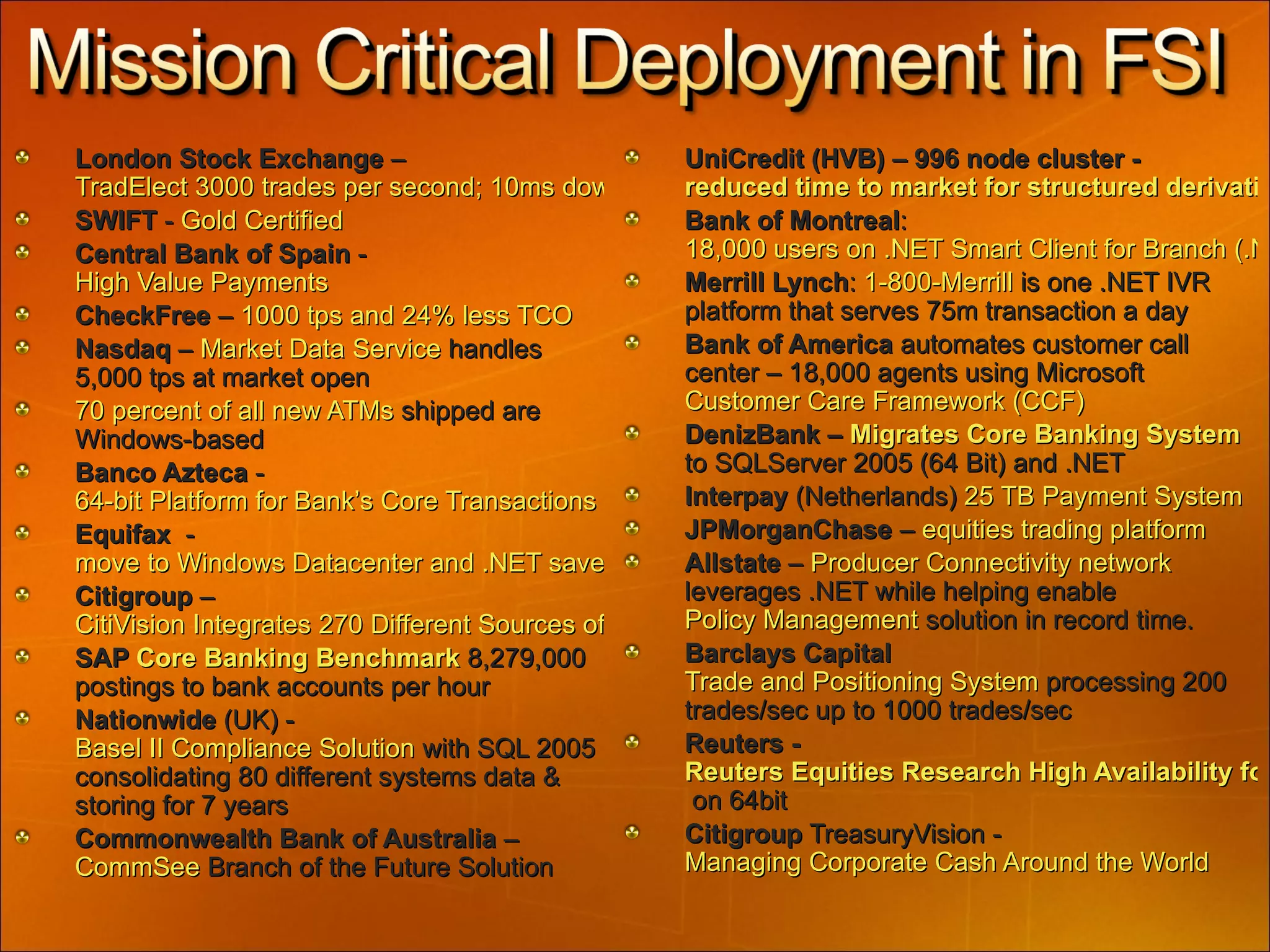

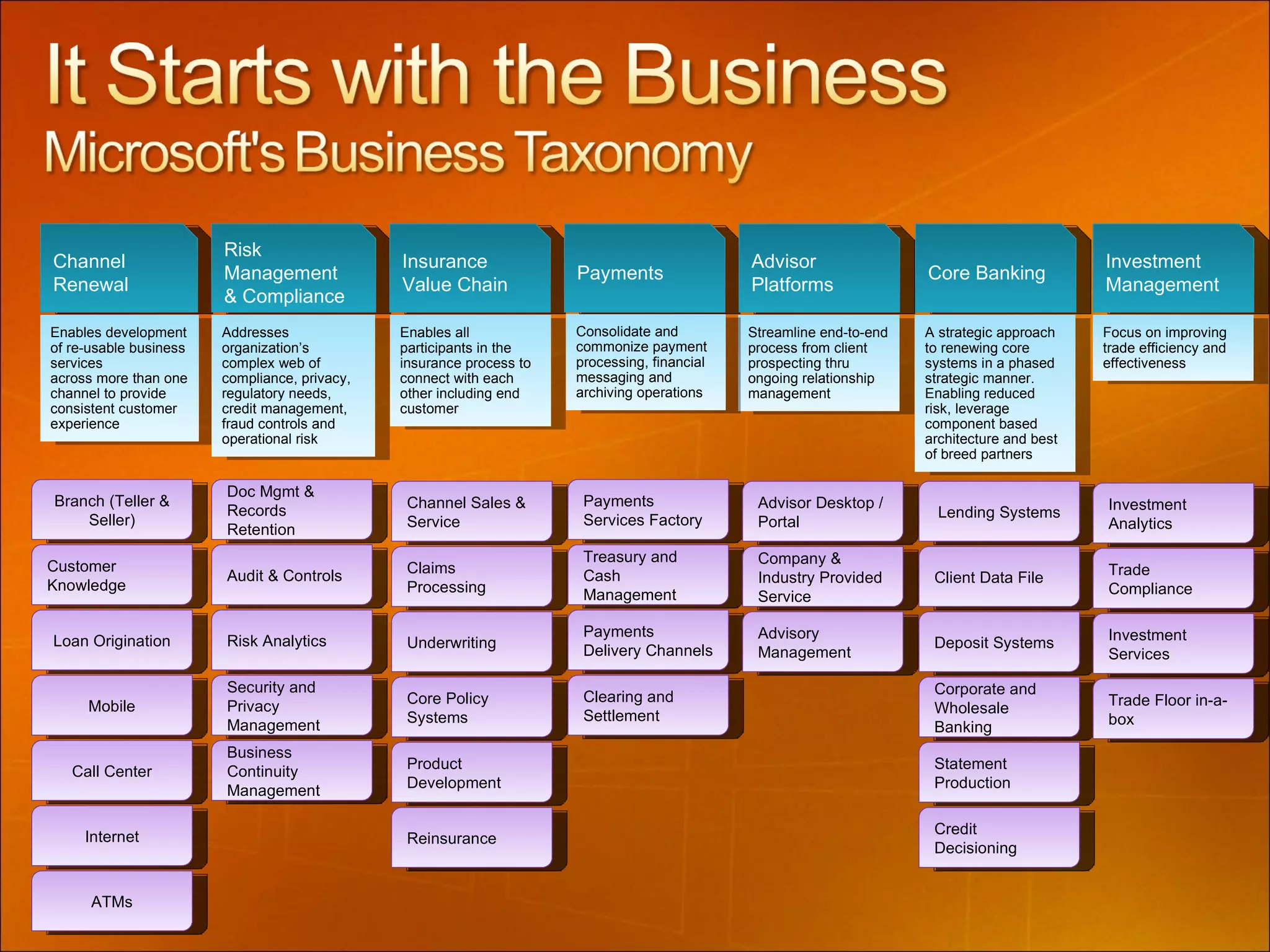

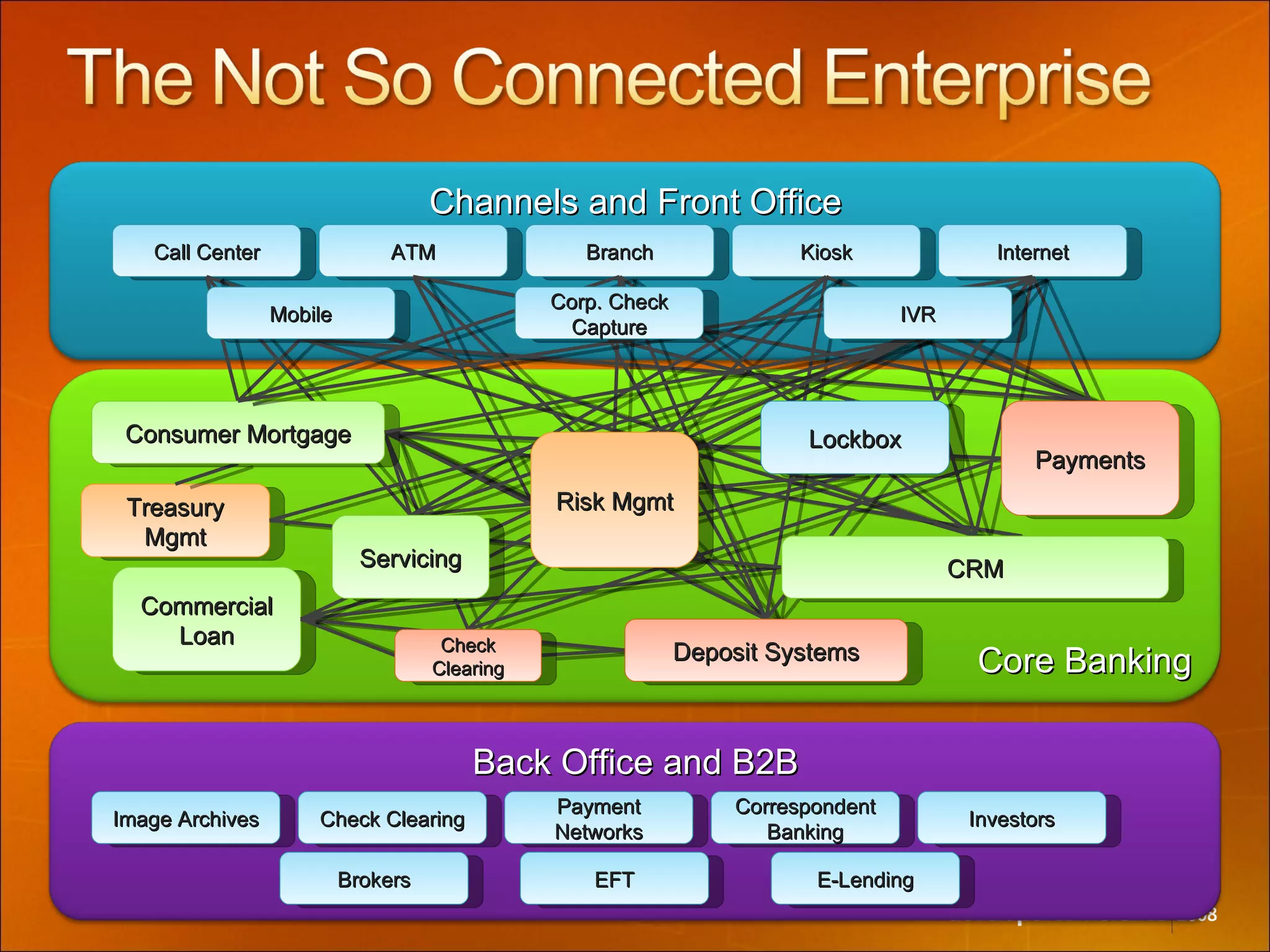

