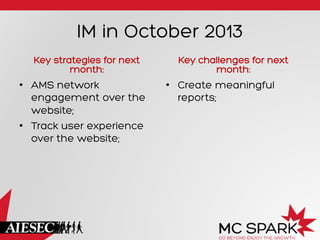

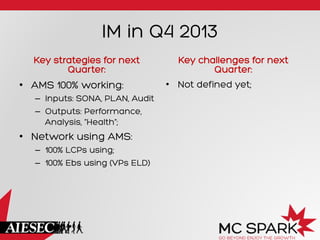

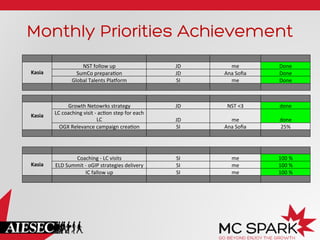

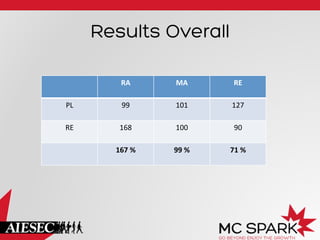

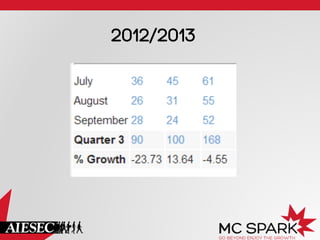

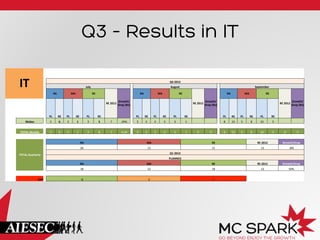

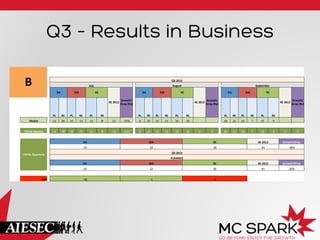

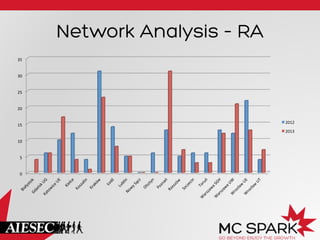

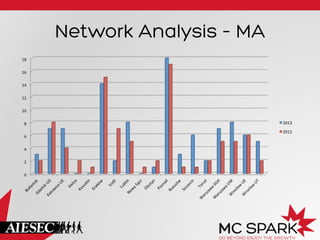

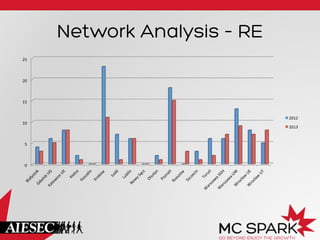

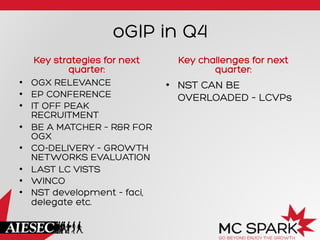

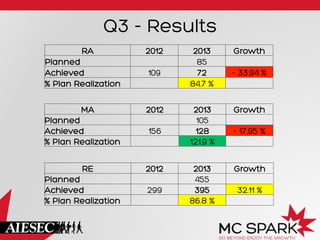

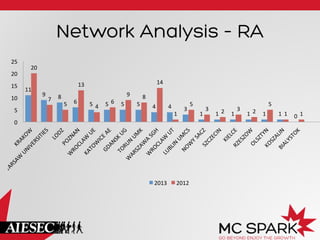

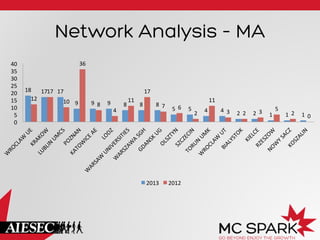

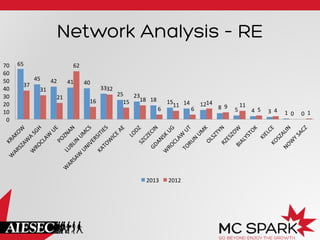

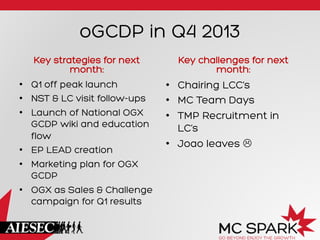

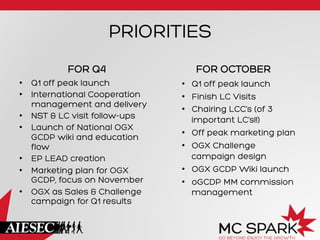

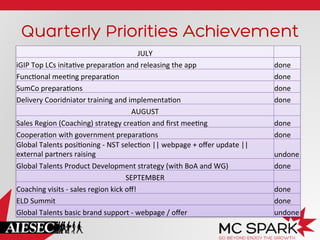

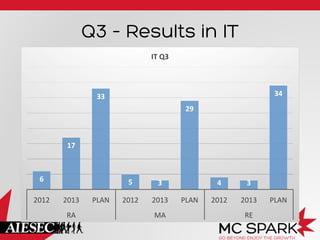

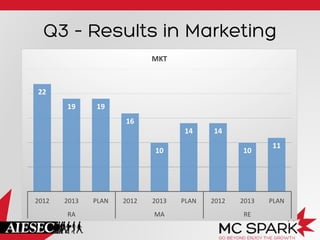

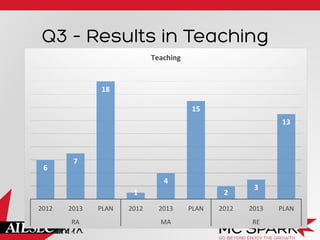

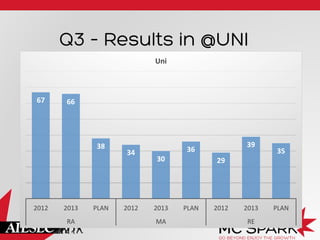

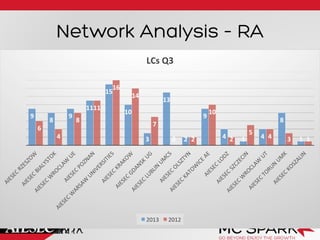

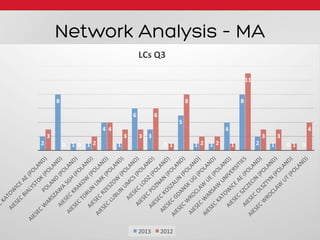

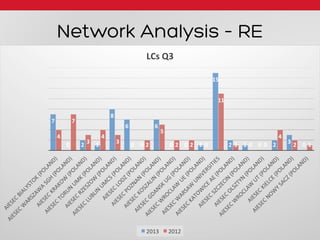

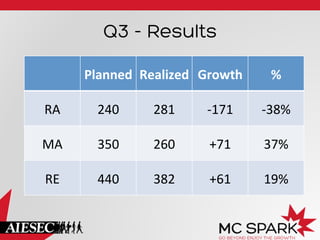

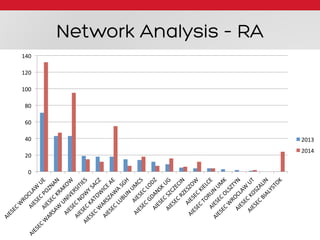

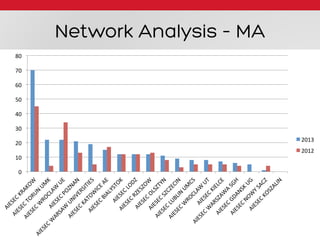

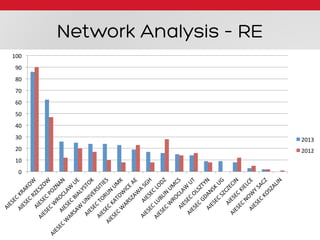

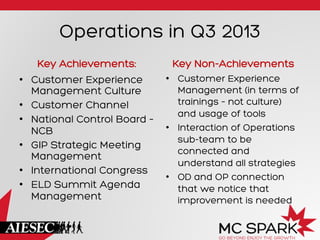

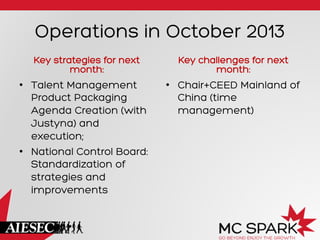

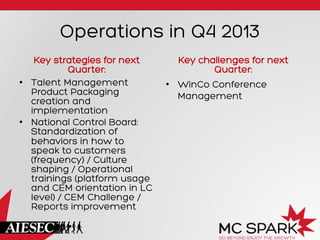

