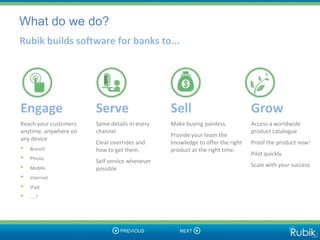

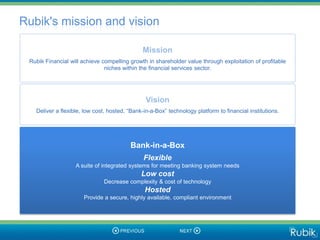

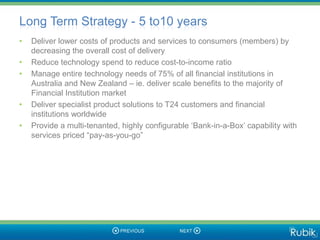

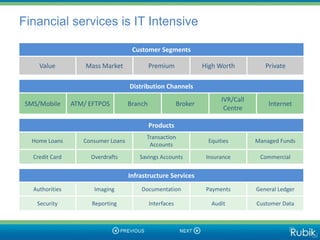

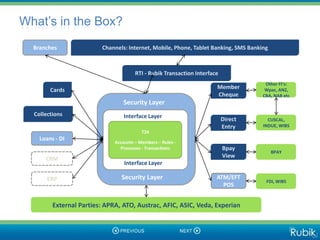

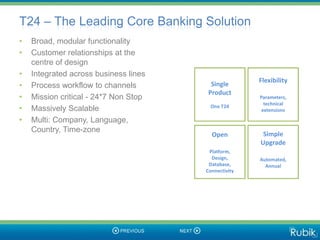

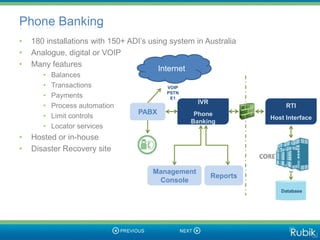

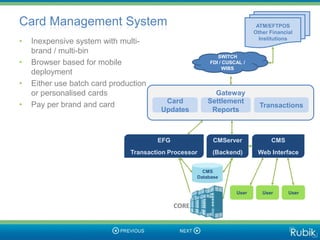

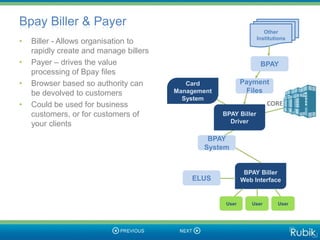

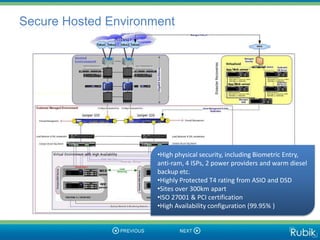

Rubik builds software for banks to help them engage customers across channels, serve customers consistently, and help banks grow their business. Rubik's mission is to deliver a flexible and low-cost "Bank-in-a-Box" platform hosted in a secure environment. This will help banks reduce their technology costs and complexity over time. Rubik currently provides core banking software, payments, cards, collections and other products to over 300 financial institutions globally on its hosted platform.