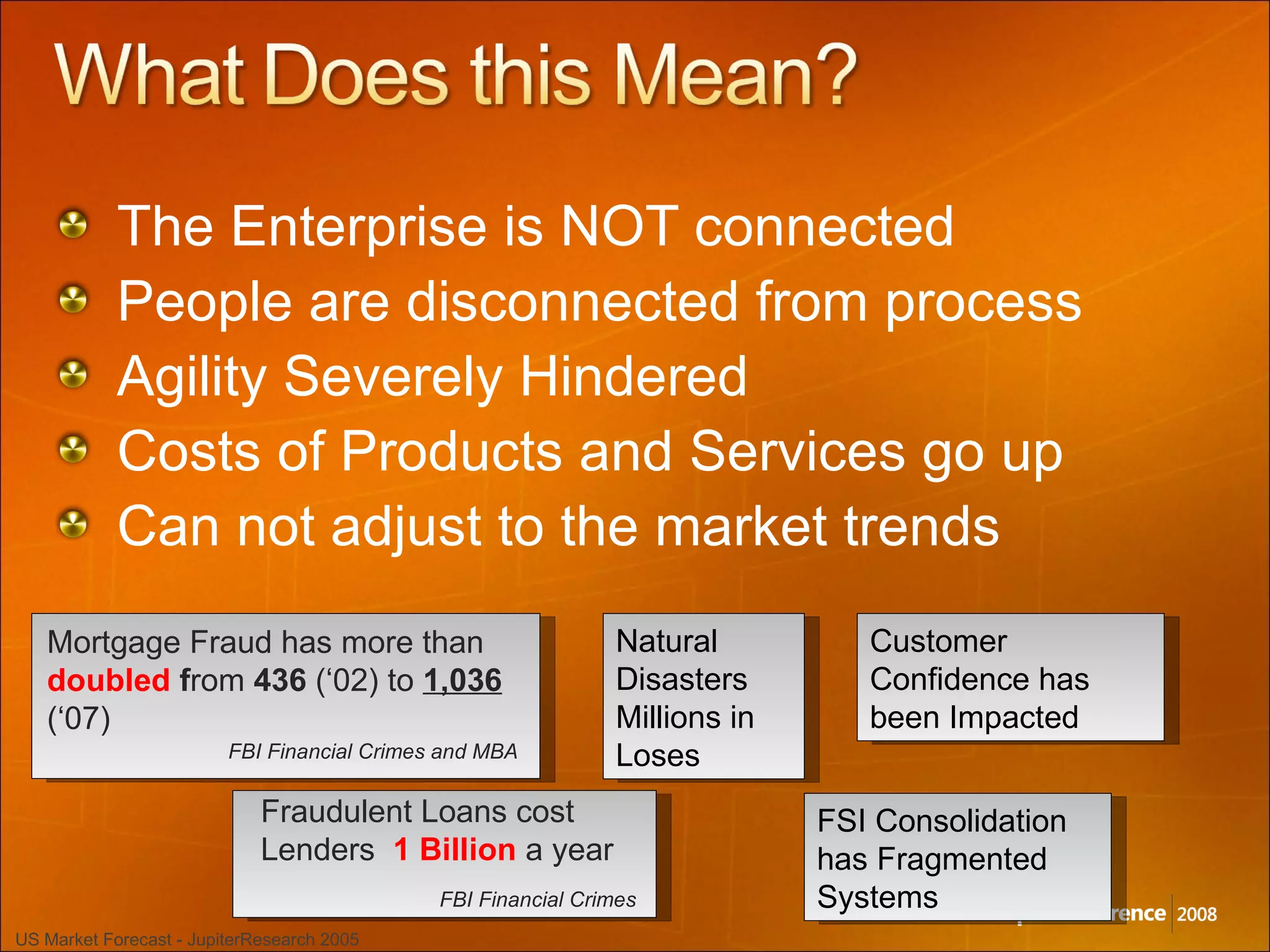

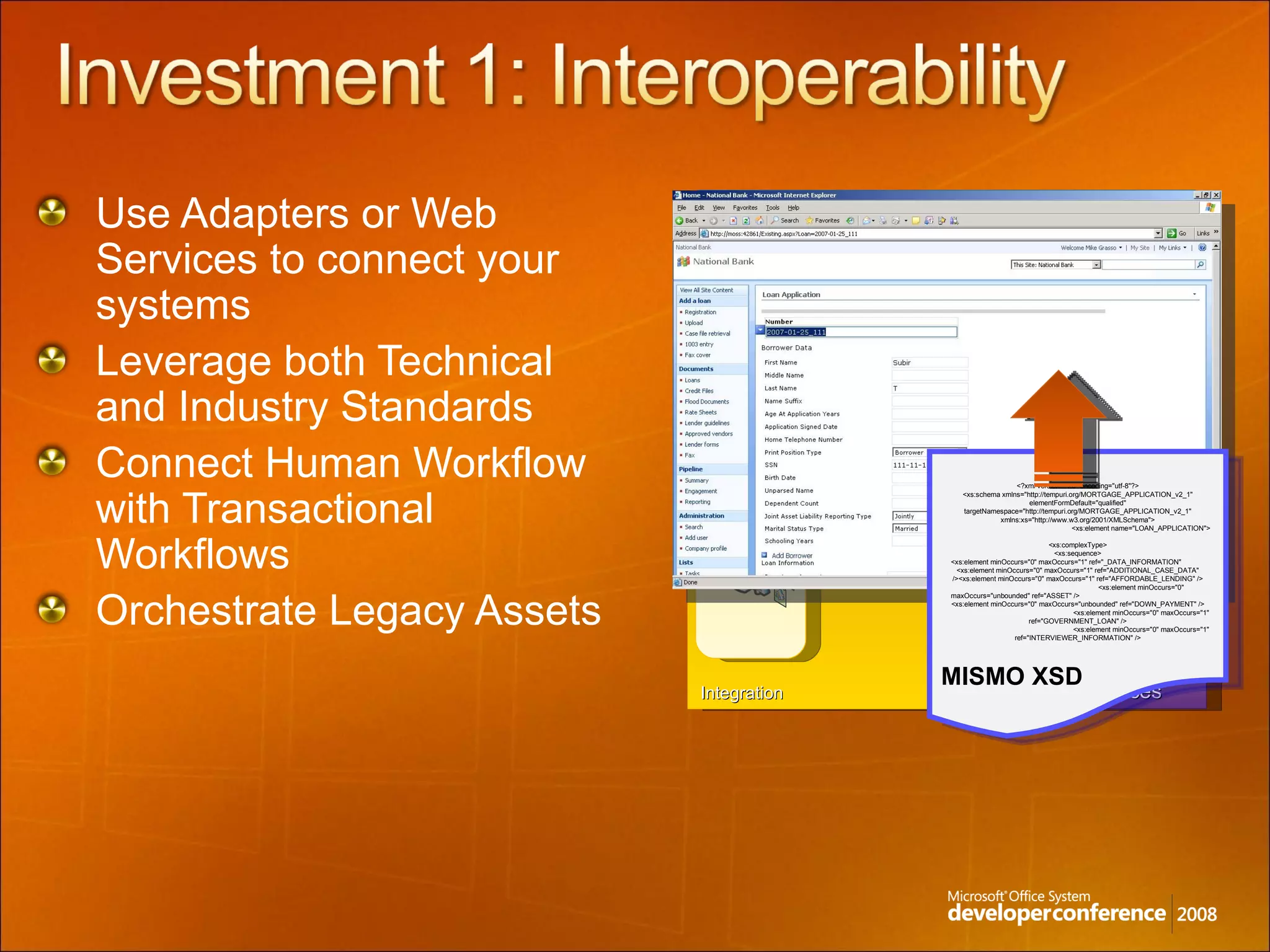

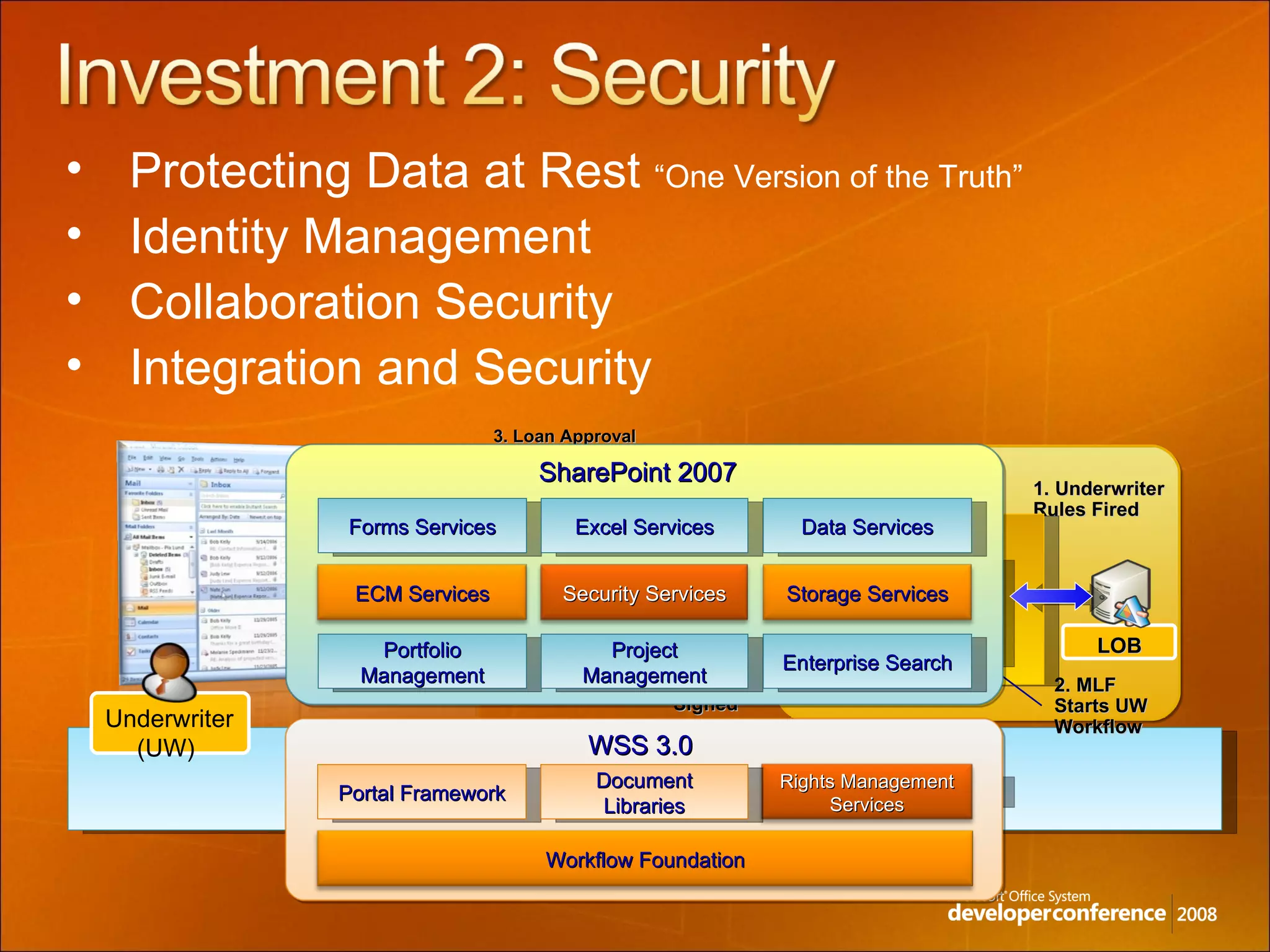

