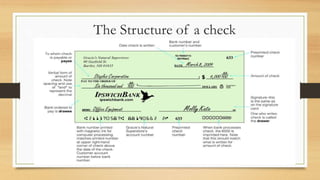

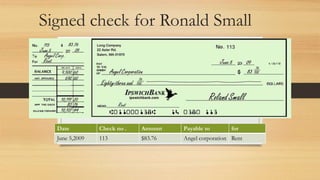

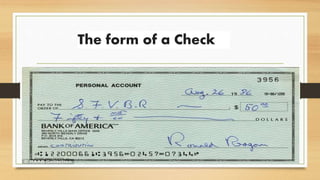

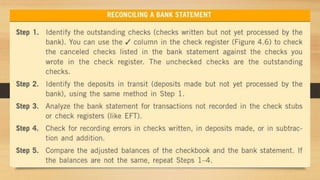

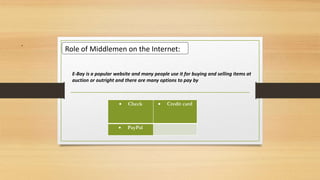

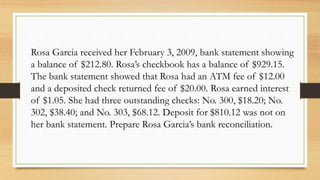

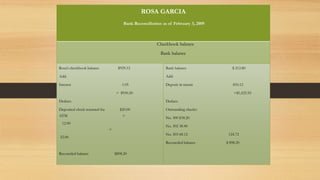

This document summarizes key aspects of banking, including checking accounts, bank statements, and trends in online banking. It discusses checking accounts, how to open a business checking account, deposit slips, and how to write and endorse checks. It also covers bank statements, the reconciliation process, and how to complete a sample bank reconciliation. Finally, it discusses trends in online banking such as increased internet usage, new banking legislation, and the role of middlemen like PayPal.