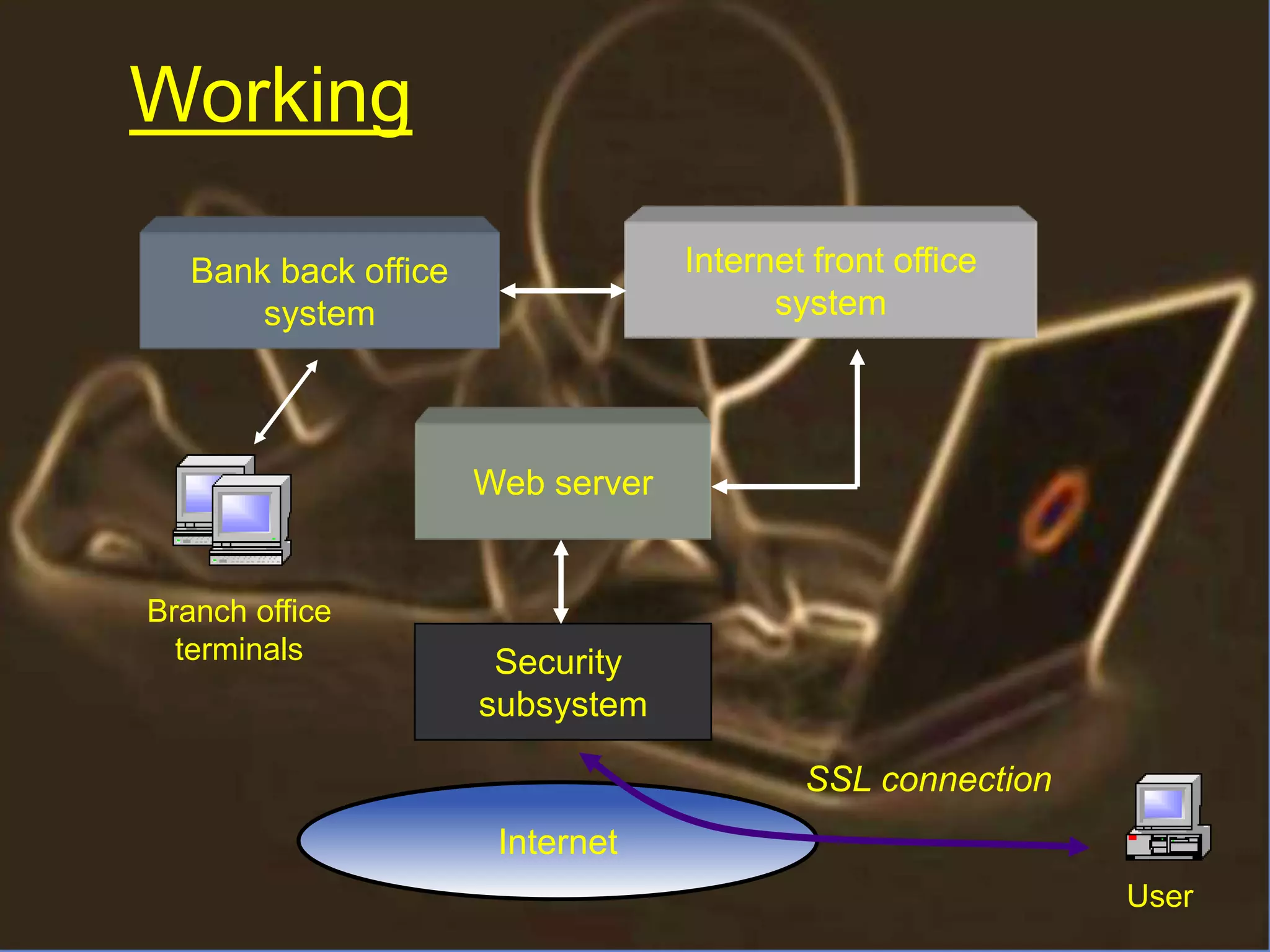

This document provides an overview of internet banking, including its history, definition, types, services, and how it works. It began in 1981 when major New York banks offered home banking services using videotext systems. Internet banking allows customers to view accounts, pay bills, and transfer money online instead of visiting a bank. While offering advantages like lower costs and faster transactions, it also presents security risks like hacking if proper precautions are not taken. The document concludes that banks aim to provide valuable online services and products to customers using internet-based technologies.