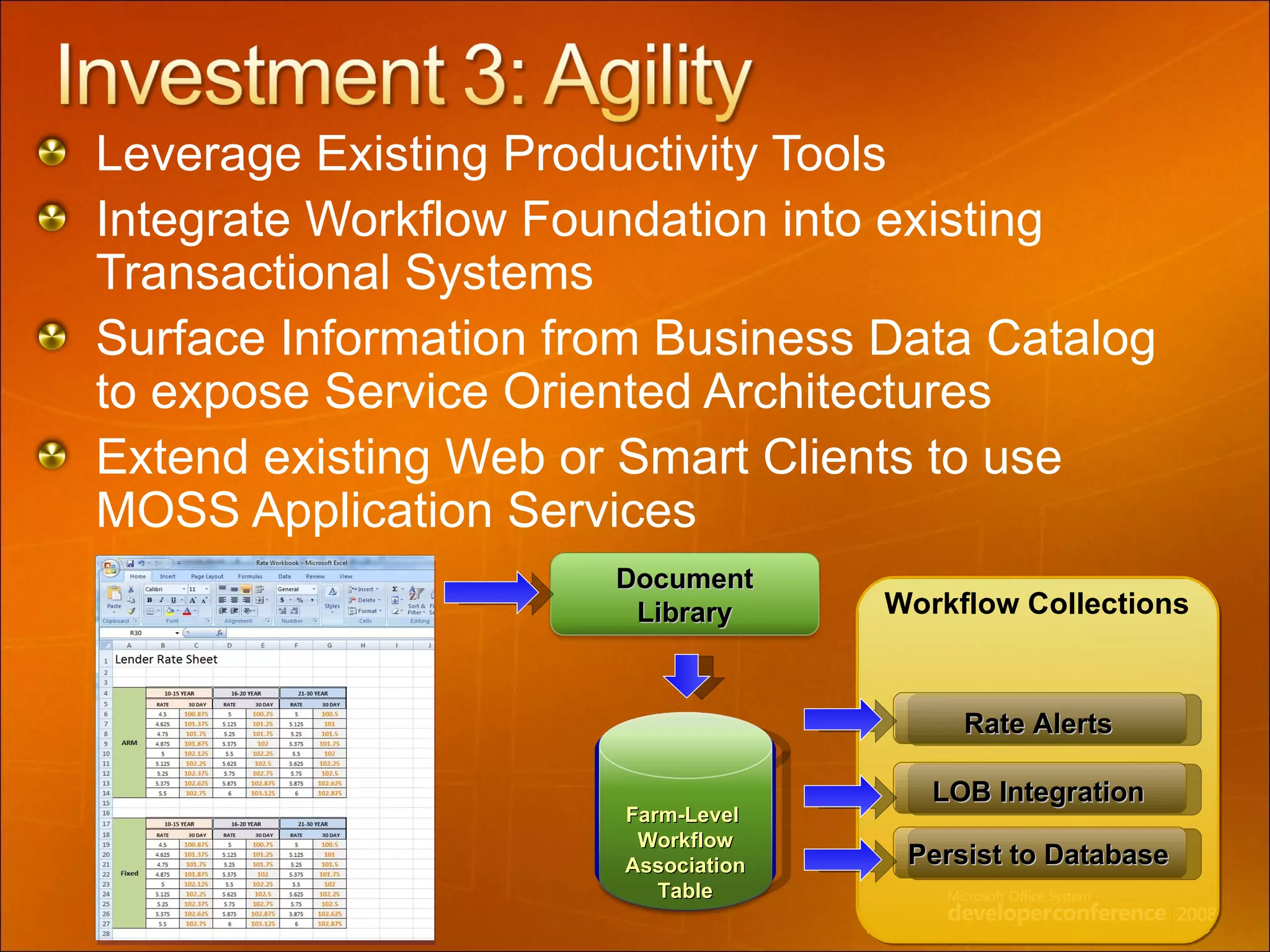

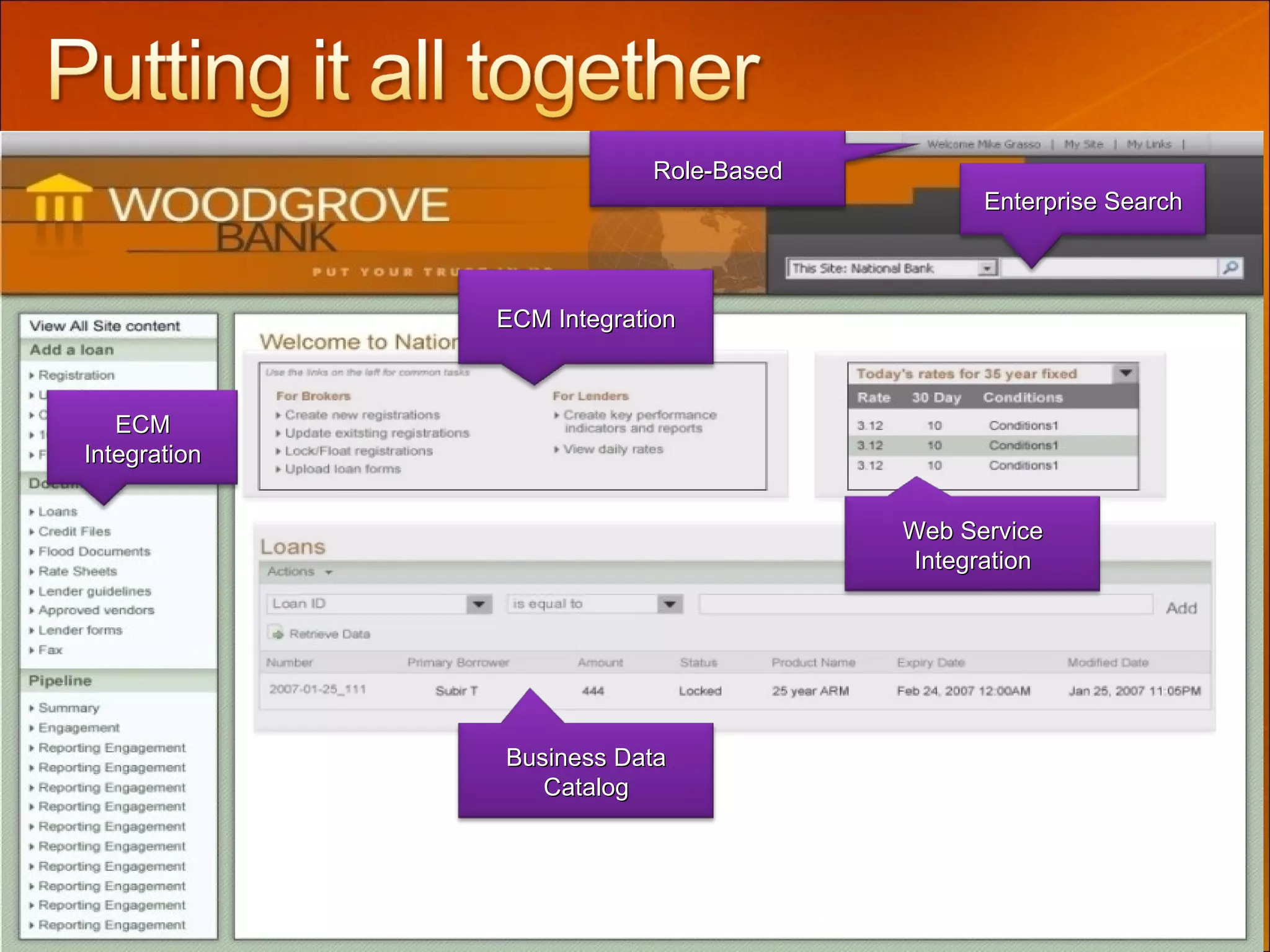

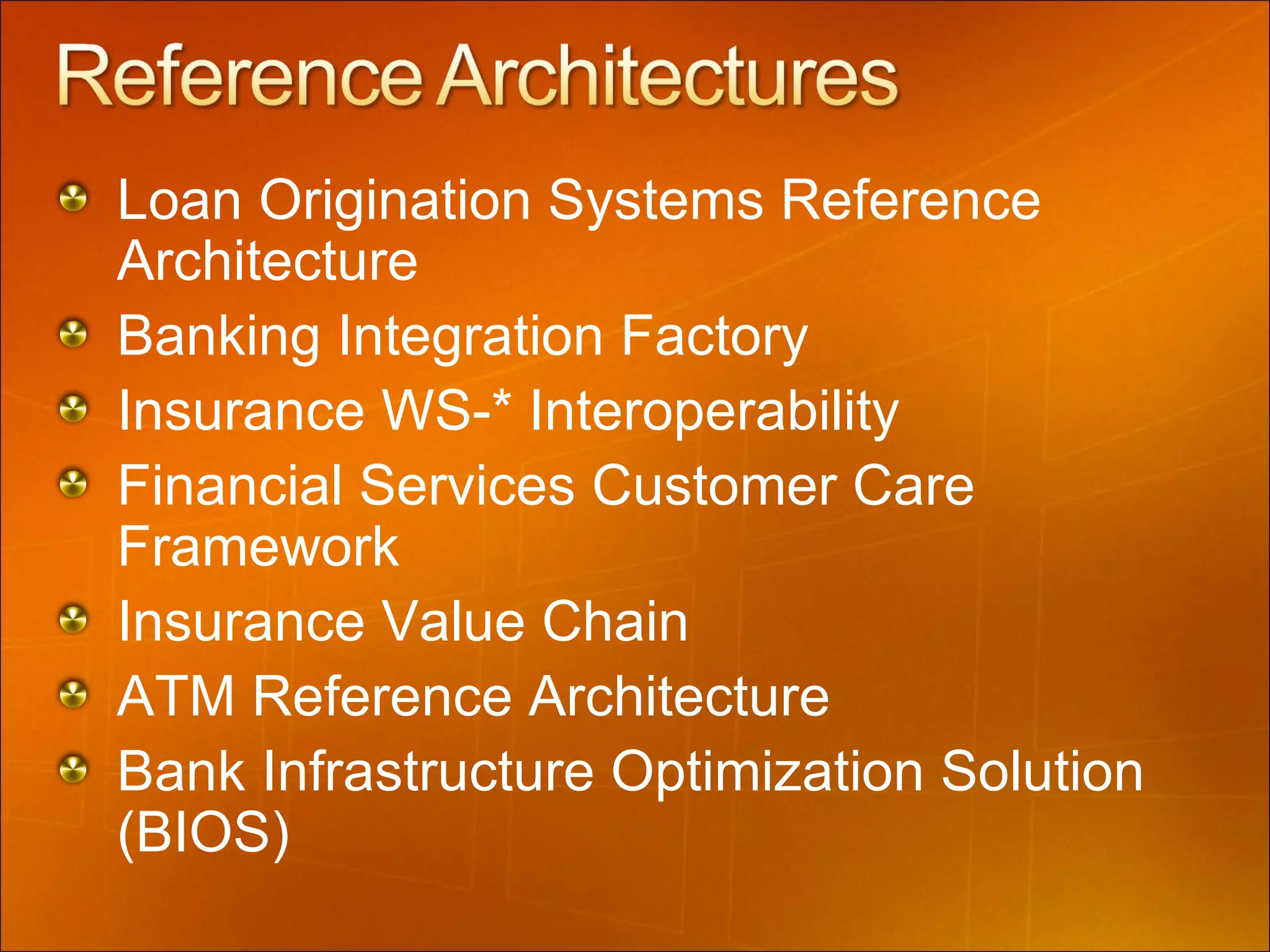