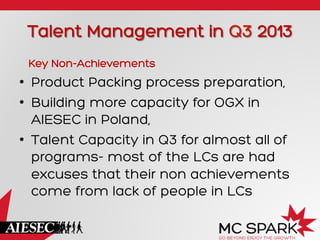

The document provides quarterly operations reports for Q3 2013. It summarizes results in IT and Business. In IT, the total quarterly results were 26 RA, 12 MA, and 11 RE, an 8% drop from 2012. Monthly priorities for staff like growth network strategies and LC coaching visits were completed. In Business, the total quarterly results were 48 RA, 74 MA, and 30 RE, a 31% drop in RE from 2012. The report analyzes monthly and quarterly key performance indicators and results.

![Quarter Priorities Achievement

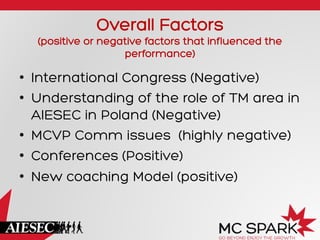

• AIESEC Management System:

– TLP Audit

– Ticket System

– SONA

– PLAN

– Site basic interface

– Admin pages to control

• [75% - 6/8] Newsletters published

• 2 Conference Outputs [Sessions: ~80%]](https://image.slidesharecdn.com/q3-operationsreport-131008015018-phpapp02/85/Q3-operations-report-72-320.jpg)

![IM in Q3 2013

Key Achievements:

• AIESEC Management

System:

– TLP Audit

– Ticket System

– SONA

– PLAN

– Site basic interface

– Admin pages to control

• [75% - 6/8] Newsletters

published

• 2 Conference Outputs

[Sessions: ~80%]

Key Non-Achievements

• AMS reporting pages;

• AMS performance

pages;](https://image.slidesharecdn.com/q3-operationsreport-131008015018-phpapp02/85/Q3-operations-report-74-320.jpg)