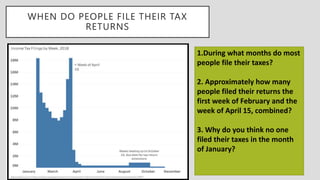

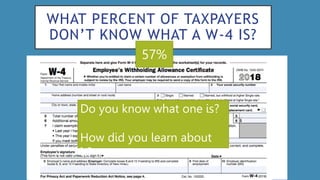

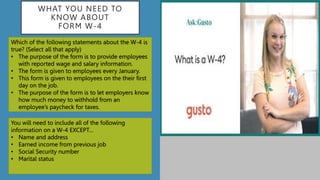

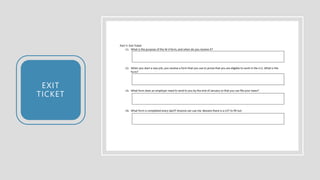

This document discusses the tax cycle and the W-4 form. It covers important dates in the tax cycle like filing taxes in February and April. Over half of taxpayers don't know what a W-4 is. The W-4 form is given to new employees and is used by employers to determine how much to withhold from paychecks for taxes. The document encourages exploring a sample W-4 form to understand the details and purpose of the different sections.