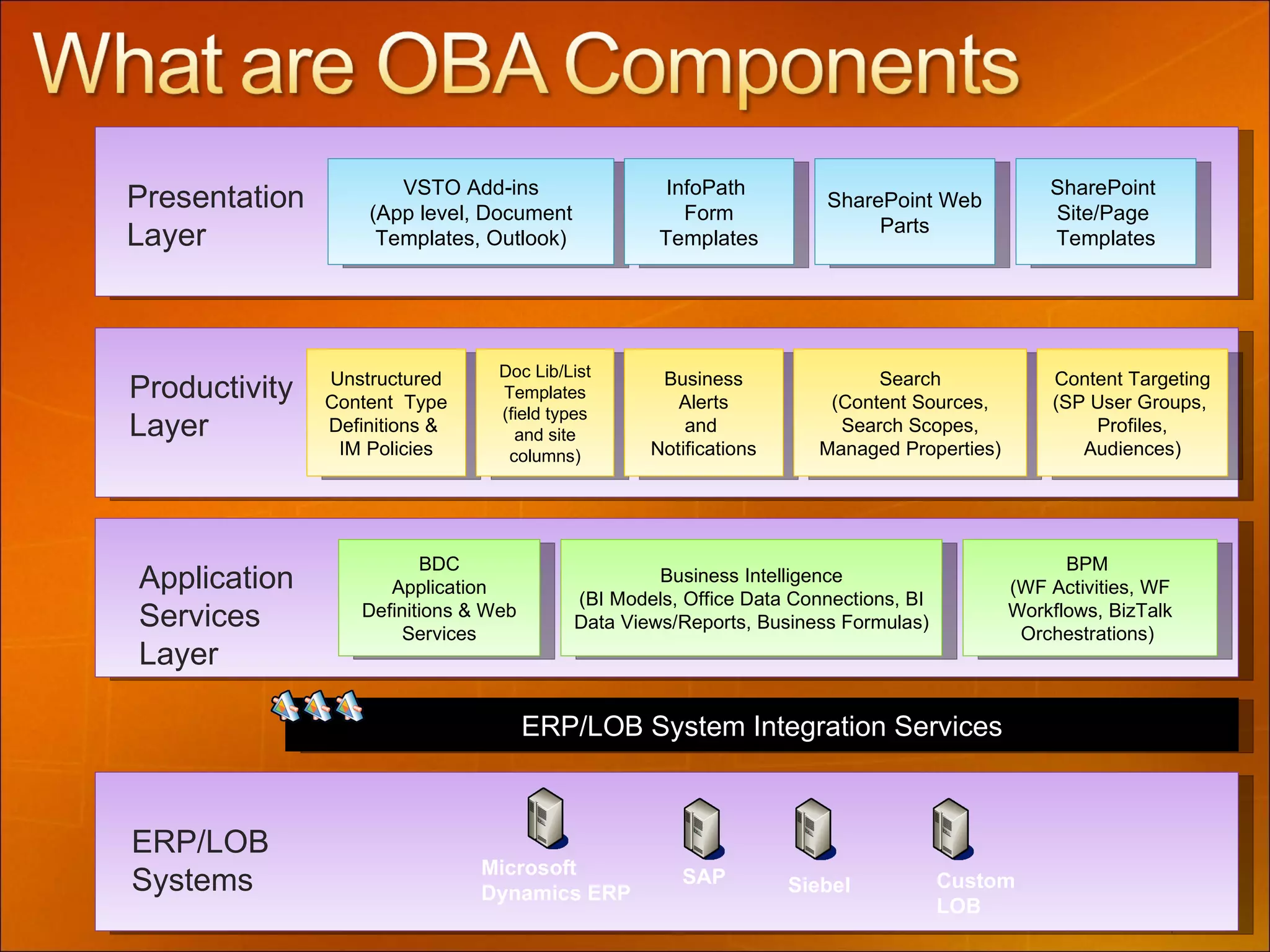

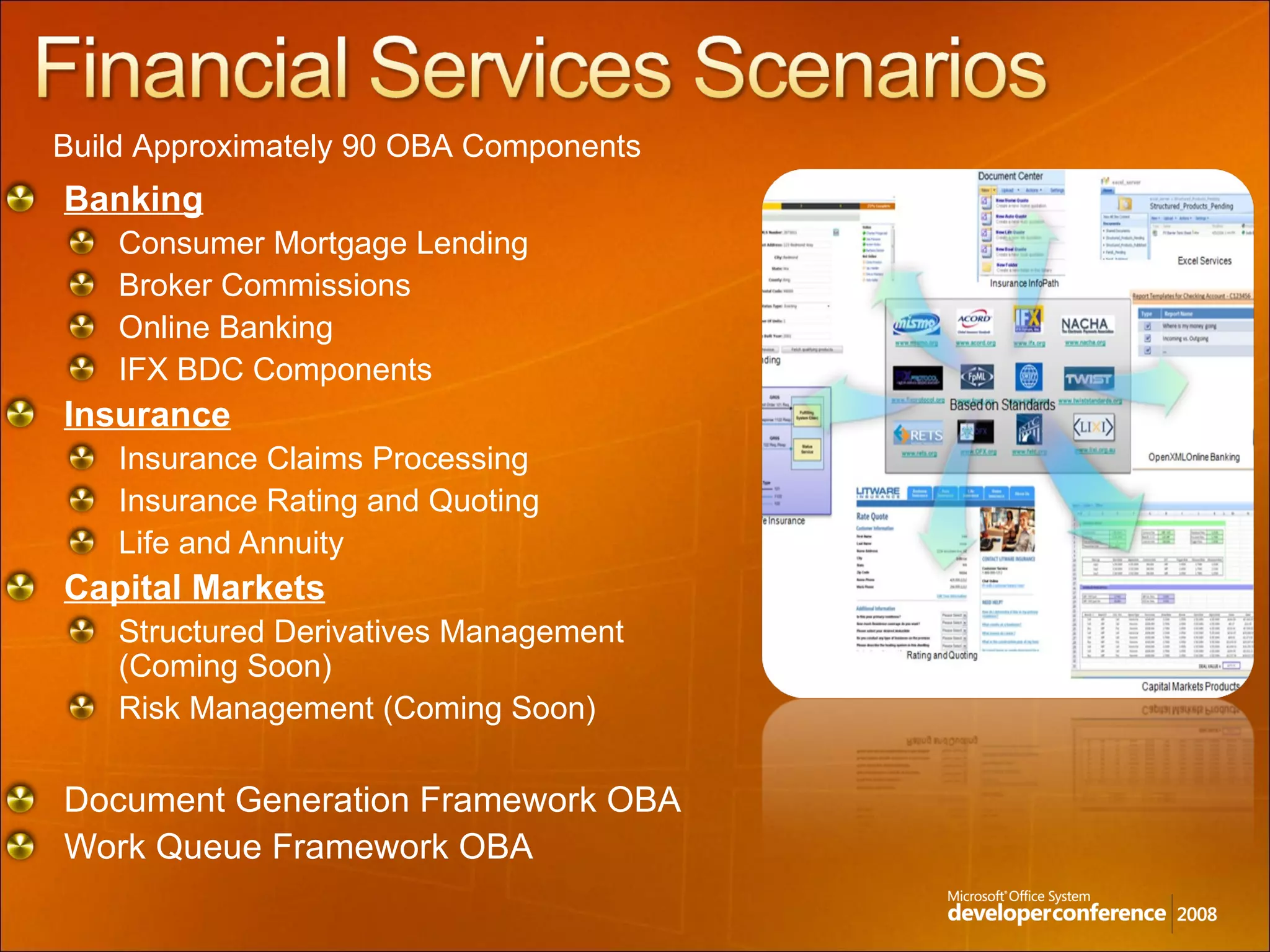

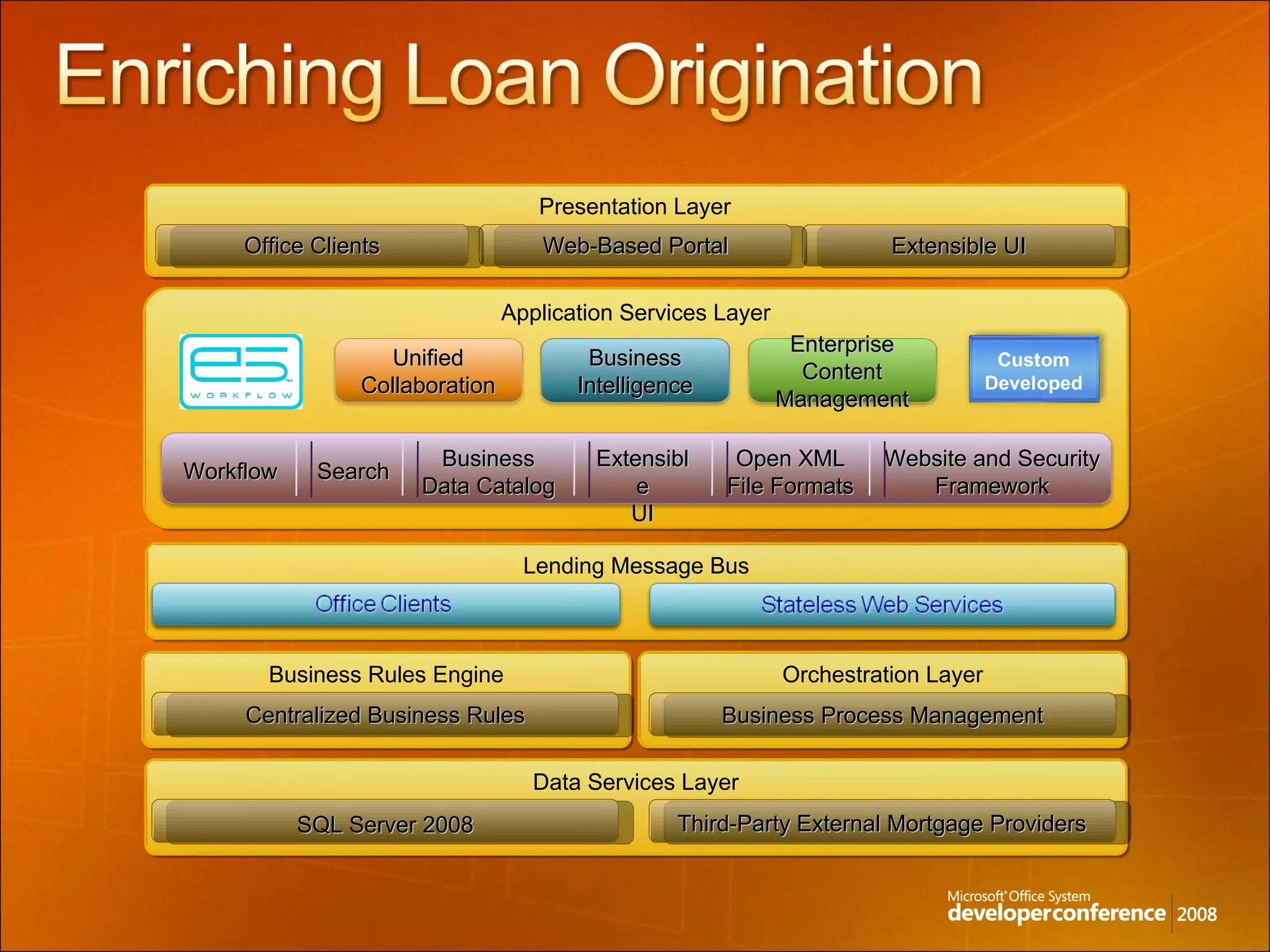

