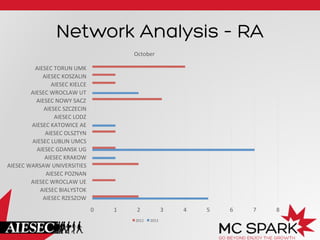

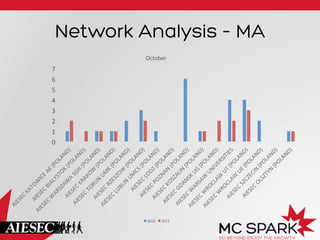

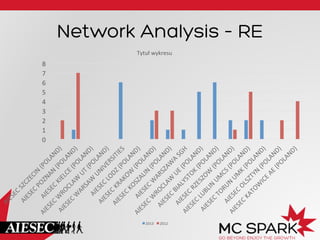

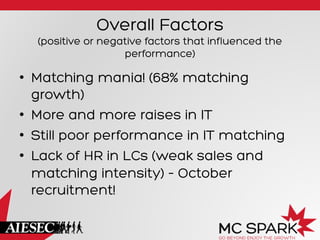

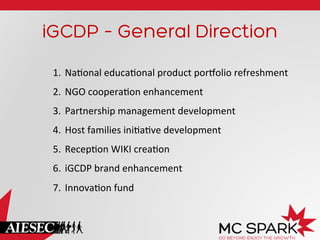

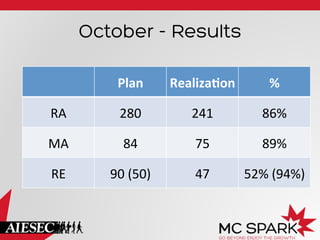

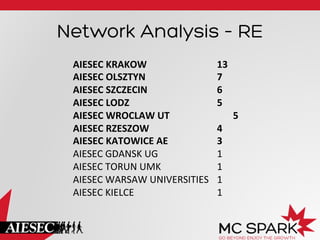

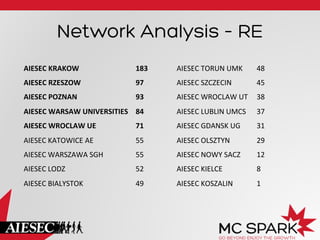

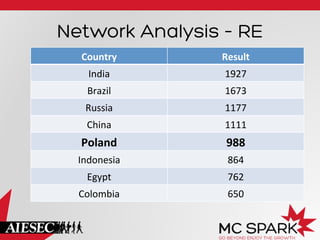

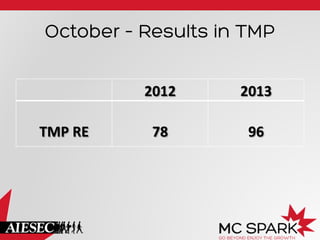

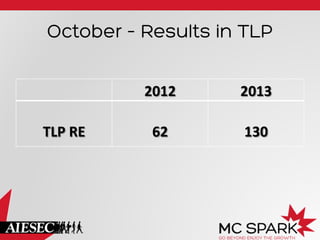

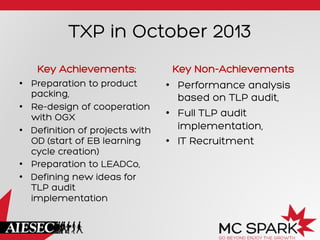

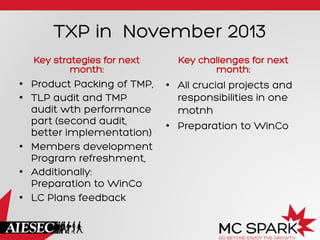

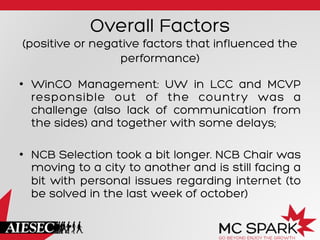

The document provides an operations monthly report for October 2013. It includes summaries for oGIP, oGCDP, iGIP, and iGCDP. The oGIP section reports on priorities achieved, results for RA, MA, and RE metrics, and network analysis. It discusses positive and negative factors and priorities for November. The oGCDP section similarly reports on MoS achievement, growth in metrics from 2012-2013, and key progress and challenges. The iGIP section discusses general direction, priorities achieved, results for RA, MA and RE, network analysis, and factors affecting performance. It outlines achievements and non-achievements for October and strategies and challenges for November. Finally, the i