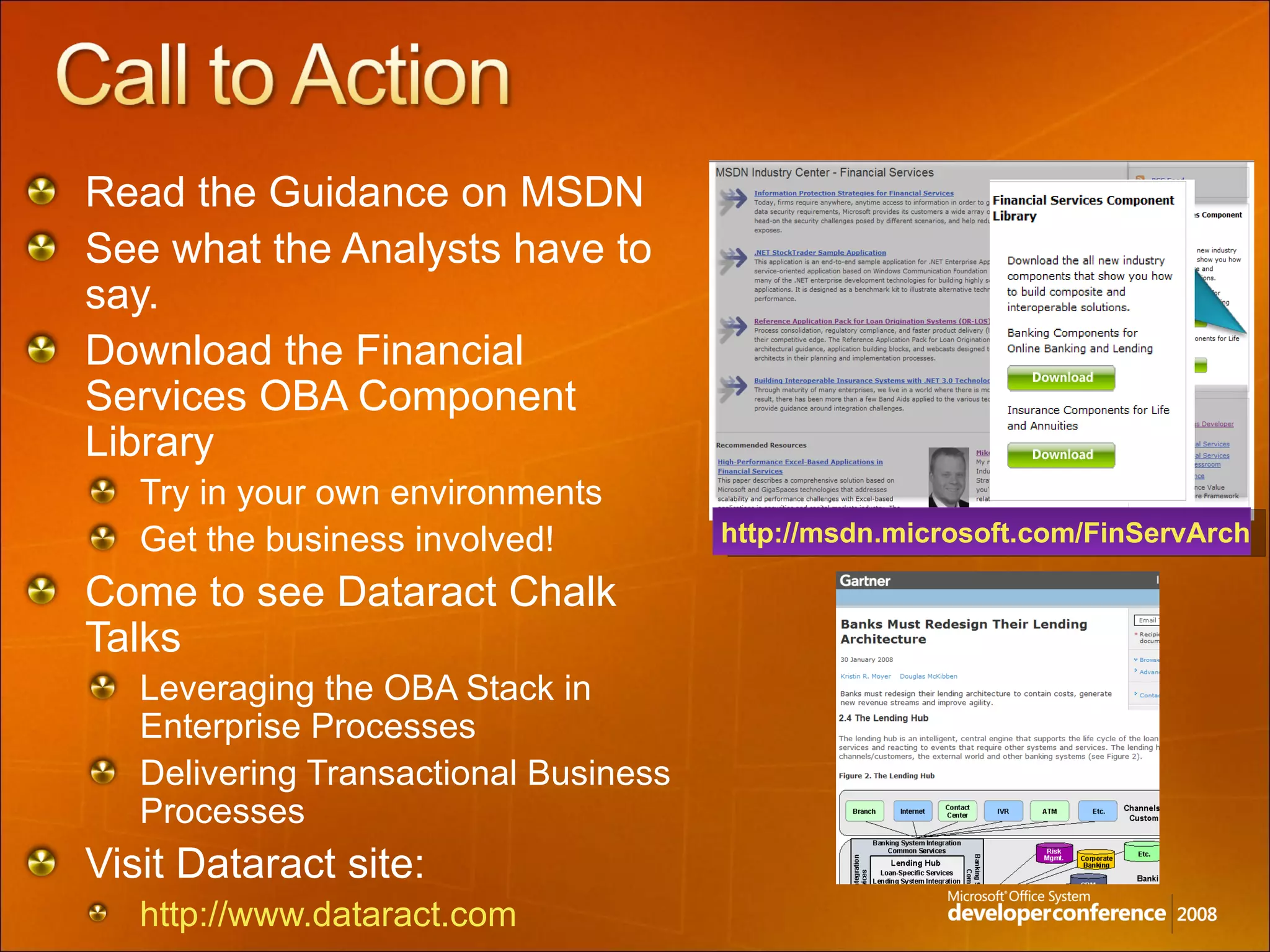

Mike Walker presents Microsoft's approach to addressing challenges in the financial services industry through partnerships and reference architectures. Key points discussed include partnerships with major financial institutions that leverage Microsoft technologies like SQL Server and .NET to improve performance, compliance and cost savings. Microsoft provides industry solutions, a component library and frameworks to help build scalable and connected enterprise architectures.